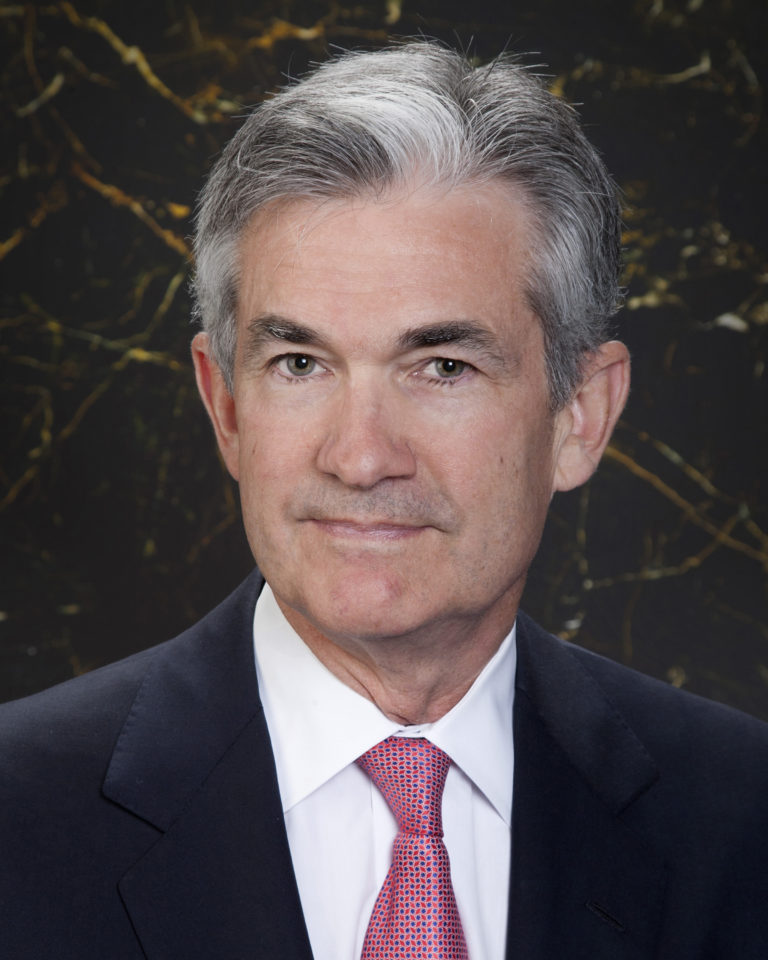

Jerome Powell has become one of the most influential figures in global economics today. As the Chair of the Federal Reserve, he plays a critical role in shaping monetary policy that impacts millions of lives. From interest rates to inflation control, his decisions resonate far beyond the borders of the United States. But who exactly is Jerome Powell? Let’s dive deep into his world and understand what makes him such a pivotal figure in modern finance.

Nowadays, it's hard to talk about the US economy without mentioning Jerome Powell. The guy's been at the helm of the Federal Reserve since 2018, and during his tenure, he's faced some serious challenges – from navigating through a global pandemic to tackling inflation spikes. His leadership style and decision-making have put him under the spotlight, making him a hot topic in financial circles worldwide.

So, why should you care about Jerome Powell? Well, whether you're an investor, a business owner, or just someone trying to make ends meet, the policies he implements directly affect your wallet. Understanding his background, key decisions, and approach to economic challenges can help you stay informed and make better financial decisions. Stick around because we’re about to break it all down for you in simple terms.

Read also:Texas Xavier The Rising Star Of The Lone Star State

Biography of Jerome Powell

Before we dive into the nitty-gritty of Powell's role as Fed Chair, let's take a step back and explore his journey. Born on February 4, 1953, in Washington, D.C., Jerome Powell grew up in a modest household. His path to becoming one of the most powerful economic leaders wasn't always straightforward, but his dedication and hard work eventually paid off.

Early Life and Education

Powell attended George Washington University, where he earned a bachelor’s degree in politics. However, his interest in economics truly took shape when he pursued a law degree at Georgetown University Law Center. It wasn't until later that he decided to shift his focus toward finance, earning an MBA from Harvard Business School in 1979. This diverse educational background has played a significant role in shaping his holistic approach to economic challenges.

Here’s a quick look at his early life details:

| Full Name | Jerome H. Powell |

|---|---|

| Date of Birth | February 4, 1953 |

| Place of Birth | Washington, D.C. |

| Education | Bachelor’s in Politics (George Washington University), JD (Georgetown University Law Center), MBA (Harvard Business School) |

Jerome Powell’s Career Journey

Powell's career trajectory is nothing short of impressive. After graduating from Harvard, he entered the world of finance, working as an investment banker at Dillon Read & Co. in New York. His expertise in corporate law and finance caught the attention of policymakers, leading to his appointment as Under Secretary of the Treasury for Domestic Finance in 1990.

Key Roles Before the Fed

- Under Secretary of the Treasury: In this role, Powell was responsible for overseeing domestic financial policies, including banking regulations and debt management.

- Private Sector Experience: After leaving government service, Powell joined The Carlyle Group, a prominent private equity firm, where he served as a partner for over a decade.

- Fed Governor: In 2012, President Barack Obama nominated Powell to serve as a member of the Board of Governors of the Federal Reserve System. This marked the beginning of his journey into central banking.

