Hey there, finance enthusiasts! If you've ever wondered why the Fed rate is such a big deal in the world of economics, you're about to dive into the ultimate breakdown. Fed rate isn’t just some random number; it’s a game-changer that affects everything from your mortgage payments to the stock market. So, buckle up because we’re about to unravel the mysteries of this financial powerhouse.

When people talk about the Fed rate, they’re referring to the interest rate set by the Federal Reserve, which is basically the central bank of the United States. Think of it as the Fed's secret weapon to keep the economy in check. It’s not just a number; it’s a signal, a strategy, and sometimes, a controversy. Whether you’re an investor, a homeowner, or just someone trying to make sense of the financial world, understanding the Fed rate is crucial.

Now, let’s get real for a moment. The Fed rate isn’t something you can ignore, especially if you’re planning to borrow money or invest. This rate influences how much it costs to borrow money, and that can have a ripple effect on your wallet. So, whether you’re saving for retirement, buying a house, or just trying to make your money work harder, knowing how the Fed rate works is essential. Stick around, because we’re about to break it all down for you.

Read also:Ekrem 304mamo287lu The Man Whos Changing Turkeys Political Landscape

What Exactly Is the Fed Rate?

The Fed rate, or the federal funds rate, is essentially the interest rate at which banks lend money to each other overnight. Think of it as the cost of borrowing between banks. The Federal Reserve sets a target range for this rate, and it’s one of the main tools the Fed uses to manage economic growth, inflation, and employment. It’s like the Fed’s way of saying, “Hey, here’s how we’re going to steer the economy.”

Here’s the kicker: when the Fed adjusts the rate, it sends shockwaves through the entire financial system. Lower rates mean cheaper borrowing, which can stimulate spending and investment. On the flip side, higher rates make borrowing more expensive, which can slow down the economy if it’s overheating. It’s a delicate balance, and the Fed has to be strategic about its moves.

Why Does the Fed Rate Matter?

Alright, let’s get to the heart of it. The Fed rate matters because it affects pretty much everything in the financial world. Here are a few reasons why:

- It influences consumer borrowing costs, like mortgages, car loans, and credit card rates.

- It impacts businesses, determining how much it costs for them to borrow money to expand or invest.

- It affects the stock market, as investors try to predict how changes in the rate will impact companies’ profits.

- It plays a role in controlling inflation, ensuring that prices don’t spiral out of control.

So, when the Fed raises or lowers the rate, it’s not just a number on a screen—it’s a decision that can shape the financial landscape for years to come.

How Does the Fed Rate Affect You?

Let’s talk about the personal impact. If you’re a homeowner with a variable-rate mortgage, changes in the Fed rate can directly affect your monthly payments. A rate hike means higher payments, while a rate cut could mean some relief. If you’re saving money in a high-yield savings account, a rate increase could mean better returns on your savings. On the flip side, if you’re carrying credit card debt, a rate hike could make those balances even more expensive.

For investors, the Fed rate can be a double-edged sword. Lower rates can boost stock prices as companies find it cheaper to borrow and invest, but higher rates can weigh on the market as borrowing becomes more expensive. It’s all about understanding how these changes ripple through the economy and how they affect your financial decisions.

Read also:Ncaab The Ultimate College Basketball Experience You Cant Miss

Real-Life Examples of Fed Rate Impact

Let’s look at some real-life scenarios to see how the Fed rate affects everyday people:

- Mortgage Rates: When the Fed lowers rates, mortgage rates tend to follow, making it a great time to buy a home or refinance an existing mortgage.

- Credit Card Debt: With a rate increase, the interest on your credit card balances can rise, making it harder to pay off debt.

- Stock Market Fluctuations: A surprise rate cut can send stocks soaring, while an unexpected rate hike can lead to market sell-offs.

These examples show just how interconnected the Fed rate is with our daily lives. It’s not just a number; it’s a powerful force that shapes the financial world.

