Hey there, let's dive into the fascinating world of fed rate! You might have heard this term being thrown around in financial news, but what exactly does it mean? Simply put, the fed rate—or federal funds rate—is the interest rate at which banks lend money to each other overnight. It's like the lifeblood of the U.S. economy, influencing everything from mortgage rates to credit card payments. So, if you're curious about how this tiny number can have such a massive impact, stick around because we're about to break it down!

Imagine the economy as a giant machine, and the fed rate is the oil that keeps it running smoothly. When the economy is overheating, the Federal Reserve—the central bank of the U.S.—steps in to raise the fed rate, cooling things down. On the flip side, during tough economic times, they lower the rate to encourage borrowing and spending. It's a delicate balancing act that affects everyone, from big corporations to everyday consumers like you and me.

Now, before we dive deeper, let's set the stage. The fed rate isn't just some random number; it's carefully calculated and adjusted by the Federal Open Market Committee (FOMC). This group meets several times a year to discuss economic conditions and decide on the appropriate fed rate. Their decisions ripple through the entire financial system, affecting everything from your savings account to the stock market. So, buckle up because we're about to explore how this crucial rate shapes our economic landscape.

Read also:Xrp Sec The Battle That Could Redefine Crypto

Understanding the Basics of Fed Rate

Alright, let's get into the nitty-gritty of what the fed rate actually is. At its core, the fed rate is the interest rate banks charge each other for overnight loans. It's not something you'll encounter in your daily life, but its effects are everywhere. Think of it as the benchmark for all other interest rates. When the fed rate goes up, borrowing becomes more expensive, which can slow down economic activity. Conversely, when it drops, borrowing becomes cheaper, stimulating growth.

Why Does the Fed Rate Matter?

Here's the thing: the fed rate matters because it influences practically every financial decision you make. For instance, if you're planning to buy a house, the fed rate affects your mortgage rate. If you're carrying a balance on your credit card, it impacts the interest you pay. Even your savings account interest rate is tied to the fed rate. So, whether you're saving, spending, or investing, this little number plays a big role.

Let's break it down with some bullet points:

- Impacts mortgage rates and housing market

- Affects credit card interest rates

- Influences savings account yields

- Shapes stock market performance

- Impacts consumer spending and borrowing

How the Fed Rate Affects the Economy

Now that we understand what the fed rate is, let's talk about how it affects the broader economy. When the Federal Reserve adjusts the fed rate, it's essentially trying to steer the economy in the right direction. If inflation is too high, raising the fed rate can help bring it under control. If unemployment is rising, lowering the rate can stimulate job creation. It's a powerful tool in the Fed's arsenal.

Key Economic Indicators Tied to the Fed Rate

There are several key economic indicators that are closely tied to the fed rate:

- Inflation: The fed rate can help control inflation by making borrowing more expensive.

- Unemployment: Lower fed rates can encourage businesses to hire more workers.

- GDP Growth: Adjusting the fed rate can influence overall economic growth.

For example, during the 2008 financial crisis, the Fed dropped the fed rate to near zero to stimulate the economy. This helped prevent a deeper recession and laid the groundwork for recovery. Similarly, during times of high inflation, like in the 1970s, the Fed raised rates significantly to bring prices under control.

Read also:Segregated Facilities The Untold Story Of Separation Equality And Progress

The Role of the Federal Reserve in Setting the Fed Rate

Let's talk about the Federal Reserve, the organization responsible for setting the fed rate. The Fed is like the central command for the U.S. economy, and its decisions have far-reaching consequences. The FOMC, a committee within the Fed, meets regularly to assess economic conditions and adjust the fed rate as needed.

Here's a quick rundown of how the Fed operates:

- Monetary Policy: The Fed uses the fed rate as part of its monetary policy to manage economic growth.

- Open Market Operations: The Fed buys and sells government securities to influence the money supply.

- Reserve Requirements: The Fed sets the amount of money banks must hold in reserve.

These tools work together to ensure the economy runs smoothly. When the Fed raises the fed rate, it's usually because the economy is growing too quickly, and inflation is becoming a concern. Conversely, when it lowers the rate, it's often trying to stimulate growth during a downturn.

