Alright folks, let's dive right into the heart of it. Fed rates, or Federal Reserve interest rates, are basically the lifeblood of the U.S. economy. If you’ve ever wondered how the government manages inflation, controls spending, or influences borrowing, then this is your golden ticket to understanding it all. It’s not just some random number floating around; it’s a crucial lever that can make or break financial stability.

Think of it like this: imagine the economy as a big machine, and the Federal Reserve is the mechanic tweaking its parts. The fed rate is the tool they use to keep everything running smoothly. When the economy overheats, they jack up the rates. When it slows down too much, they lower them. It’s a balancing act, and understanding it can help you make smarter financial decisions.

But hey, don’t just take my word for it. Whether you’re a small business owner, a first-time homebuyer, or someone trying to save up for retirement, the fed rate affects you in more ways than you might realize. Stick with me as we break it all down, from the basics to the nitty-gritty details.

Read also:Spring 2025 Your Ultimate Guide To Whatrsquos Coming Next

What Exactly Are Fed Rates and Why Should You Care?

Fed rates, or Federal Funds Rate, are essentially the interest rates that banks charge each other for overnight loans. Yeah, I know, it sounds boring at first glance, but trust me, it’s a big deal. These rates have a ripple effect across the entire economy, influencing everything from mortgage loans to credit card interest rates.

Here’s the deal: when the Federal Reserve raises or lowers these rates, it’s like turning a giant economic dial. Higher rates mean borrowing becomes more expensive, which can slow down spending and inflation. Lower rates, on the other hand, make borrowing cheaper, encouraging people to spend more. It’s like a see-saw, and the Fed is the one trying to keep it balanced.

So why should you care? Well, if you’re planning to take out a loan, buy a house, or even invest in the stock market, the fed rate can significantly impact your financial situation. Even if you’re just saving money in a bank account, changes in the fed rate can affect how much interest you earn. It’s not just for economists and bankers; it’s something everyone should have on their radar.

How Fed Rates Impact Everyday People

Let’s break it down a bit further. Here’s a quick rundown of how fed rates can affect you:

- Mortgage Rates: When the fed rate goes up, mortgage rates usually follow suit. This means buying a home might become more expensive.

- Credit Card Interest: Higher fed rates often lead to higher credit card interest rates, making it more costly to carry a balance.

- Savings Accounts: On the flip side, higher fed rates can mean better returns on savings accounts and certificates of deposit (CDs).

- Investments: Fed rate changes can influence the stock market, affecting your investment portfolio.

See what I mean? It’s not just some abstract concept; it’s something that touches almost every aspect of your financial life.

