Interest rates might sound like a boring topic, but trust me, it’s the silent force driving your wallet’s mood swings. Whether you’re saving, borrowing, or investing, these little percentages can make or break your financial dreams. So, buckle up, because we’re diving deep into the world where money talks—and interest rates whisper secrets that can change your life.

Picture this: you’re chilling at home, scrolling through your bank statements, and suddenly you notice something weird. Your loan payment went up—or maybe your savings account got a tiny boost. What’s the deal? It’s probably interest rates doing their thing. They’re the unsung heroes—or villains—of the financial world, depending on how you look at it.

Now, I know what you’re thinking: “Why should I care about interest rates? I’m just trying to pay my bills and maybe save for a vacation.” But here’s the thing—interest rates touch every corner of your financial life. From mortgages to credit cards, from savings accounts to investments, they’re like the puppet masters pulling the strings behind the scenes. So, let’s break it down and figure out how to make them work for you instead of against you.

Read also:American University Your Ultimate Guide To Pursuing Higher Education In The Usa

Let’s jump into the nitty-gritty of how interest rates work, why they matter, and how you can navigate them like a pro. Stick around, because by the end of this, you’ll be armed with knowledge that could save—or make—you a ton of cash. And who doesn’t want that?

What Exactly Are Interest Rates Anyway?

Alright, let’s get real for a sec. Interest rates are basically the cost of borrowing money—or the reward for lending it. Think of it like renting money. If you borrow from a bank, they charge you interest as a fee for letting you use their cash. On the flip side, if you park your money in a savings account, the bank pays you interest because they’re using your cash to lend to others.

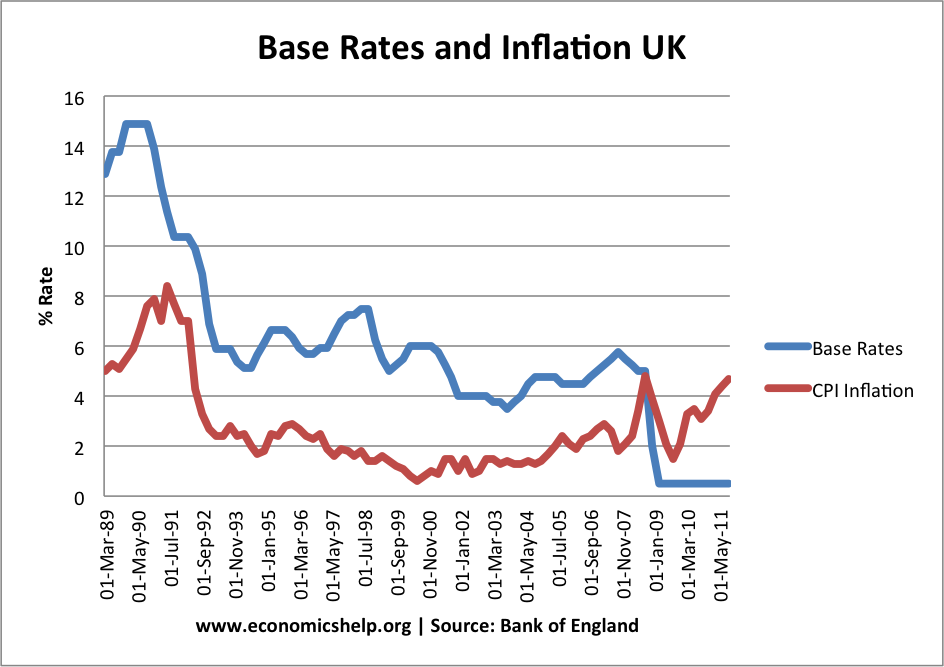

Interest rates are set by central banks, like the Federal Reserve in the U.S. or the Bank of England in the UK. These bigwigs tweak rates based on the economy’s health. If the economy’s sluggish, they might lower rates to encourage borrowing and spending. If inflation’s getting out of control, they’ll hike rates to slow things down.

So, why does this matter to you? Because when interest rates change, it ripples through your entire financial life. Your mortgage payments, car loans, credit card bills—they all feel the impact. And if you’re saving or investing, your returns might get a boost—or a smackdown—depending on what’s happening with rates.

How Are Interest Rates Determined?

Interest rates aren’t just plucked out of thin air. They’re influenced by a bunch of factors, like economic conditions, inflation, and even global events. Central banks keep a close eye on all this stuff before deciding whether to raise, lower, or keep rates steady.

- Economic Growth: If the economy’s booming, central banks might raise rates to keep things from overheating.

- Inflation: High inflation? Expect rates to go up to keep prices in check.

- Global Events: Wars, pandemics, or trade disputes can send shockwaves through the financial markets, affecting rates.

- Supply and Demand: Like anything else, interest rates are influenced by how much money’s out there and how badly people want to borrow it.

It’s a balancing act, and central banks have to weigh all these factors carefully. Too high, and borrowing gets too expensive. Too low, and people might spend too much, driving up inflation. It’s a delicate dance, and we’re all caught in the middle.

