When it comes to understanding the financial world, the FOMC is more than just an acronym—it’s a powerhouse shaping global markets. If you’ve ever wondered why interest rates go up or down, or why the dollar fluctuates, the Federal Open Market Committee (FOMC) plays a central role. This group isn’t just some faceless entity; it’s a group of decision-makers who have the power to influence your wallet, your investments, and even your mortgage. So, buckle up, because we’re diving deep into the world of FOMC and breaking it down in a way that’ll make you feel like a financial guru.

Now, before we get too far ahead of ourselves, let’s rewind for a moment. Imagine the economy as a giant ship. The FOMC? They’re the ones steering the wheel, making sure the ship doesn’t crash into an iceberg or drift off course. These folks meet regularly to discuss monetary policy, interest rates, and other economic factors that affect everyone from Wall Street traders to Main Street consumers. So, if you’ve ever wondered why your savings account suddenly earns more interest or why loans seem harder to come by, the FOMC might just be the reason.

Here’s the deal: the FOMC isn’t just for economists or finance nerds. It impacts everyday people like you and me. Whether you’re saving for a house, investing in stocks, or just trying to make ends meet, understanding the FOMC can give you a leg up in managing your finances. In this article, we’ll break down what the FOMC does, why it matters, and how it affects your money. So, grab a cup of coffee, and let’s get started.

Read also:Fed The Financial Engine Driving The Economy

What Exactly is the FOMC?