The History of Fed Rates: A Quick Timeline

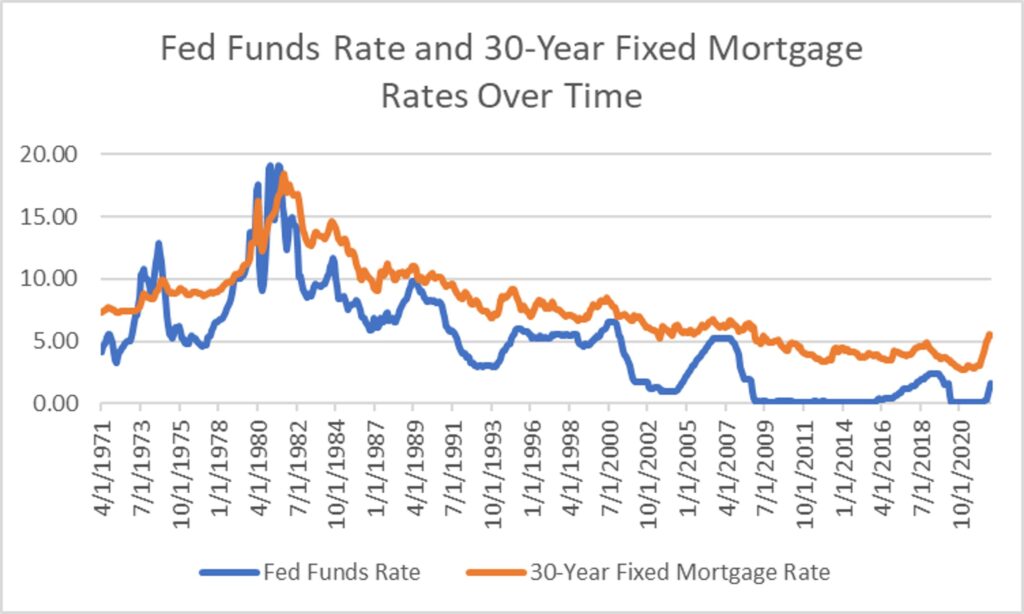

Now, let’s take a little trip back in time to understand how fed rates have evolved over the years. The Federal Reserve was established in 1913, but it wasn’t until the 1980s that fed rates really started to play a major role in economic policy.

Read also:2025 Best Picture A Sneak Peek Into The Future Of Cinema

Back in the 1970s, inflation was running rampant, reaching double-digit levels. Enter Paul Volcker, the Fed Chairman who decided to take drastic action. He jacked up the fed rate to an eye-popping 20% in 1981, effectively slamming the brakes on the economy. It worked, though, bringing inflation under control, but not without causing a recession.

Fast forward to the 2008 financial crisis, and the fed rate was practically at zero. The Fed kept it there for years to stimulate the economy and encourage borrowing. More recently, as the economy recovered, they started raising rates again to prevent overheating.

Key Moments in Fed Rate History

Here’s a quick summary of some key moments in fed rate history:

- 1981: Fed rate peaks at 20% under Paul Volcker to combat inflation.

- 2008: Fed rate drops to near-zero during the financial crisis.

- 2022: Fed begins aggressively raising rates to combat rising inflation post-pandemic.

Each of these moments had a profound impact on the economy, and they serve as important lessons for understanding how the Fed uses its tools to manage economic conditions.

How the Fed Decides on Rate Changes

Alright, so how does the Federal Reserve decide when to raise or lower rates? It’s not just a random decision; there’s a whole process behind it. The Fed looks at a variety of economic indicators, including inflation, employment rates, and GDP growth.

If inflation is too high, the Fed might decide to raise rates to cool things down. If unemployment is rising, they might lower rates to stimulate job growth. It’s all about finding that sweet spot where the economy is growing without overheating.

But here’s the thing: it’s not an exact science. The Fed has to make educated guesses based on the data they have, and sometimes things don’t go exactly as planned. That’s why they constantly monitor the economy and adjust their policies as needed.

The Role of the Federal Open Market Committee (FOMC)

The Federal Open Market Committee, or FOMC, is the group within the Federal Reserve that’s responsible for setting monetary policy, including fed rates. They meet eight times a year to discuss economic conditions and decide whether to raise, lower, or keep rates the same.

These meetings are closely watched by economists, investors, and pretty much anyone with a stake in the economy. Their decisions can send shockwaves through financial markets, so it’s no surprise that people pay attention.

The Impact of Fed Rates on Businesses

Now let’s talk about how fed rates affect businesses. For small business owners, changes in the fed rate can have a big impact on their bottom line. When rates go up, borrowing becomes more expensive, which can make it harder to expand or invest in new projects. On the flip side, lower rates can make it easier to access capital, allowing businesses to grow and thrive.

For larger corporations, the impact can be even more pronounced. Changes in the fed rate can affect everything from stock prices to profit margins. Companies that rely heavily on borrowing, like real estate developers, are especially sensitive to rate changes.

Small Business vs. Big Business: Who’s Affected More?

Here’s a quick comparison:

- Small Businesses: More vulnerable to rate changes due to limited access to capital.

- Large Corporations: Better equipped to weather rate changes, but still affected by market fluctuations.

Both groups have to navigate the ups and downs of the economy, but they do it in different ways. Understanding how fed rates affect businesses can help you make better decisions, whether you’re a business owner or just an investor.

Fed Rates and the Stock Market: A Love-Hate Relationship

Let’s talk about the stock market for a moment. Fed rates have a complex relationship with the stock market, and it’s not always straightforward. When rates go up, it can make stocks less attractive compared to bonds, which now offer higher returns. This can lead to a sell-off in the stock market.

