Hey there, folks! If you’re one of the millions who haven’t claimed your $1,400 stimulus check from 2021, listen up. The deadline is approaching, and you don’t want to miss out on this chunk of cash. Uncle Sam has got your back, but only if you act fast. Let’s dive into the details so you don’t lose out on what’s rightfully yours.

Remember those pandemic days when life felt like a rollercoaster? Well, the government rolled out stimulus checks to help ease the financial burden for many Americans. One of the biggest payouts was the $1,400 check back in 2021. But here’s the kicker—not everyone got theirs automatically. If you’re one of the folks who missed out, now’s the time to take action.

This isn’t just about money; it’s about securing your financial future. Whether you’re planning to pay off debt, save for a rainy day, or treat yourself to something nice, that $1,400 could make all the difference. So, buckle up as we break down everything you need to know about claiming your stimulus check before the deadline.

Read also:Country Music Star Announces New Single Dropping This Week

Before we dive deeper, let’s organize the info for you. Here’s a quick table of contents to help you navigate:

- Overview: What’s the Stimulus Check About?

- Who’s Eligible for the $1,400 Stimulus Check?

- How to Claim Your Stimulus Check

- Common Questions About the Stimulus Check

- Impact on Your Taxes

- Important Dates to Remember

- What If You’re Missing Your Check?

- Beware of Scams Related to Stimulus Checks

- Useful Resources for More Info

- Final Thoughts: Act Now!

Overview: What’s the Stimulus Check About?

Let’s rewind to 2021 when the American Rescue Plan was signed into law. Part of this plan included sending out $1,400 stimulus checks to eligible individuals. The goal? To provide financial relief during the ongoing pandemic. But not everyone received their checks automatically, especially if you didn’t file taxes or didn’t update your info with the IRS.

Fast forward to today, and the IRS is still giving folks a chance to claim their missing checks. But here’s the deal: the clock is ticking. If you haven’t claimed your stimulus payment yet, you need to act fast. Once the deadline passes, you might lose out on that sweet $1,400 forever.

Why You Should Care

Look, $1,400 isn’t chump change. It could be the lifeline you need to cover rent, utilities, or even splurge on something fun. Plus, it’s your money. Uncle Sam set it aside for you, so why let it go to waste? Understanding the ins and outs of the stimulus check program is crucial if you want to maximize your benefits.

Who’s Eligible for the $1,400 Stimulus Check?

Not everyone qualifies for the $1,400 stimulus check, but don’t worry—it’s pretty straightforward. Here’s a quick breakdown:

- Single filers with an adjusted gross income (AGI) below $75,000 qualify for the full amount.

- Head of household filers with an AGI below $112,500 also qualify for the full amount.

- Married couples filing jointly with an AGI below $150,000 get $2,800 combined.

- Dependents, including adult dependents, also qualify for a $1,400 payment per dependent.

But here’s the catch: if your income exceeds these thresholds, the payment phases out. For every $100 over the limit, your stimulus check decreases by $5. So, if you’re close to the cutoff, double-check your numbers to see if you’re still eligible.

Read also:Understanding Interest Rates A Deep Dive Into What Moves Your Money

Special Cases

Some folks might have unique situations that affect their eligibility. For instance:

- Non-filers: If you don’t usually file taxes, you might still qualify for the stimulus check. You just need to file a simplified tax return.

- Social Security recipients: If you receive Social Security benefits, you’re automatically eligible, but you might need to verify your info with the IRS.

- Immigrants: Certain non-citizens with valid Social Security numbers can also claim the stimulus check.

How to Claim Your Stimulus Check

Alright, so you think you qualify. Now what? Here’s the step-by-step process to claim your $1,400 stimulus check:

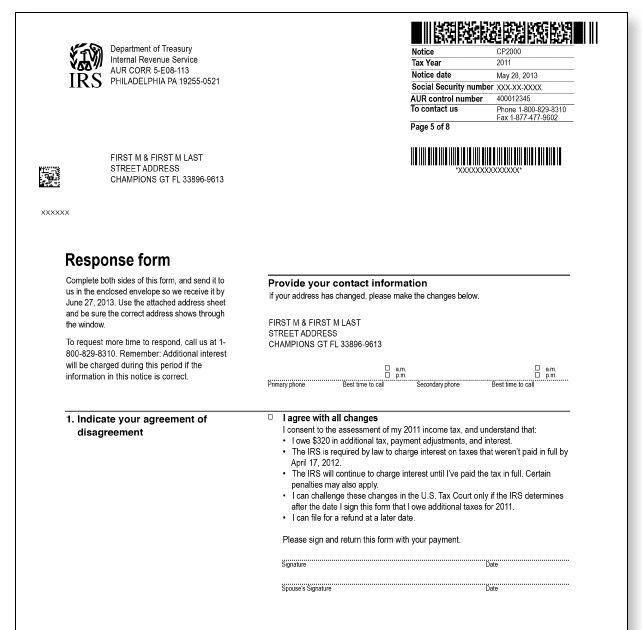

Step 1: File Your 2021 Tax Return

If you haven’t filed your 2021 taxes yet, now’s the time. The IRS uses your tax return to determine your eligibility and calculate your payment. Even if you don’t owe any taxes, you still need to file to claim your stimulus check.