Each of these roles equipped Powell with the skills and knowledge necessary to tackle the complexities of the Federal Reserve.

Jerome Powell as Fed Chair: A Leadership Profile

When Jerome Powell was appointed as the Chair of the Federal Reserve in 2018, many wondered how his non-economist background would influence his leadership style. Turns out, his diverse experience has been a major asset. Powell is known for his pragmatic approach, clear communication, and ability to adapt to changing circumstances.

Read also:Ncaa Basketball Games Today Your Ultimate Guide To The Hottest Matches

Communication Style

One of Powell's standout traits is his ability to communicate complex economic concepts in a way that everyone can understand. Unlike some of his predecessors, he doesn't rely heavily on jargon, making him more accessible to the general public. This transparency helps build trust and ensures that people are aware of the Fed's actions and their implications.

The Challenges Faced by Jerome Powell

Being the Fed Chair is no easy job, especially in today's volatile economic climate. Jerome Powell has had to navigate several major challenges during his tenure, each requiring a unique approach and set of solutions.

Pandemic Response

When the COVID-19 pandemic hit in early 2020, Powell quickly sprang into action. The Fed implemented unprecedented measures to stabilize the economy, including slashing interest rates to near zero and launching massive asset purchase programs. These actions helped prevent a deeper economic downturn and provided much-needed relief to businesses and consumers.

Inflation Concerns

As the economy began to recover, inflation started to rise, posing another challenge for Powell. Balancing the need to control inflation while supporting economic growth is a delicate act, and Powell's decisions have been closely scrutinized. Critics argue that the Fed acted too slowly in raising interest rates, but Powell maintains that patience was necessary to ensure a full recovery.

Jerome Powell’s Impact on Monetary Policy

Powell's leadership has left a lasting impact on monetary policy, both in the US and globally. His tenure has seen significant changes in how the Fed approaches inflation, employment, and financial stability.

Updated Framework for Inflation

In 2020, the Fed introduced a new framework for inflation targeting, allowing for periods of higher inflation to offset times when inflation falls below the target rate. This shift reflects Powell's commitment to achieving maximum employment while maintaining price stability.

Key Decisions Under Jerome Powell

Throughout his time as Fed Chair, Powell has made several key decisions that have shaped the economic landscape. Let’s take a closer look at some of the most notable ones.

- Interest Rate Cuts: In response to the pandemic, the Fed slashed interest rates to near zero, providing much-needed liquidity to the market.

- Quantitative Easing: The Fed launched large-scale asset purchase programs to support the economy during uncertain times.

- Inflation Targeting: The updated framework allows for more flexibility in managing inflation, focusing on long-term outcomes rather than short-term fluctuations.

Jerome Powell’s Approach to Economic Challenges

Powell's approach to economic challenges is rooted in data-driven decision-making and a commitment to transparency. He believes in gathering as much information as possible before taking action, ensuring that the Fed's policies are well-informed and effective.

Data-Driven Decisions

Instead of relying on gut feelings or political pressures, Powell prioritizes data when making decisions. This approach helps minimize risks and ensures that policies are aligned with economic realities.

Public Perception of Jerome Powell

Public perception of Jerome Powell varies depending on who you ask. Some praise his calm demeanor and steady leadership, while others criticize his handling of inflation and interest rates. Despite the mixed opinions, there’s no denying that Powell has become a household name in the world of finance.

Criticism and Praise

While some critics argue that Powell's policies have contributed to rising inflation, many economists credit him with preventing a more severe economic downturn during the pandemic. His ability to communicate complex issues clearly has also earned him respect from both policymakers and the general public.

Looking Ahead: The Future of Jerome Powell’s Leadership

As Powell continues his second term as Fed Chair, the challenges ahead are significant. With inflation remaining a concern and global economic uncertainty on the rise, his leadership will be crucial in guiding the US economy through these turbulent times.

Potential Challenges

- Global Economic Uncertainty: Geopolitical tensions and supply chain disruptions could pose risks to economic stability.

- Inflation Control: Balancing inflation with economic growth remains a top priority for the Fed.

- Financial Stability: Ensuring the stability of the financial system in the face of new risks is essential.

Conclusion: Why Jerome Powell Matters

In conclusion, Jerome Powell has emerged as a key player in shaping the global economic landscape. His leadership at the Federal Reserve has been marked by transparency, data-driven decision-making, and a commitment to achieving maximum employment and price stability. Whether you’re an investor, a business owner, or just someone trying to make sense of the economy, understanding Powell’s role and decisions is crucial.

So, what’s next? Take a moment to reflect on what you’ve learned and consider how Powell’s policies might impact your own financial situation. Got thoughts or questions? Drop a comment below or share this article with your network. Together, let’s keep the conversation going!

Table of Contents

- Biography of Jerome Powell

- Jerome Powell’s Career Journey

- Jerome Powell as Fed Chair: A Leadership Profile

- The Challenges Faced by Jerome Powell

- Jerome Powell’s Impact on Monetary Policy

- Key Decisions Under Jerome Powell

- Jerome Powell’s Approach to Economic Challenges

- Public Perception of Jerome Powell

- Looking Ahead: The Future of Jerome Powell’s Leadership

- Conclusion: Why Jerome Powell Matters