On the other hand, when rates are low, it can make stocks more appealing, driving prices higher. But here’s the catch: if rates stay too low for too long, it can lead to asset bubbles, where stock prices become inflated beyond their true value.

It’s a delicate balance, and the Fed has to be careful not to tip the scales too far in either direction. Investors, meanwhile, have to navigate these changes and adjust their strategies accordingly.

What Investors Need to Know About Fed Rates

Here are a few key takeaways for investors:

- Pay Attention to FOMC Meetings: These meetings can provide clues about future rate changes.

- Stay Diversified: Don’t put all your eggs in one basket; diversification can help protect your portfolio.

- Be Prepared for Volatility: Rate changes can cause short-term fluctuations in the market.

Investing is all about managing risk, and understanding how fed rates affect the market is a crucial part of that.

The Global Impact of Fed Rates

While we’ve been focusing on the U.S. economy, it’s important to remember that fed rates have a global impact as well. The U.S. dollar is the world’s reserve currency, so changes in fed rates can affect economies around the world.

For example, when the Fed raises rates, it can strengthen the dollar, making it more expensive for other countries to repay their dollar-denominated debts. This can lead to economic instability in those countries, especially if they’re already struggling with high inflation or debt levels.

On the flip side, when the Fed lowers rates, it can weaken the dollar, making it easier for other countries to repay their debts. But it can also lead to capital outflows, where investors pull their money out of emerging markets and put it into safer U.S. assets.

How Emerging Markets Are Affected

Emerging markets are particularly vulnerable to changes in fed rates. Here’s why:

- Debt Repayment: Many emerging markets have large amounts of debt denominated in U.S. dollars.

- Capital Flows: Changes in fed rates can affect the flow of capital in and out of these markets.

- Currency Fluctuations: A stronger dollar can make it harder for emerging market currencies to compete.

It’s a complex web of interconnectedness, and the Fed has to be mindful of its global impact when making decisions about rates.

The Future of Fed Rates: What Lies Ahead?

So, what’s the future hold for fed rates? That’s the million-dollar question, and the answer isn’t exactly clear. The Fed is constantly monitoring the economy and adjusting its policies as needed, but there are a lot of factors at play.

With inflation still a concern, it’s likely that the Fed will continue to raise rates for the foreseeable future. But how high will they go? And for how long? That’s anyone’s guess. What we do know is that the Fed will be closely watching economic indicators to guide its decisions.

For everyday people, businesses, and investors, the best strategy is to stay informed and be prepared for change. The economy is constantly evolving, and the fed rate is just one of the many tools the Fed uses to manage it.

Tips for Navigating the Fed Rate Landscape

Here are a few tips to help you navigate the ever-changing world of fed rates:

- Stay Informed: Keep up with economic news and FOMC meetings.

- Plan Ahead: Consider how rate changes might affect your financial situation.

- Be Flexible: Be prepared to adjust your plans as conditions change.

The more you understand about fed rates, the better equipped you’ll be to make informed decisions about your finances.

Conclusion: Why Fed Rates Matter to You

Alright, let’s wrap things up. Fed rates might seem like a dry, technical topic, but they’re actually incredibly important for anyone who cares about their financial well-being. From influencing mortgage rates and credit card interest to affecting the stock market and global economies, the fed rate touches almost every aspect of our financial lives.

By understanding how the Fed uses its tools to manage the economy, you can make smarter decisions about borrowing, investing, and saving. And hey, who doesn’t want to be a little more financially savvy?

So, what’s next? Take a moment to reflect on what you’ve learned and think about how it applies to your own situation. And if you found this article helpful, don’t forget to share it with your friends and family. Knowledge is power, and the more people understand about fed rates, the better off we all are.

Thanks for sticking with me through this deep dive into the world of fed rates. I hope you found it informative and, dare I say, even a little entertaining. Until next time, stay sharp and keep those finances in check!

Table of Contents

What Exactly Are Fed Rates and Why Should You Care?

How Fed Rates Impact Everyday People