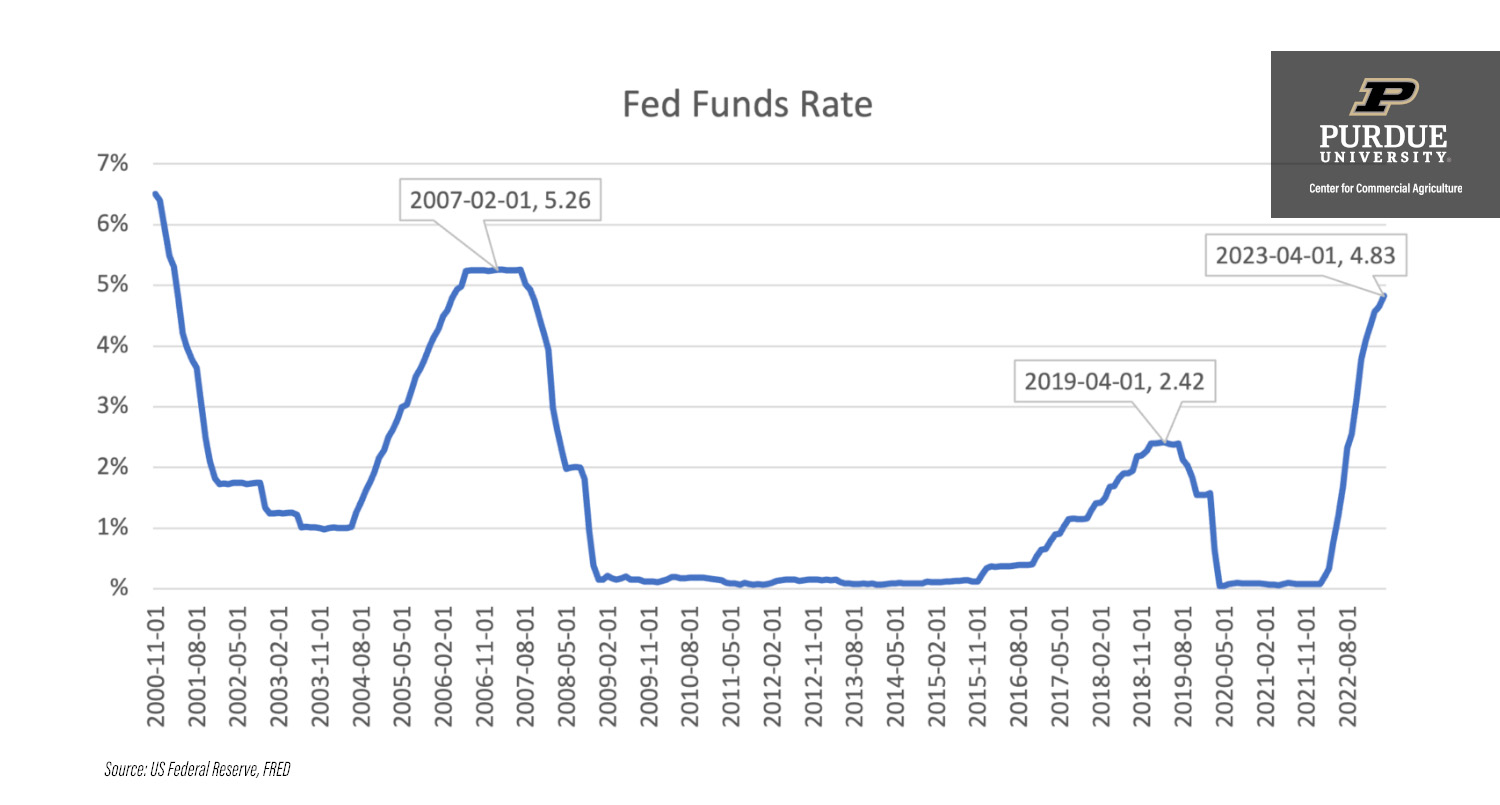

Historical Context of the Fed Rate

Now, let's take a look at the historical context of the fed rate. Over the years, the fed rate has fluctuated significantly, reflecting the changing economic landscape. For instance, during the 1980s, under Chairman Paul Volcker, the fed rate soared to nearly 20% to combat rampant inflation. In contrast, during the Great Recession of 2008, the fed rate was slashed to near zero to prevent a complete economic collapse.

