Hey there, tech enthusiasts and stock market wizards! If you've ever wondered about the ins and outs of Google stock price, you've come to the right place. This isn't just about numbers on a screen; it's about understanding the pulse of one of the most powerful companies in the world. Alphabet Inc., the parent company of Google, is more than just a search engine—it's a tech giant reshaping industries and influencing economies. So, buckle up as we dive into the nitty-gritty of Google's stock performance, trends, and what it means for investors like you.

Now, let's get something straight: Google stock price isn't just a metric for Wall Street analysts. It's a reflection of how the market views innovation, growth, and sustainability in the tech sector. Whether you're a seasoned investor or just starting your journey, knowing what drives Google's stock can be a game-changer. In this article, we'll break it down in a way that's easy to digest but packed with insights.

By the end of this read, you'll not only understand the factors influencing Google stock price but also how to make informed decisions. So, whether you're here to buy, sell, or hold, this guide has got your back. Let's jump in, shall we?

Read also:Fed Rate Your Ultimate Guide To Understanding The Fedrsquos Powerhouse Tool

Understanding Google Stock Price: The Basics

Before we dive headfirst into the deep end, let's take a moment to understand the basics. Google stock price is essentially the value of a single share of Alphabet Inc. on the stock market. But hold up—there's more to it than just a number. Alphabet trades under two primary classes: Class A (GOOGL) and Class C (GOOG). Each class has its own nuances, so it's worth knowing the difference.

What Drives Google Stock Price?

Several factors play a role in determining Google stock price. From revenue growth and ad revenue to product launches and regulatory challenges, every move Alphabet makes ripples through the market. Here are a few key drivers:

- Revenue Growth: Google's ad revenue remains its bread and butter, accounting for a significant chunk of its earnings. Any fluctuations here can send shockwaves through the stock price.

- Cloud Computing: Google Cloud is rapidly gaining ground, challenging AWS and Microsoft Azure. Its success directly impacts investor sentiment.

- Innovation and R&D: Alphabet's commitment to cutting-edge tech like AI, autonomous vehicles, and healthcare innovations keeps investors intrigued.