Read also:Fed The Financial Engine Driving The Economy

Why Should You Care About Interest Rates?

Let’s face it—interest rates aren’t just numbers on a screen. They have real-world consequences that hit you right in the pocketbook. Here’s how:

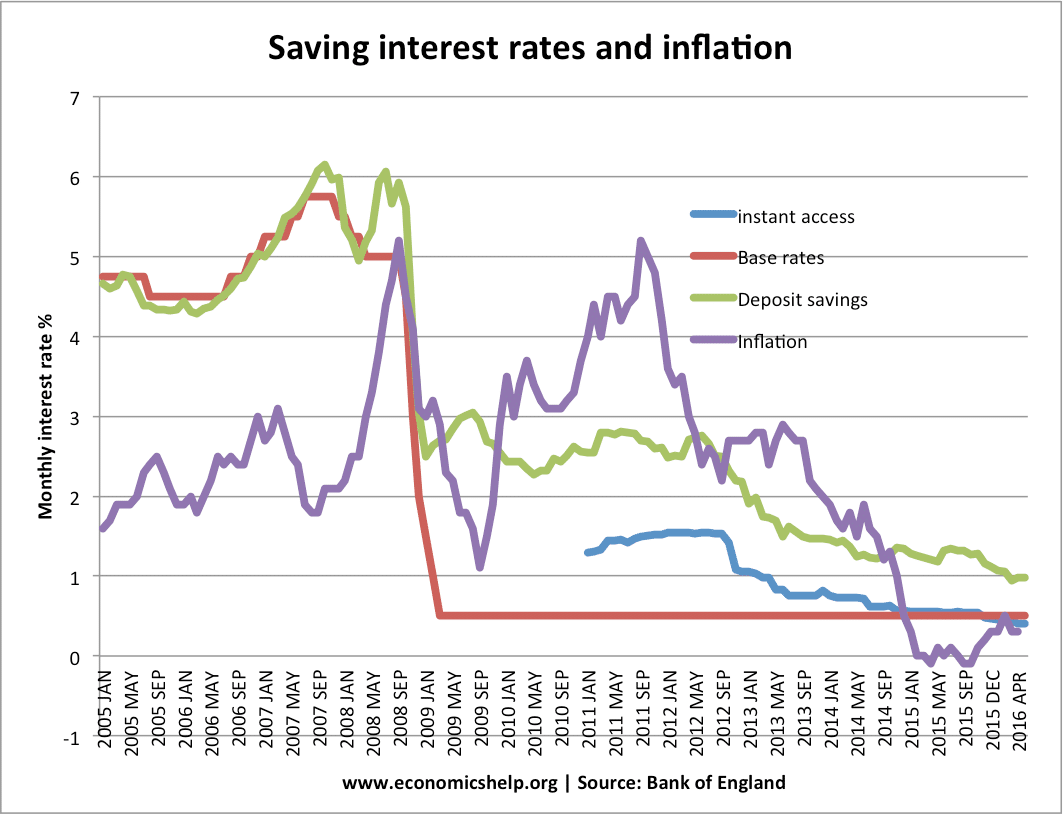

When interest rates rise, borrowing gets more expensive. That means your mortgage payments might go up, your car loan could cost you more, and those credit card balances? Yeah, they’re gonna hurt even more. But here’s the flip side: if you’ve got savings, higher rates mean your money could grow faster. Win-win, right?

On the flip side, when rates fall, borrowing gets cheaper. That’s great news if you’re thinking about buying a house or a car. But if you’re saving, your returns might take a hit. It’s a trade-off, and understanding it can help you make smarter financial decisions.

Impact on Everyday Life

Interest rates touch almost every aspect of your financial life. Here’s a quick rundown:

- Mortgages: A small change in interest rates can mean hundreds of dollars more—or less—on your monthly payment.

- Credit Cards: High interest rates can turn that impulse buy into a long-term financial headache.

- Savings: Higher rates mean your savings could grow faster, while lower rates might leave them stagnating.

- Investments: Interest rates affect everything from stocks to bonds, so they’re a big deal for investors.

See what I mean? Interest rates are the financial equivalent of the weather—they’re always there, whether you like it or not. But unlike the weather, you can actually do something about it. By understanding how interest rates work, you can plan ahead and protect yourself from getting caught in a financial storm.

Interest Rates and the Economy: A Love-Hate Relationship

Interest rates and the economy are like an old married couple—sometimes they’re in sync, and sometimes they’re at each other’s throats. When the economy’s doing well, central banks might raise rates to keep things from getting too wild. But if the economy’s struggling, they’ll lower rates to give it a boost.

It’s a balancing act, and it doesn’t always go smoothly. Sometimes, central banks have to make tough decisions that might not be popular in the short term but are necessary for long-term stability. Think of it like a parent setting boundaries for their kids—it’s not always fun, but it’s for their own good.

How Interest Rates Affect Businesses

Businesses are just as affected by interest rates as consumers are. When rates are low, it’s easier for companies to borrow money to expand, hire more workers, or invest in new projects. But when rates are high, borrowing gets more expensive, which can slow down growth.