Key Historical Events

Here are some key historical events related to the fed rate:

- 1980s: High fed rates to fight inflation

- 2008: Near-zero fed rates during the financial crisis

- 2020: Emergency rate cuts in response to the pandemic

Each of these events highlights the Fed's role in managing the economy during times of crisis. By adjusting the fed rate, the Fed can help stabilize the economy and prevent extreme fluctuations.

Current Trends in the Fed Rate

As of today, the fed rate is a hot topic in financial circles. With inflation rising and the economy recovering from the pandemic, the Fed is carefully monitoring conditions and making adjustments as needed. Recent trends show a gradual increase in the fed rate to combat inflation without stifling growth.

Here are some current trends to watch:

- Gradual rate hikes to control inflation

- Focus on long-term economic stability

- Monitoring global economic conditions

These trends reflect the Fed's commitment to maintaining a balanced economy. By carefully adjusting the fed rate, the Fed aims to ensure sustainable growth without overheating the economy.

Impact of the Fed Rate on Global Markets

While we've been focusing on the U.S. economy, it's important to note that the fed rate has a global impact. As the world's largest economy, the U.S. influences financial markets worldwide. When the fed rate changes, it affects currency exchange rates, international trade, and global investment flows.

Global Economic Effects

Here are some ways the fed rate impacts global markets:

- Currency Fluctuations: A higher fed rate can strengthen the U.S. dollar, affecting trade balances.

- International Investment: Changes in the fed rate can influence where investors choose to put their money.

- Emerging Markets: Rising fed rates can lead to capital outflows from emerging markets.

These effects highlight the interconnectedness of the global economy. What happens in the U.S. can have ripple effects around the world, making the fed rate a crucial factor for international investors and policymakers alike.

Future Outlook for the Fed Rate

Looking ahead, the future of the fed rate is uncertain but fascinating. With ongoing economic challenges, the Fed will continue to adjust the rate as needed. The key will be finding the right balance between controlling inflation and supporting growth. As the global economy evolves, the Fed will need to adapt its strategies to meet new challenges.

Here are some potential future scenarios:

- Continued gradual rate hikes if inflation persists

- Possible rate cuts if economic growth slows

- Focus on sustainable long-term policies

These scenarios underscore the importance of the fed rate in shaping the future of the economy. By staying informed and understanding the fed rate, you'll be better equipped to navigate the financial landscape ahead.

Expert Insights on the Fed Rate

Let's hear from some experts on the fed rate. Economists and analysts closely follow the Fed's decisions, offering insights and predictions based on their analysis. While opinions may vary, one thing is clear: the fed rate is a crucial factor in the economic equation.

What the Experts Say

Here are some expert insights:

- Many economists believe the fed rate will continue to rise gradually.

- Some analysts warn of potential risks if rates rise too quickly.

- Others emphasize the need for long-term stability in monetary policy.

These perspectives highlight the complexity of the fed rate and its impact on the economy. By considering multiple viewpoints, we can gain a deeper understanding of its significance.

Conclusion: Why the Fed Rate Matters to You

So, there you have it—a comprehensive look at the fed rate and its importance in the economy. From influencing mortgage rates to shaping global markets, the fed rate plays a crucial role in our financial lives. By understanding how it works and its impact, you'll be better prepared to make informed financial decisions.

Now, here's where you come in. If you found this article helpful, leave a comment below and share it with your friends. The more we understand the fed rate, the better we can navigate the ever-changing economic landscape. And if you're hungry for more knowledge, check out our other articles on finance and economics. Stay informed, stay ahead!

Table of Contents

- Understanding the Basics of Fed Rate

- How the Fed Rate Affects the Economy

- The Role of the Federal Reserve in Setting the Fed Rate

- Historical Context of the Fed Rate

- Current Trends in the Fed Rate

- Impact of the Fed Rate on Global Markets

- Future Outlook for the Fed Rate

- Expert Insights on the Fed Rate

- Conclusion: Why the Fed Rate Matters to You