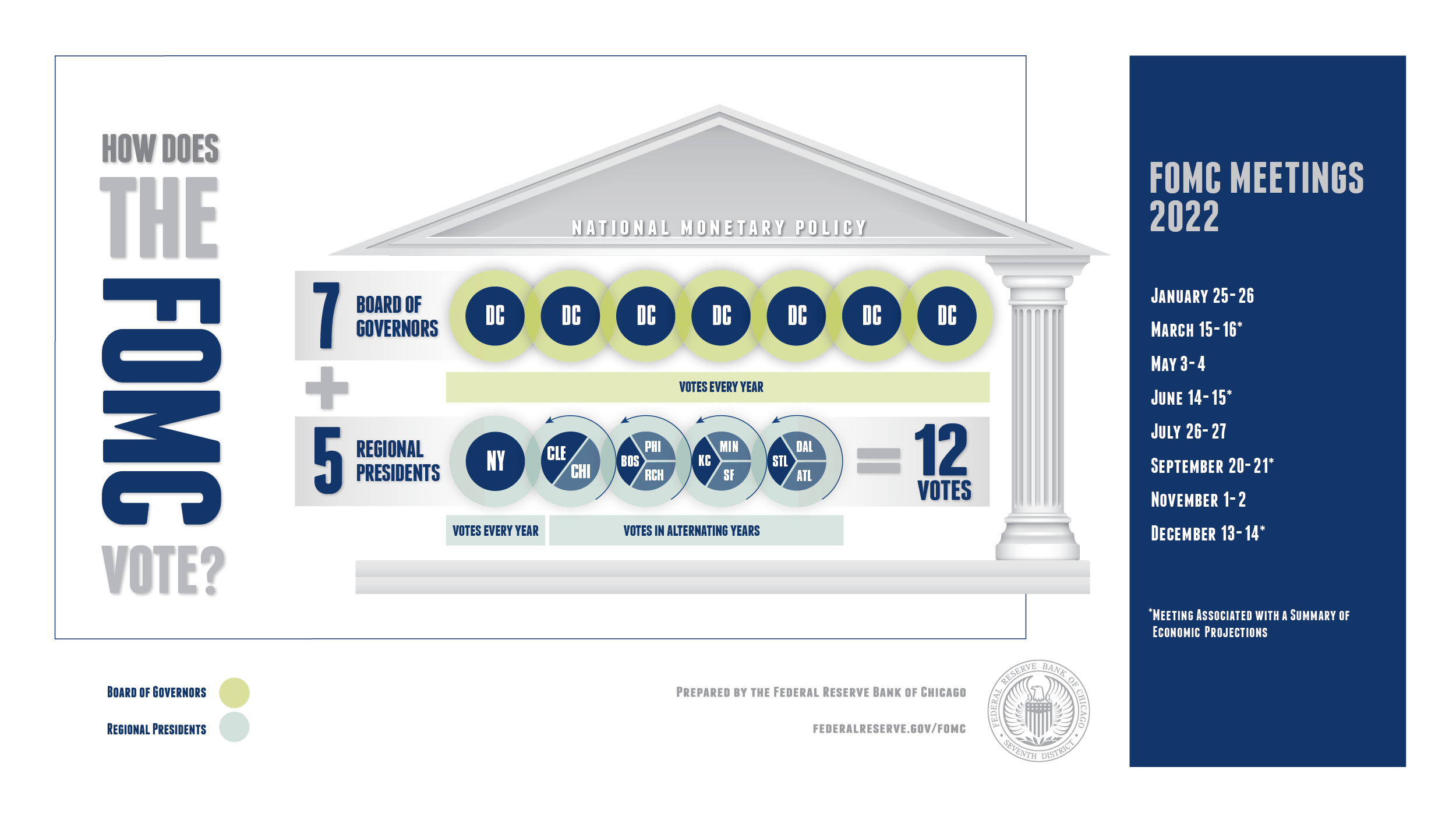

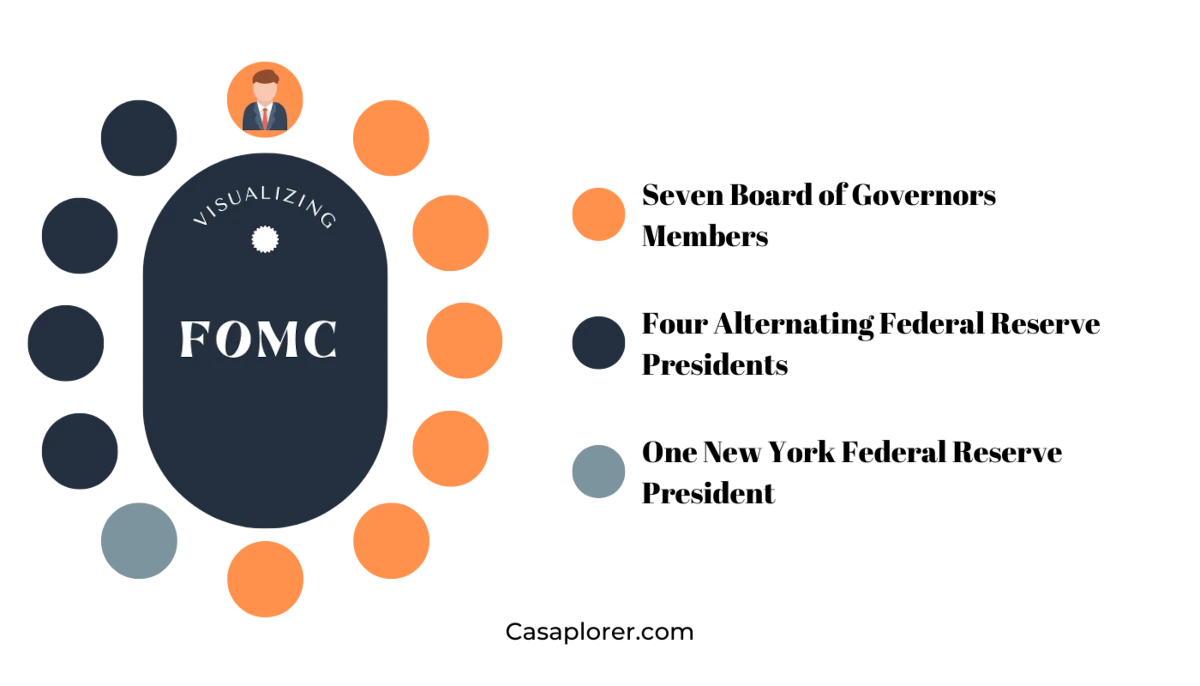

Alright, let’s start with the basics. The Federal Open Market Committee, or FOMC, is essentially the brain behind the Federal Reserve System’s monetary policy. Think of it as the quarterback calling plays in a football game. The FOMC is made up of 12 members, including the seven members of the Board of Governors of the Federal Reserve System and five of the 12 Federal Reserve Bank presidents. These folks meet eight times a year to discuss and decide on key economic policies.

