Interest rates are the heartbeat of the global economy, influencing everything from your savings account to your mortgage payments. Whether you're a first-time homebuyer or an experienced investor, understanding interest rates is crucial. It's not just about numbers; it's about how these rates shape your financial decisions and future. So, buckle up because we're about to break down the ins and outs of interest rates in a way that'll make you feel like a financial guru.

Now, you might be wondering, "Why should I care about interest rates?" Well, here's the thing—interest rates affect almost every financial decision you make. From the cost of borrowing money to the return on your investments, these rates play a massive role. Think of them as the invisible hand guiding your wallet. If you're planning to buy a house, start a business, or even save for retirement, knowing how interest rates work can save you thousands of dollars in the long run.

But don't worry; we're not gonna throw a bunch of complicated jargon at you. This article is all about breaking down interest rates into bite-sized pieces that anyone can understand. We'll cover everything from the basics to the more complex stuff, so whether you're a beginner or a seasoned pro, there's something here for everyone. So, let's get started, shall we?

Read also:The Spring Equinox Is Here What Does That Mean

What Are Interest Rates, Anyway?

Let's start with the basics. Interest rates are essentially the cost of borrowing money. When you take out a loan or use a credit card, the lender charges you interest as a fee for lending you that money. On the flip side, when you deposit money into a savings account, the bank pays you interest for keeping your money with them. It's a two-way street, and both sides have their own set of rules.

Interest rates can vary depending on several factors, including the type of loan, the borrower's creditworthiness, and the overall economic climate. For example, if you have a stellar credit score, you might qualify for a lower interest rate on a car loan. But if your credit score is less than ideal, you could end up paying more. It's all about risk and reward.

How Interest Rates Affect Borrowers

For borrowers, interest rates can make a big difference in how much you end up paying for a loan. Let's say you're taking out a $200,000 mortgage. If the interest rate is 4%, your monthly payment might be around $955. But if the rate jumps to 6%, your payment could rise to about $1,199. That's a difference of over $200 per month, which adds up quickly over the life of the loan.

It's not just mortgages, though. Credit card interest rates can also be a major factor in how much you pay for everyday purchases. If you carry a balance on your credit card, even a small purchase can turn into a big expense if the interest rate is high. That's why it's important to shop around for the best rates and always pay off your balance on time.

