Listen up, folks. If you're one of the millions of people out there with student loans, you might already know that Income-Driven Repayment (IDR) plans can be a lifesaver when it comes to managing your payments. But guess what? The IDR recertification process can sometimes feel like navigating a maze, especially when applications are temporarily closed. So, are your student loans up for IDR recertification? If they are, don’t panic. We’ve got you covered with all the info you need to stay on top of things.

This is not just another article about student loans. It’s a deep dive into what happens when IDR applications are closed, what your options are, and how you can still keep your financial life in check. Whether you're dealing with federal loans or private ones, understanding the ins and outs of IDR recertification is crucial for anyone trying to make ends meet.

Let’s face it, student loans can be overwhelming. But hey, knowledge is power. By the time you finish reading this, you’ll know exactly what steps to take, what to expect, and how to prepare for the next phase of your loan journey. So, buckle up, and let’s get into the nitty-gritty of IDR recertification.

Read also:Oscars Best Picture 2025 The Ultimate Guide To The Most Coveted Award

Understanding IDR and Why Recertification Matters

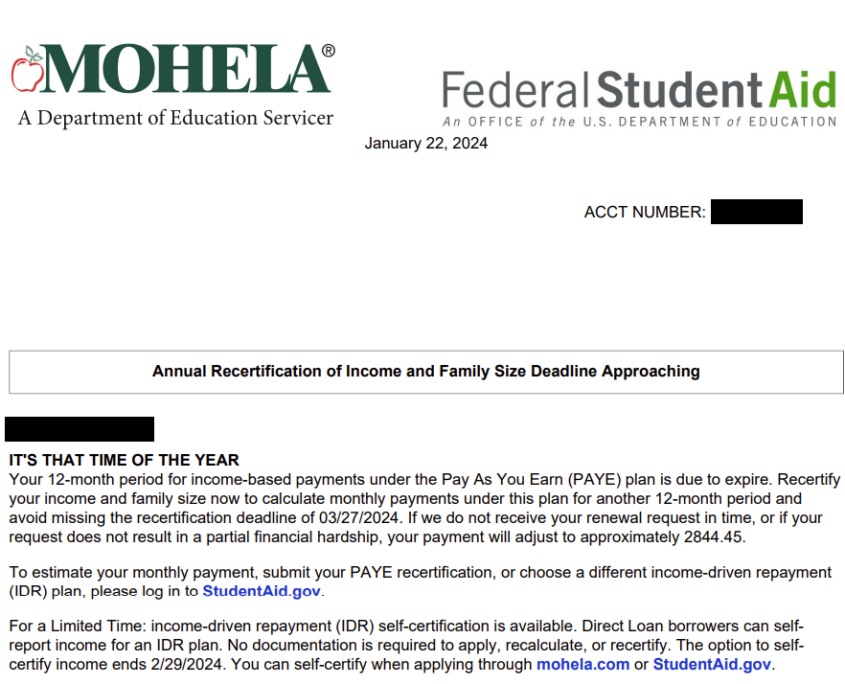

First things first, let’s talk about IDR. Income-Driven Repayment plans are designed to make your student loan payments more manageable based on your income and family size. The idea is simple: you pay what you can afford, not what some random lender decides you should pay. But here’s the kicker—these plans require annual recertification.

Recertification is basically the process of updating your income and family size information with your loan servicer. Why does it matter? Well, if you skip this step, your payments could skyrocket, or worse, you might lose access to the benefits of the IDR plan altogether. It’s like renewing your driver’s license—yeah, it’s a hassle, but you gotta do it.

What Happens When IDR Applications Are Closed?

Now, here’s the tricky part. Sometimes, the Department of Education or your loan servicer might temporarily close IDR applications for various reasons. Maybe they’re updating their systems, maybe there’s a backlog of applications, or maybe they’re just having one of those days. Whatever the reason, it can leave borrowers in a tough spot.

When applications are closed, you might not be able to submit your recertification forms or make changes to your existing plan. But don’t freak out just yet. There are still things you can do to stay ahead of the game.

What Are Your Options While Applications Are Closed?