But here’s the kicker: the FOMC doesn’t just sit around and chat. They have a big job to do. Their primary responsibility is to set the federal funds rate, which is the interest rate at which banks lend money to each other overnight. This rate has a ripple effect throughout the economy, influencing everything from mortgage rates to credit card interest. So, when the FOMC raises or lowers this rate, it’s not just a number on a screen—it’s a decision that affects millions of people.

Why Should You Care About the FOMC?

Let’s be real here. If you’re reading this, chances are you’re not just casually interested in the FOMC—you’re probably wondering how it affects you. And the truth is, it affects you a lot. Whether you’re saving for retirement, paying off debt, or just trying to keep your budget in check, the decisions made by the FOMC can have a direct impact on your financial life.

For example, when the FOMC raises interest rates, borrowing becomes more expensive. That means if you’re planning to take out a mortgage or a car loan, you might end up paying more in interest. On the flip side, higher interest rates can be great news for savers, as banks may offer better returns on savings accounts and certificates of deposit. So, depending on your financial goals, the FOMC’s decisions can either be a blessing or a curse.

How the FOMC Impacts Inflation

One of the biggest roles of the FOMC is managing inflation. Inflation is like that pesky houseguest who overstays their welcome—it can wreak havoc on the economy if left unchecked. The FOMC aims to keep inflation at a healthy level, typically around 2%. When inflation gets too high, the FOMC may raise interest rates to cool things down. Conversely, if inflation is too low, they might lower rates to stimulate economic growth.

But why does inflation matter to you? Well, inflation affects the purchasing power of your money. If inflation rises too quickly, your dollars won’t stretch as far. That means the coffee you buy today might cost more tomorrow. By keeping inflation in check, the FOMC helps ensure that your money retains its value over time.

Read also:Bracket Predictions 2025 The Ultimate Guide To Whats Coming Your Way

Breaking Down the FOMC Meetings

Okay, so we know the FOMC meets eight times a year, but what exactly happens during these meetings? Think of it as a high-stakes poker game where the stakes are the entire economy. During these meetings, FOMC members review economic data, discuss market trends, and debate the best course of action for monetary policy.

Each meeting typically lasts for two days, and the outcome is highly anticipated by investors, economists, and pretty much anyone who cares about the economy. After the meeting, the FOMC releases a statement outlining their decisions and providing insights into their reasoning. These statements can move markets in an instant, as investors react to any changes in interest rates or economic projections.

Key Players in the FOMC

Now, let’s talk about the people behind the curtain. The FOMC is made up of some of the brightest minds in economics and finance. At the helm is the Chair of the Federal Reserve, currently Jerome Powell. The Chair plays a crucial role in guiding the committee’s decisions and communicating them to the public.

But the FOMC isn’t just a one-person show. The other members bring diverse perspectives and expertise to the table. Some are economists, others are bankers, and a few have backgrounds in academia. This diversity of thought helps ensure that the FOMC makes well-rounded decisions that consider all aspects of the economy.

The FOMC and Monetary Policy

Monetary policy is the bread and butter of the FOMC’s work. It’s the set of actions taken by the central bank to influence the availability and cost of money and credit. The FOMC uses two main tools to implement monetary policy: setting the federal funds rate and conducting open market operations.