The Role of Central Banks in Setting Interest Rates

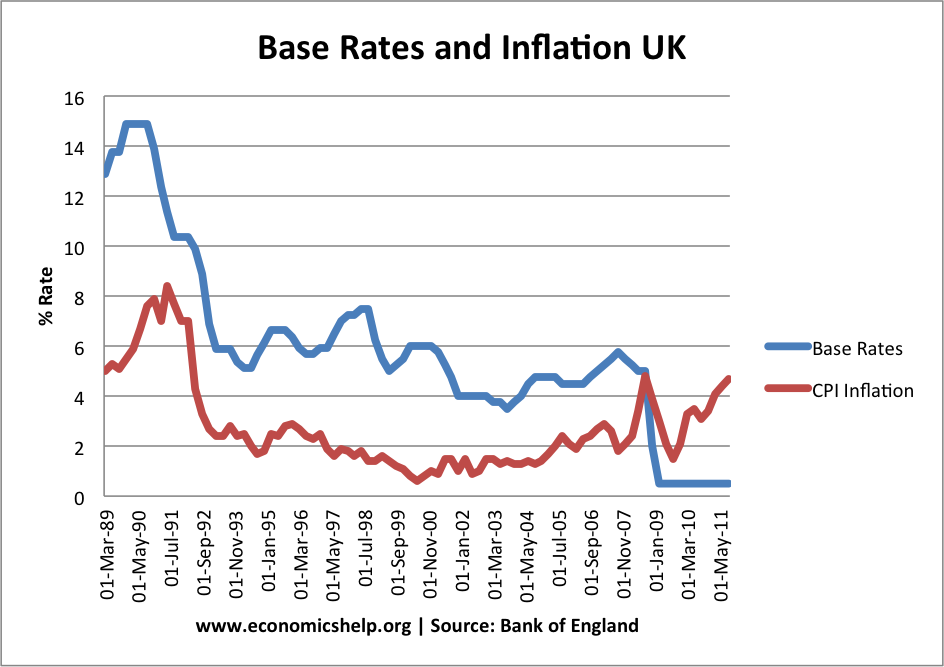

Central banks, like the Federal Reserve in the U.S., play a key role in setting interest rates. They use monetary policy to influence the economy by raising or lowering rates. When the economy is sluggish, they might lower rates to encourage borrowing and spending. But if inflation starts to creep up, they might raise rates to cool things down.

It's a delicate balancing act, and the decisions made by central banks can have far-reaching effects. For example, when the Fed lowers interest rates, it can make borrowing cheaper, which can stimulate economic growth. But if they raise rates too high, it can slow down the economy and lead to job losses. It's all about finding the sweet spot that keeps the economy humming along without overheating.

Read also:Kristine Barnett Now All About Her Life After The Natalia Grace Case

Factors Influencing Central Bank Decisions

Central banks consider a variety of factors when setting interest rates. One of the biggest is inflation. If prices are rising too quickly, they might raise rates to slow down spending. But if inflation is under control, they might keep rates low to encourage growth. Employment levels, GDP growth, and global economic conditions also play a role in their decision-making process.

For example, during the 2008 financial crisis, the Fed lowered interest rates to near zero to help stabilize the economy. This made it easier for businesses and consumers to borrow money, which helped kickstart recovery efforts. But as the economy improved, they gradually raised rates to prevent overheating. It's a constant cycle of adjustment based on current economic conditions.

Types of Interest Rates

Not all interest rates are created equal. There are several different types, each with its own set of rules and implications. Let's take a look at some of the most common ones:

- Prime Rate: This is the rate that banks charge their most creditworthy customers. It's often used as a benchmark for other types of loans.

- Federal Funds Rate: This is the rate at which banks lend money to each other overnight. It's set by the Federal Reserve and influences other interest rates.

- APR (Annual Percentage Rate): This is the total cost of borrowing, including interest and fees, expressed as a yearly rate. It's often used for credit cards and loans.

- Fixed vs. Variable Rates: Fixed rates stay the same throughout the life of the loan, while variable rates can fluctuate based on market conditions.

Understanding the differences between these rates can help you make more informed financial decisions. For example, if you're taking out a mortgage, you might choose a fixed rate to lock in a low rate for the long term. But if you're confident that rates will stay low, a variable rate might save you money in the short term.

How Interest Rates Impact Investments

Interest rates don't just affect borrowers; they also play a big role in investments. When rates are low, it can be a great time to invest in stocks or real estate because borrowing costs are lower. But if rates rise, it can make bonds and other fixed-income investments more attractive because they offer higher returns.

For example, if you're an investor looking to buy rental properties, low interest rates can make it easier to finance those purchases. But if rates rise, it might make more sense to focus on dividend-paying stocks or other income-generating investments. It's all about weighing the risks and rewards based on current interest rate trends.

The Impact on Stock Markets

Interest rates can also have a significant impact on stock markets. When rates are low, companies can borrow money more cheaply, which can boost their profits and stock prices. But if rates rise too quickly, it can lead to a sell-off in the markets as investors become more risk-averse.

It's important to keep an eye on interest rate trends when making investment decisions. If you're planning to invest in stocks, bonds, or real estate, understanding how rates affect those markets can help you make smarter choices. And remember, diversification is key—don't put all your eggs in one basket.

Interest Rates and the Global Economy

Interest rates don't just affect individual countries; they also play a role in the global economy. When one country raises or lowers its rates, it can have ripple effects on other nations. For example, if the U.S. raises interest rates, it can attract foreign investors looking for higher returns, which can strengthen the dollar. But if other countries keep their rates low, it can make their currencies less attractive.