The History of the Fed Rate

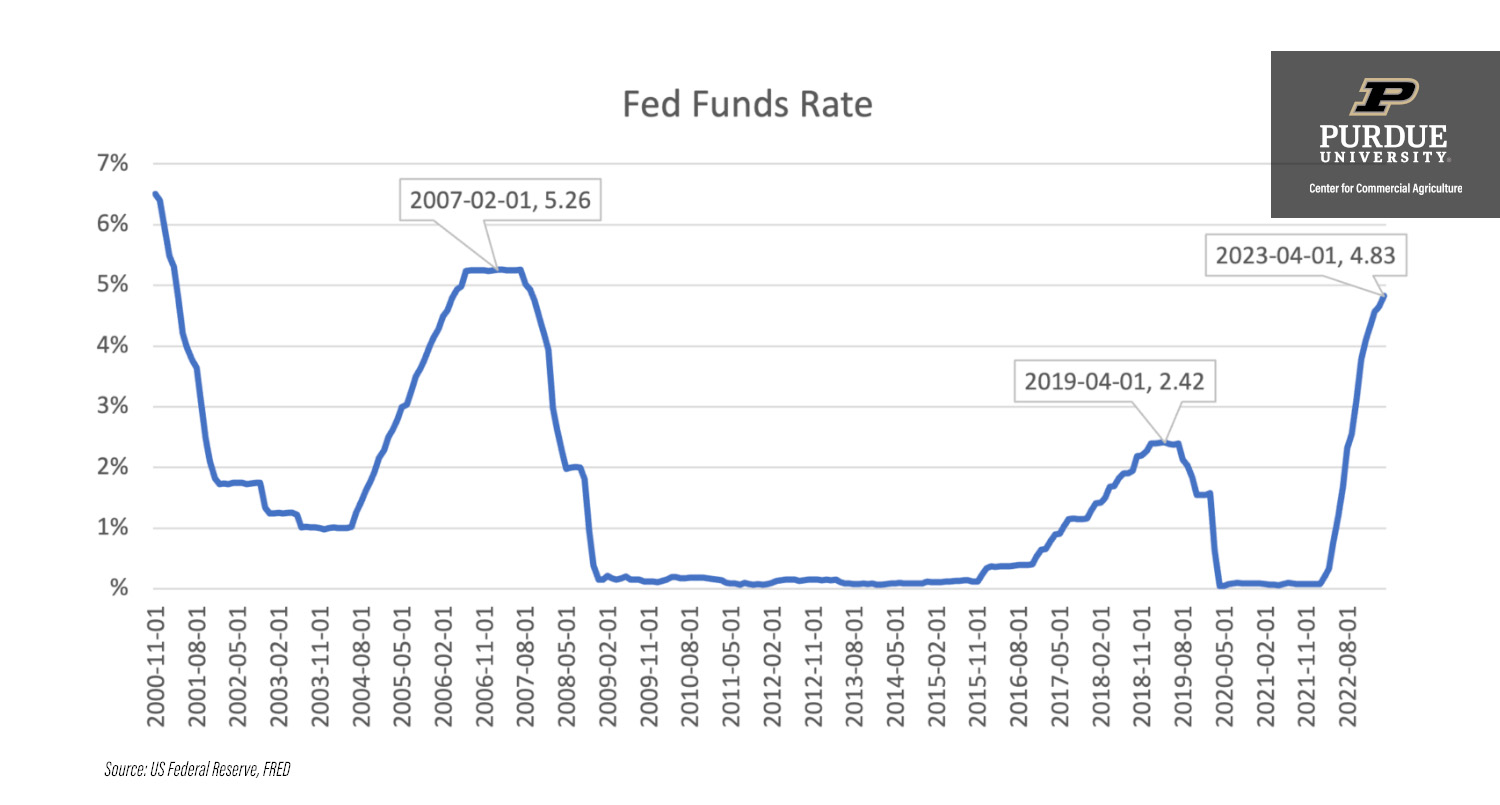

To truly understand the Fed rate, we need to look back at its history. The Federal Reserve was established in 1913, and since then, it’s been fine-tuning its tools to manage the economy. Over the years, the Fed has used the federal funds rate to respond to economic challenges, from the Great Depression to the 2008 financial crisis.

One of the most dramatic periods in Fed rate history was during the early 1980s, when inflation was spiraling out of control. The Fed, under Chairman Paul Volcker, raised rates to double-digit levels to tame inflation. It was painful in the short term, but it laid the groundwork for decades of stable prices. Fast forward to the 2008 financial crisis, and the Fed slashed rates to near zero to prevent a total economic collapse.