Step 2: Claim the Recovery Rebate Credit

If you didn’t receive your full stimulus payment in 2021, you can claim the Recovery Rebate Credit when filing your taxes. This credit covers any missing payments, so it’s worth checking.

Step 3: Verify Your Payment

Once you’ve filed, keep an eye on your bank account or mailbox for your stimulus check. If you don’t receive it within a few weeks, use the IRS Get My Payment tool to track your status.

Common Questions About the Stimulus Check

Got some burning questions? We’ve got answers. Here are some FAQs to help clarify things:

Do I Have to Pay Back the Stimulus Check?

Nope! The stimulus check is a gift from Uncle Sam, so you don’t have to pay it back. However, if you received more than you were entitled to, the IRS might ask for the excess amount.

Can I Still Claim the Check If I Missed the Deadline?

Technically, no. Once the deadline passes, you can’t claim the $1,400 stimulus check directly. However, you might still be able to claim the Recovery Rebate Credit on future tax returns, so don’t give up hope.

What If I Moved and Never Got My Check?

If your check got sent to an old address, you can try contacting the IRS to track it down. They might be able to reissue the payment if it’s been lost or undelivered.

Impact on Your Taxes

Let’s talk taxes. While the stimulus check itself isn’t taxable, it can affect your tax return. For instance:

- If you claimed the Recovery Rebat Credit but later found out you weren’t eligible, you might owe the IRS money.

- On the flip side, if you didn’t receive your full payment, you can claim the remaining amount as a credit on your next tax return.

It’s always a good idea to consult with a tax professional if you’re unsure about how the stimulus check impacts your taxes. They can help you navigate the complexities and ensure you’re getting everything you’re entitled to.

Important Dates to Remember

Deadlines are crucial when it comes to claiming your stimulus check. Here’s a quick timeline to keep in mind:

- April 18, 2023: Deadline to file your 2021 taxes and claim the Recovery Rebate Credit.

- July 15, 2023: Extended deadline for those who need more time to file.

Mark these dates on your calendar and make sure you’re ready to act. Missing the deadline means missing out on that sweet $1,400.

What If You’re Missing Your Check?

Lost checks happen. If you never received your stimulus payment, don’t panic. Here’s what you can do:

Contact the IRS

Use the IRS Get My Payment tool to track your check. If it shows as delivered but you haven’t received it, contact the IRS for assistance. They might be able to reissue the payment or provide more info.

Check with Your Bank

Some banks might hold direct deposit payments for verification. Double-check with your financial institution to make sure the funds didn’t get stuck in limbo.

Beware of Scams Related to Stimulus Checks

Scammers love to prey on folks during times of financial uncertainty. Here’s how to protect yourself:

- The IRS will never call, text, or email you demanding payment info. If someone claims to be from the IRS and asks for sensitive data, it’s probably a scam.

- Be wary of websites or apps promising to help you claim your stimulus check for a fee. The IRS provides all the tools you need for free.

- Stick to official sources like IRS.gov for accurate info.

Useful Resources for More Info

Need more info? Here are some trusted resources to help you navigate the stimulus check process:

- IRS.gov: The official IRS website has tons of info on stimulus checks and tax filing.

- Taxpayer Advocate Service: If you run into issues with the IRS, this service can help mediate.

- Local Tax Professionals: Sometimes, talking to a local expert can clear up confusion and ensure you’re on the right track.

Final Thoughts: Act Now!

Alright, here’s the bottom line: the deadline for claiming your $1,400 stimulus check is fast approaching. If you haven’t acted yet, now’s the time to get moving. File your taxes, claim the Recovery Rebate Credit, and secure that cash before it’s too late.

Don’t forget to share this article with friends and family who might also qualify. The more people know about this opportunity, the better. And hey, if you’ve got questions or feedback, drop a comment below. We’d love to hear from you!

Remember, life’s too short to leave money on the table. So, go ahead and claim what’s yours. You’ve earned it!