This ripple effect can lead to job losses, reduced wages, or even business closures. It’s a domino effect that starts with interest rates and ends up impacting the entire economy. So, while it might seem like interest rates are just numbers on a screen, they’re actually a powerful force shaping the world around us.

Types of Interest Rates

Not all interest rates are created equal. There are different types, each with its own purpose and impact. Let’s break them down:

Prime Rate

The prime rate is the interest rate that banks charge their best customers. It’s usually lower than other rates and serves as a benchmark for other rates, like mortgage rates or credit card rates. Think of it like the VIP pass to borrowing—it’s only for the most creditworthy.

Federal Funds Rate

This is the rate that banks charge each other for overnight loans. It’s set by the Federal Reserve and influences other rates, like the prime rate. Think of it like the central bank’s way of keeping the financial system running smoothly.

Discount Rate

The discount rate is the interest rate that the Federal Reserve charges banks for loans. It’s usually higher than the federal funds rate and is used as a last resort when banks need cash fast.

Fixed vs. Variable Rates

When you’re borrowing money, you’ll often have the choice between fixed and variable rates. Fixed rates stay the same for the life of the loan, while variable rates can change based on market conditions. Fixed rates give you stability, but variable rates might save you money if rates go down.

How to Navigate Interest Rates Like a Pro

Now that you know what interest rates are and how they work, it’s time to put that knowledge into action. Here’s how:

First, stay informed. Follow economic news and keep an eye on what central banks are doing. You don’t have to become an expert, but having a general understanding of the trends can help you make better financial decisions.

Second, shop around. Whether you’re borrowing or saving, don’t settle for the first rate you see. Compare rates from different lenders or banks to make sure you’re getting the best deal possible.

Third, consider locking in rates if you think they’re going to rise. For example, if you’re buying a house and you think mortgage rates are going to go up, it might be worth locking in a fixed rate while they’re still low.

Tips for Borrowers

- Pay off high-interest debt first. Credit card balances with sky-high interest rates should be your top priority.

- Consider refinancing if rates have dropped since you took out your loan. You could save a ton of money by locking in a lower rate.

- Build a strong credit score. The better your credit, the better rates you’ll qualify for.

Tips for Savers

- Look for high-yield savings accounts or CDs that offer competitive rates.

- Be patient. If rates are low, your savings might not grow as fast, but they’ll still grow.

- Consider diversifying your savings into different types of accounts to maximize your returns.

Interest Rates and Inflation: The Tug of War

Inflation and interest rates are like two kids on a seesaw—when one goes up, the other goes down. Inflation erodes the purchasing power of your money, so central banks raise interest rates to keep it in check. But higher rates can slow down the economy, which might lead to job losses or reduced wages.

It’s a delicate balance, and central banks have to tread carefully. Too much inflation, and people lose faith in the currency. Too high interest rates, and the economy might stall. It’s a constant tug of war, and we’re all caught in the middle.

How to Protect Yourself from Inflation

While you can’t control inflation, you can take steps to protect yourself:

- Invest in assets that tend to outpace inflation, like stocks or real estate.

- Consider index-linked bonds, which adjust their value based on inflation.

- Build an emergency fund to cushion the blow if prices start rising faster than your income.

The Future of Interest Rates

No one has a crystal ball, but economists can make educated guesses about where interest rates are headed. Global events, technological advancements, and demographic shifts will all play a role in shaping the future of interest rates.

For now, the trend seems to be toward higher rates as central banks try to rein in inflation. But who knows? The financial world is unpredictable, and anything can happen. The key is to stay informed, stay flexible, and be ready to adapt when things change.

What Can You Do Today?

Don’t wait for the perfect time to act. Whether you’re borrowing, saving, or investing, there’s always something you can do to improve your financial situation:

- Review your loans and credit card balances. See if you can refinance or consolidate to get a better rate.

- Shop around for savings accounts or CDs that offer higher returns.

- Consider consulting a financial advisor to help you navigate the complexities of interest rates and the economy.

Conclusion

Interest rates might not be the sexiest topic in the world, but they’re one of the most important. They shape the financial landscape, influence your daily life, and determine how much you pay—or earn—on your money. By understanding how they work and staying informed, you can make smarter financial decisions and take control of your financial future.

So, what’s next? Take a look at your finances. Are you paying too much in interest? Could you be earning more on your savings? There’s always room for improvement, and the time to start is now. Share this article with your friends, leave a comment with your thoughts, and let’s keep the conversation going. Because when it comes to interest rates, knowledge really is power.

Table of Contents

- What Exactly Are Interest Rates Anyway?

- How Are Interest Rates Determined?

- Why Should You Care About Interest Rates?

- Impact on Everyday Life

- Interest Rates and the Economy: A Love-Hate Relationship

![Buying a Home? Mortgage Rate Guide for Singapore [2023]](https://blog.roshi.sg/wp-content/uploads/2022/08/Singapore-Home-Loan-Rates-2022.jpeg)