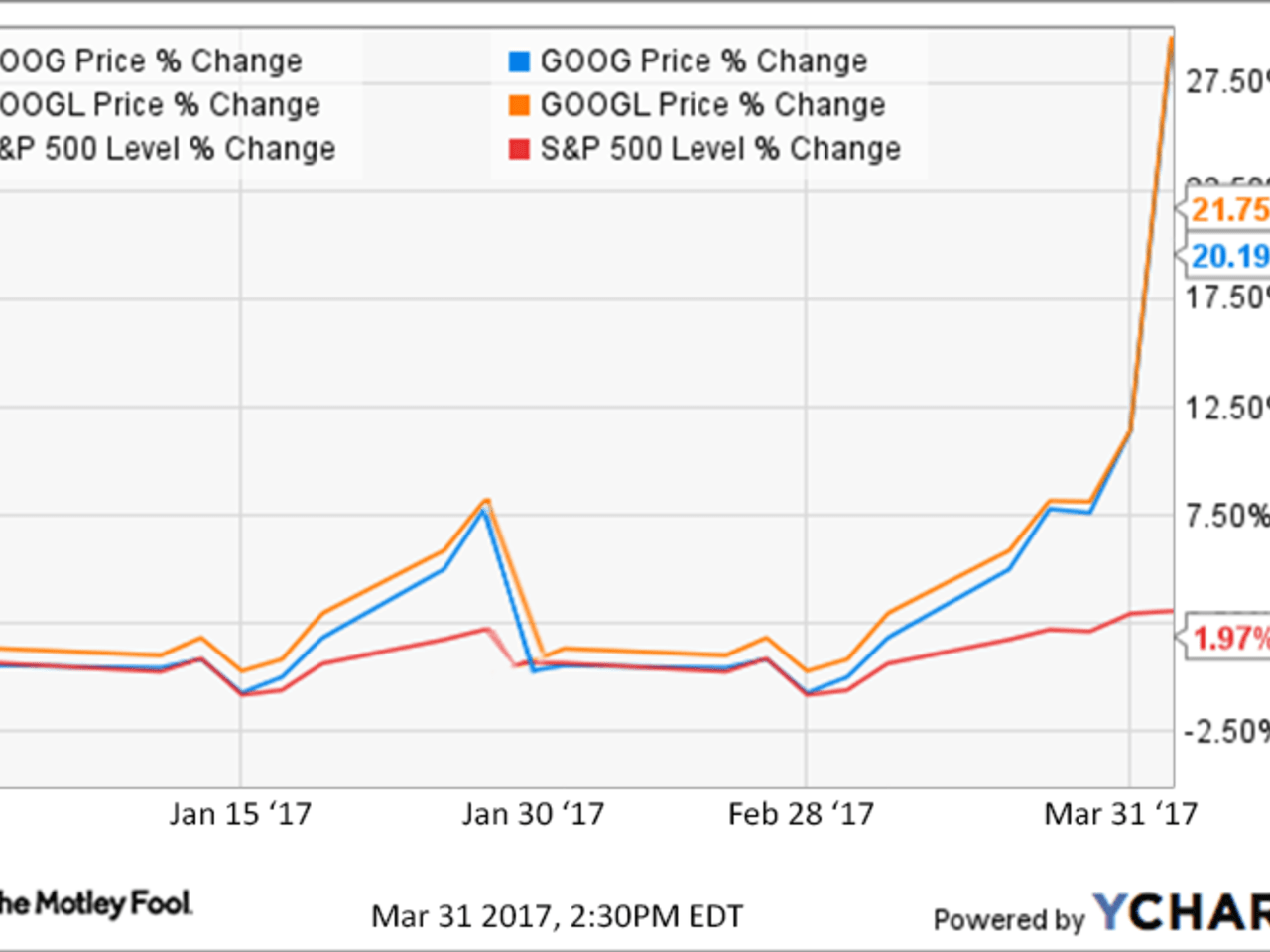

Google Stock Price Trends Over the Years

If you're thinking about jumping into the Google stock game, it's crucial to look back at its historical performance. Over the years, Google stock price has seen both highs and lows, mirroring the broader market trends and the company's strategic decisions. Let's take a stroll down memory lane.

Key Milestones in Google's Stock Journey

From its IPO in 2004 to its transformation into Alphabet Inc. in 2015, Google's stock has been on a rollercoaster ride. Here are some key moments:

- 2004 IPO: Google went public at $85 per share, sparking excitement in the tech world.

- 2015 Reorganization: The creation of Alphabet Inc. added a layer of complexity but also clarity to its operations.

- 2020 Pandemic: Like many tech giants, Google's stock weathered the storm and emerged stronger, driven by increased digital ad spending.

Factors Influencing Google Stock Price Today

In the present day, Google stock price is influenced by a myriad of factors. Let's break them down:

1. Economic Conditions

The health of the global economy plays a huge role in how investors view tech stocks. Recessions, inflation, and interest rate hikes can all impact Google stock price.

Read also:Pearl Masked Singer Unveiling The Glitz Glamour And Mystery

2. Regulatory Environment

Antitrust investigations and data privacy concerns are constant companions for Alphabet. Any regulatory action can send the stock tumbling—or soaring, depending on the outcome.

3. Technological Advancements

Alphabet's ventures into AI, quantum computing, and self-driving cars keep investors on their toes. Each breakthrough or setback affects the stock's trajectory.

How to Analyze Google Stock Price

Now that you know the factors at play, how do you analyze Google stock price? Here are some tools and techniques:

1. Fundamental Analysis

This involves looking at financial statements, earnings reports, and other metrics to gauge the intrinsic value of the stock. It's all about understanding the company's financial health.