Key Moments in Fed Rate History

Here are a few key moments in the Fed rate’s history:

- 1980s: The Volcker era, where rates soared to fight inflation.

- 2008: Rates dropped to near zero during the financial crisis.

- 2020: Rates were cut to near zero again during the pandemic to stabilize the economy.

These moments highlight the Fed’s role as a stabilizing force in times of economic uncertainty.

How the Fed Sets the Rate

So, how does the Fed decide what the rate should be? It’s not a random decision; it’s based on a lot of data and analysis. The Federal Open Market Committee (FOMC), which is part of the Fed, meets several times a year to assess the economy and set the target rate. They look at factors like inflation, unemployment, and economic growth to make their decisions.

Here’s a simplified breakdown of the process:

- The FOMC reviews economic data and forecasts.

- They discuss the current state of the economy and potential risks.

- Based on their analysis, they decide whether to raise, lower, or maintain the rate.

It’s a complex process, but the goal is always the same: to keep the economy on track and avoid extremes of inflation or recession.

The Role of the FOMC

The FOMC is like the Fed’s steering committee. It’s made up of Fed governors and regional bank presidents, and it’s responsible for setting monetary policy. Their decisions have far-reaching consequences, and they take their role very seriously. The FOMC’s meetings are closely watched by economists, investors, and policymakers because their decisions can move markets.

Impact on Global Economies

While the Fed rate is primarily focused on the U.S. economy, its impact is felt around the world. Many countries peg their currencies to the U.S. dollar, so changes in the Fed rate can affect exchange rates and international trade. For example, a stronger dollar can make U.S. exports more expensive, while a weaker dollar can boost exports.

Emerging markets are particularly sensitive to Fed rate changes. A rate hike can lead to capital outflows as investors seek higher returns in the U.S., while a rate cut can bring capital back into emerging markets. It’s a delicate balance, and the Fed has to consider the global implications of its decisions.

Case Study: The 2015 Rate Hike

In 2015, the Fed raised rates for the first time since the financial crisis, marking a turning point in monetary policy. The move sent shockwaves through global markets, as investors tried to gauge the impact on emerging economies. Some countries saw capital outflows, while others benefited from stronger currencies. It was a reminder of just how interconnected the global economy is.

Future Trends in Fed Rate Policy

Looking ahead, the Fed faces new challenges in setting its rate policy. With the rise of digital currencies and changing economic dynamics, the Fed has to adapt its strategies. Climate change, inequality, and technological advancements are all factors that could influence future rate decisions.

One trend to watch is the Fed’s focus on “average inflation targeting.” This means the Fed may allow inflation to run higher for a period before raising rates, which could have long-term implications for the economy. It’s a shift in thinking that reflects the evolving nature of economic policy.

Predicting the Future of Fed Rate

Predicting the Fed’s future moves is no easy task, but here are a few things to keep an eye on:

- Inflation Trends: If inflation starts to rise faster than expected, the Fed may act more aggressively.

- Economic Growth: Strong growth could lead to rate hikes, while sluggish growth might prompt cuts.

- Global Developments: Geopolitical events and global economic trends can influence the Fed’s decisions.

Staying informed and keeping an eye on these factors can help you anticipate future rate moves.

Conclusion: Why You Should Care About the Fed Rate

So, there you have it—the ultimate guide to understanding the Fed rate. Whether you’re a homeowner, an investor, or just someone trying to make sense of the financial world, the Fed rate plays a crucial role in shaping your financial future. It’s not just a number; it’s a powerful tool that affects everything from borrowing costs to stock prices.

We’ve covered a lot of ground, from the history of the Fed rate to its impact on global economies. The key takeaway is this: the Fed rate matters, and understanding it can help you make better financial decisions. So, stay informed, keep an eye on the Fed’s moves, and don’t be afraid to ask questions.

And now, it’s your turn. Have you noticed how changes in the Fed rate have affected your finances? Share your thoughts in the comments below, and don’t forget to check out our other articles for more insights into the world of finance. Thanks for reading, and see you in the next one!

Table of Contents

- What Exactly Is the Fed Rate?

- Why Does the Fed Rate Matter?

- How Does the Fed Rate Affect You?

- The History of the Fed Rate

- How the Fed Sets the Rate

- Impact on Global Economies

- Future Trends in Fed Rate Policy

- Conclusion: Why You Should Care About the Fed Rate