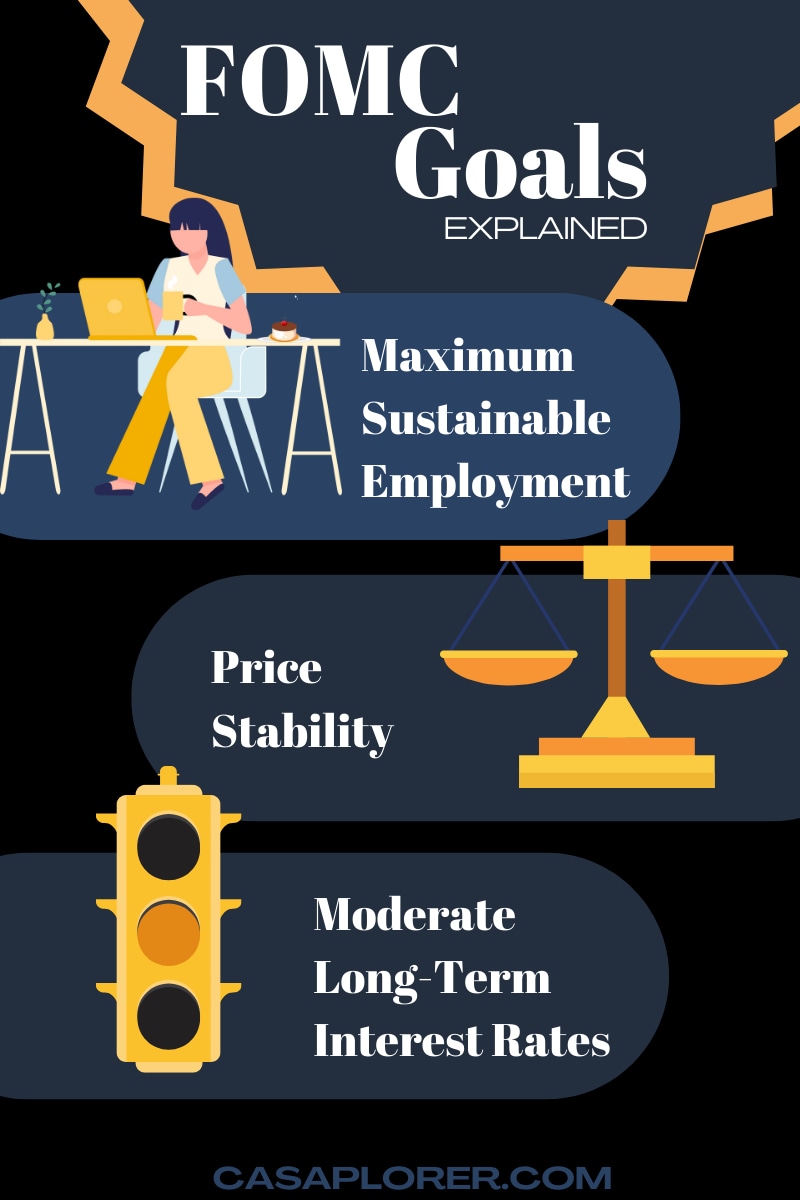

Setting the federal funds rate is like adjusting the thermostat in your house. If the economy is too hot, the FOMC might raise rates to cool things down. If it’s too cold, they might lower rates to stimulate growth. Open market operations, on the other hand, involve buying and selling government securities to influence the money supply. By controlling the money supply, the FOMC can influence economic conditions and help achieve its goals of maximum employment and stable prices.

Understanding Open Market Operations

Open market operations might sound like a mouthful, but they’re actually pretty straightforward. When the FOMC buys government securities, it injects money into the economy, making it easier for businesses and consumers to borrow. Conversely, when they sell securities, they reduce the money supply, making borrowing more difficult. This tool allows the FOMC to fine-tune the economy and respond to changing conditions.

But why does this matter to you? Well, if the FOMC is buying securities, it could mean lower interest rates, which might make it easier for you to get a loan or refinance your mortgage. On the other hand, if they’re selling securities, you might see higher interest rates, which could affect your borrowing costs. So, whether you’re a borrower or a saver, open market operations can have a big impact on your financial life.