Global trade, currency exchange rates, and international investments are all influenced by interest rate decisions. It's a complex web of interconnectedness that can have far-reaching effects. That's why it's important to stay informed about global economic trends and how they might impact your finances.

How Exchange Rates Are Affected

Exchange rates are closely tied to interest rates. When a country raises its rates, it can make its currency more attractive to foreign investors, which can lead to an appreciation in value. But if rates are too high, it can make exports more expensive and hurt the country's trade balance.

For example, if the U.S. raises interest rates while other countries keep theirs low, the dollar might strengthen against other currencies. This can make U.S. goods more expensive for foreign buyers, which can hurt exports. But it can also make foreign goods cheaper for American consumers, which can boost imports. It's a delicate balance that requires careful consideration.

Managing Debt in a High-Interest Rate Environment

When interest rates rise, managing debt can become more challenging. If you have variable-rate loans or credit card debt, your payments might increase, which can put a strain on your budget. That's why it's important to have a plan in place for managing debt in a high-interest rate environment.

One strategy is to refinance your debt at a lower rate. For example, if you have a high-interest credit card balance, you might be able to transfer it to a card with a lower rate or even a 0% introductory rate. Another option is to consolidate your debt into a single loan with a lower rate, which can make it easier to manage and reduce your overall interest costs.

Tips for Reducing Debt

Here are a few tips for reducing debt in a high-interest rate environment:

- Pay more than the minimum payment on your credit cards to reduce interest charges.

- Consider a balance transfer to a card with a lower interest rate.

- Refinance your mortgage or car loan to lock in a lower rate.

- Create a budget and stick to it to avoid taking on new debt.

By taking proactive steps to manage your debt, you can protect your finances from the impact of rising interest rates. And remember, even small changes can add up over time, so don't be afraid to start with the basics.

The Future of Interest Rates

So, what does the future hold for interest rates? That's a question that economists and financial experts are constantly trying to answer. While no one can predict the future with certainty, there are a few trends to watch for.

As the global economy continues to recover from the pandemic, central banks are likely to keep a close eye on inflation and economic growth. If inflation starts to rise too quickly, they might raise rates to keep it in check. But if growth slows down, they might keep rates low to stimulate the economy.

Key Trends to Watch

Here are a few key trends to watch for in the future of interest rates:

- Inflation levels: If inflation rises, central banks might raise rates to control it.

- Economic growth: Strong growth could lead to higher rates, while slower growth might keep rates low.

- Global trade: Trade tensions or agreements could impact currency values and interest rates.

By staying informed about these trends, you can make smarter financial decisions and be better prepared for whatever the future holds.

Conclusion: Taking Control of Your Financial Future

In conclusion, interest rates are a critical factor in shaping our financial lives. From borrowing money to making investments, understanding how these rates work can help you make smarter decisions and achieve your financial goals. Whether you're a first-time homebuyer or a seasoned investor, taking the time to learn about interest rates is well worth the effort.

So, what can you do next? Start by reviewing your current financial situation and identifying areas where interest rates might be impacting you. Then, take proactive steps to manage your debt, invest wisely, and plan for the future. And don't forget to stay informed about global economic trends and how they might affect interest rates.

We'd love to hear your thoughts! Leave a comment below and let us know how interest rates have impacted your financial decisions. And if you found this article helpful, be sure to share it with your friends and family. Together, we can all become more financially savvy and take control of our financial futures.

Table of Contents

- What Are Interest Rates, Anyway?

- The Role of Central Banks in Setting Interest Rates

- Types of Interest Rates

- How Interest Rates Impact Investments

- Interest Rates and the Global Economy

- Managing Debt in a High-Interest Rate Environment

- The Future of Interest Rates

- Conclusion: Taking Control of Your Financial Future

![Buying a Home? Mortgage Rate Guide for Singapore [2023]](https://blog.roshi.sg/wp-content/uploads/2022/08/Singapore-Home-Loan-Rates-2022.jpeg)