If you’re stuck in limbo with closed IDR applications, don’t worry. You’re not alone, and there are still options on the table. Here’s what you can do to keep things moving forward:

1. Gather Your Documents Early

Read also:Department Of Defense Your Ultimate Guide To Understanding Americas Shield

Even if you can’t submit your recertification right now, you can still get all your ducks in a row. Collect all the necessary documents, like your tax returns, W-2 forms, and any other proof of income. This way, as soon as the applications reopen, you’ll be ready to hit the ground running.

2. Reach Out to Your Loan Servicer

Your loan servicer is your best friend in this situation. Give them a call or send them an email to find out exactly what’s going on and when they plan to reopen applications. They might even have some insider tips or workarounds to help you out.

3. Explore Temporary Payment Adjustments

Some loan servicers offer temporary payment adjustments during periods when applications are closed. This means you might be able to lower your payments temporarily until the recertification process is back up and running. It’s not a permanent solution, but it can help ease the financial strain in the meantime.

4. Consider Other Repayment Plans

If recertification feels like it’s taking forever, you might want to explore other repayment options. Standard repayment plans, graduated repayment plans, or even deferment/forbearance could be viable alternatives while you wait for IDR to reopen.

How to Prepare for Recertification

Recertification doesn’t have to be a headache if you’re prepared. Here’s a quick checklist to help you get ready:

- Gather all necessary financial documents.

- Double-check your income and family size information.

- Update your contact information with your loan servicer.

- Set reminders for important deadlines.

- Stay informed about any changes to IDR policies.

By staying organized and proactive, you can avoid last-minute stress and ensure a smoother recertification process.

Common Mistakes to Avoid During Recertification

Even the best-laid plans can go awry if you’re not careful. Here are some common mistakes to watch out for:

- Missing the deadline for recertification.

- Submitting incomplete or incorrect information.

- Not updating your income or family size when it changes.

- Assuming everything will be fine without following up.

Avoiding these pitfalls can save you a lot of headaches down the road.

Understanding IDR Plan Options

Not all IDR plans are created equal. Here’s a quick rundown of the most popular options:

1. Income-Based Repayment (IBR)

IBR limits your monthly payments to 10-15% of your discretionary income, depending on when you took out your loans. It’s a great option for borrowers with lower incomes.

2. Pay As You Earn (PAYE)

PAYE caps your payments at 10% of your discretionary income and offers loan forgiveness after 20-25 years of qualifying payments.

3. Revised Pay As You Earn (REPAYE)

REPAYE is similar to PAYE but includes both undergraduate and graduate loans. It also offers forgiveness after 20-25 years.

How to Choose the Right IDR Plan

Finding the right IDR plan depends on your unique financial situation. Here are some factors to consider:

- Your current income and expected future income.

- Your total loan balance.

- Your family size and any anticipated changes.

- Your eligibility for loan forgiveness programs.

Taking the time to evaluate these factors can help you choose the plan that works best for you.

Staying Informed About IDR Policies

The world of student loans is constantly evolving. To stay ahead of the curve, make sure you’re keeping up with the latest news and policy updates. Follow reliable sources, sign up for email alerts from your loan servicer, and don’t hesitate to ask questions if something seems unclear.

Final Thoughts: Taking Control of Your Student Loans

In conclusion, dealing with IDR recertification can be a challenge, especially when applications are closed. But by staying informed, organized, and proactive, you can navigate this process with confidence. Remember, your student loans don’t have to control your life. With the right strategies and resources, you can take control of your financial future.

So, what’s next? If you found this article helpful, feel free to share it with others who might benefit. And if you have any questions or comments, drop them below. Let’s keep the conversation going and help each other out along the way.

Table of Contents

- Understanding IDR and Why Recertification Matters

- What Happens When IDR Applications Are Closed?

- What Are Your Options While Applications Are Closed?

- How to Prepare for Recertification

- Common Mistakes to Avoid During Recertification

- Understanding IDR Plan Options

- How to Choose the Right IDR Plan

- Staying Informed About IDR Policies

- Final Thoughts: Taking Control of Your Student Loans

:max_bytes(150000):strip_icc()/GettyImages-1391441687-8b6edda38e0845f1ae522ced3c0301cc.jpg)