The FOMC’s Role in Economic Stability

One of the FOMC’s primary goals is to promote economic stability. This means ensuring that the economy grows at a steady pace without overheating or falling into recession. To achieve this, the FOMC uses a variety of indicators to gauge the health of the economy, including employment data, inflation rates, and GDP growth.

When the economy is growing too quickly, the FOMC might take steps to slow things down, such as raising interest rates. Conversely, if the economy is sluggish, they might lower rates to stimulate growth. By balancing these factors, the FOMC helps create an environment where businesses can thrive and consumers can feel confident about their financial futures.

How the FOMC Supports Employment

Another key goal of the FOMC is to promote maximum employment. This doesn’t mean that everyone will have a job, but rather that the economy will operate at a level where unemployment is as low as possible without causing inflation to spiral out of control. The FOMC achieves this by using monetary policy to support job creation and economic growth.

For example, during times of economic downturn, the FOMC might lower interest rates to encourage businesses to invest and hire more workers. This can help reduce unemployment and boost consumer confidence. So, if you’ve ever wondered why job creation seems to pick up after a rate cut, now you know—it’s all part of the FOMC’s plan to support employment.

The FOMC and Global Markets

While the FOMC’s primary focus is on the U.S. economy, its decisions also have a significant impact on global markets. In today’s interconnected world, what happens in one country can have ripple effects around the globe. When the FOMC raises or lowers interest rates, it affects the value of the U.S. dollar, which in turn influences trade, investment, and financial flows across borders.

For example, a stronger dollar can make U.S. exports more expensive and imports cheaper, affecting trade balances and economic growth. Conversely, a weaker dollar can boost exports but make imports more expensive. These dynamics can have far-reaching consequences for businesses and consumers worldwide, highlighting the global significance of the FOMC’s decisions.

Key Statistics to Watch

When it comes to understanding the FOMC’s impact, there are a few key statistics you’ll want to keep an eye on. First and foremost is the federal funds rate, which we’ve already discussed. But there are other indicators to watch as well, such as the unemployment rate, inflation data, and GDP growth.

For example, if the unemployment rate is falling and inflation is rising, the FOMC might consider raising interest rates to prevent the economy from overheating. Conversely, if unemployment is rising and inflation is low, they might lower rates to stimulate growth. By keeping an eye on these statistics, you can get a sense of where the FOMC might be headed and how their decisions could affect your finances.

How to Prepare for FOMC Decisions

Now that you understand the FOMC’s role and impact, let’s talk about how you can prepare for their decisions. Whether you’re an investor, a borrower, or just someone trying to manage their finances, there are steps you can take to position yourself for success.

- Stay Informed: Keep up with the latest economic data and FOMC statements to stay ahead of the curve.

- Review Your Finances: If you have loans or investments, consider how changing interest rates might affect them.

- Consult a Financial Advisor: If you’re unsure how to navigate the impact of FOMC decisions, a financial advisor can provide personalized guidance.

- Be Flexible: The economy is constantly evolving, so be prepared to adjust your financial strategies as needed.

Final Thoughts

As we wrap up this deep dive into the FOMC, it’s clear that this group plays a crucial role in shaping the global economy. From setting interest rates to managing inflation, the FOMC’s decisions have far-reaching consequences that affect everyone. By understanding how the FOMC works and staying informed about their decisions, you can position yourself to make smarter financial choices and achieve your goals.

So, whether you’re a seasoned investor or just starting to explore the world of finance, the FOMC is a force to be reckoned with. Keep an eye on their meetings, stay informed about economic trends, and don’t be afraid to take action when the time is right. Your financial future depends on it!

Table of Contents

- What Exactly is the FOMC?

- Why Should You Care About the FOMC?

- How the FOMC Impacts Inflation

- Breaking Down the FOMC Meetings

- Key Players in the FOMC

- The FOMC and Monetary Policy

- Understanding Open Market Operations

- The FOMC’s Role in Economic Stability

- How the FOMC Supports Employment

- The FOMC and Global Markets

- Key Statistics to Watch