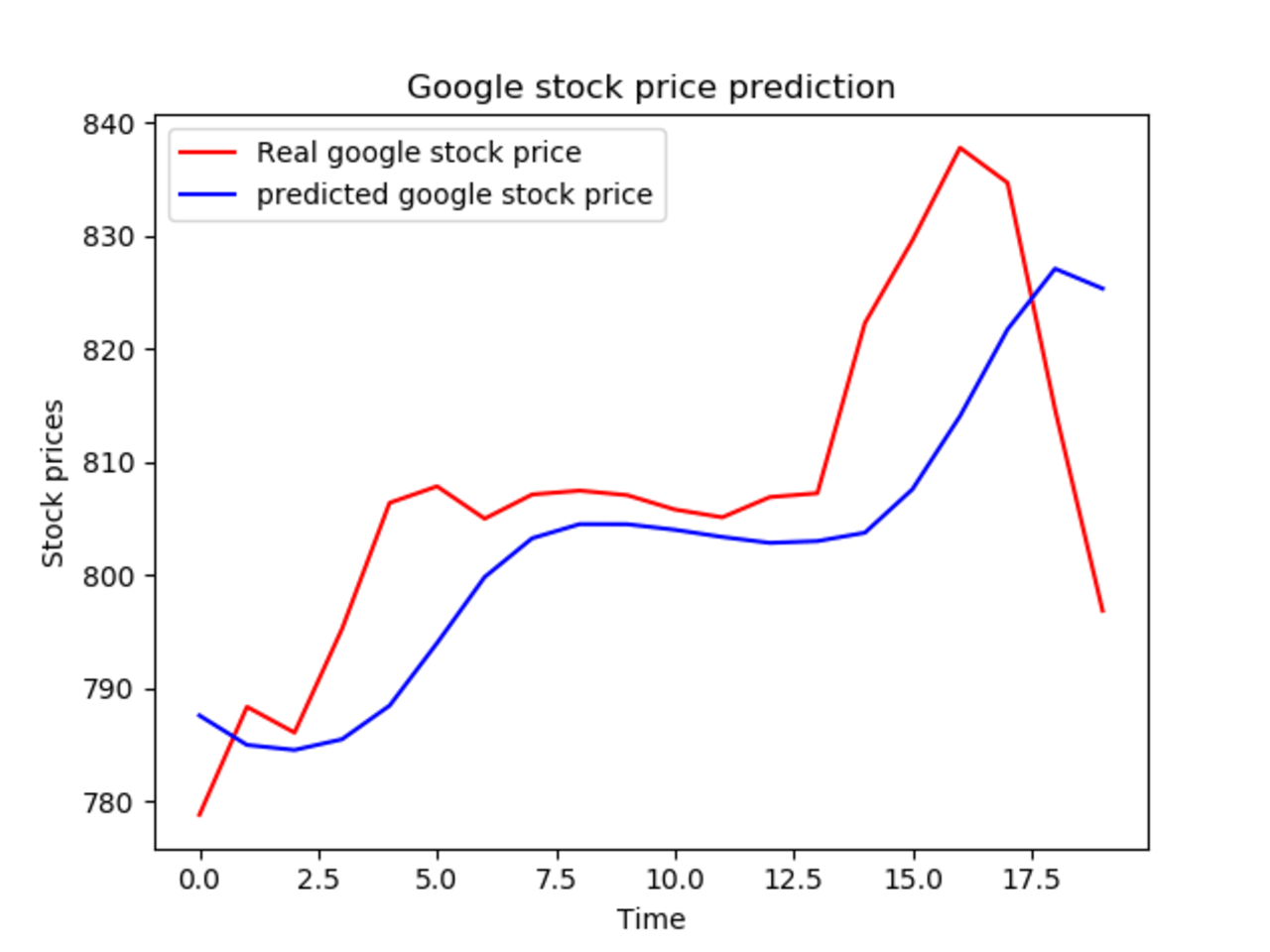

2. Technical Analysis

For those who prefer charts and patterns, technical analysis focuses on historical price movements and trading volumes. It's like reading tea leaves, but with data.

3. Sentiment Analysis

How the market feels about Alphabet can be just as important as the numbers. Social media, news articles, and investor sentiment can all influence Google stock price.

Investing in Google Stock: Is It Worth It?

So, you're thinking about buying Google stock. Is it worth the investment? Let's weigh the pros and cons:

Pros:

- Strong Financials: Alphabet boasts robust revenue streams and a solid balance sheet.

- Innovative Pipeline: With ventures in AI, cloud computing, and healthcare, the company is well-positioned for the future.

- Brand Power: Google's dominance in search and advertising is unparalleled.

Cons:

- Regulatory Risks: Antitrust cases could pose significant challenges.

- Market Saturation: Some sectors, like search, might be nearing their growth limits.

- Economic Uncertainty: Global economic downturns could hit ad revenue hard.

Google Stock Price Predictions: What Analysts Say

Analysts are always busy forecasting Google stock price. While no one has a crystal ball, they use data and trends to make educated guesses. Here's what the experts are saying:

Short-Term Outlook

In the short term, analysts expect Google stock price to remain volatile, driven by macroeconomic factors and company-specific news.

Long-Term Outlook

Over the long term, many analysts are bullish on Alphabet, citing its diverse revenue streams and innovation potential. However, regulatory hurdles could pose challenges.

How to Buy Google Stock

Ready to take the plunge? Buying Google stock is easier than ever. Here's how:

1. Choose a Broker

Pick a reputable online broker that offers access to U.S. stocks. Some popular options include Robinhood, Charles Schwab, and Fidelity.

2. Open an Account

Create an account, verify your identity, and fund it with the amount you want to invest.

3. Place Your Order

Search for GOOGL or GOOG, decide on the number of shares, and place your order. It's as simple as that!

Common Misconceptions About Google Stock Price

There are plenty of myths floating around about Google stock price. Let's bust a few:

1. It's Too Expensive

While Google stock might seem pricey, its value is justified by the company's earnings and growth potential.

2. It's Only About Ads

While ad revenue is crucial, Alphabet has diversified its portfolio significantly, reducing reliance on any single revenue stream.

3. Regulatory Issues Will Doom It

While antitrust cases are serious, Alphabet has a track record of navigating such challenges successfully.

Conclusion: The Final Word on Google Stock Price

So, there you have it—a comprehensive look at Google stock price. Whether you're a long-term investor or a day trader, understanding the dynamics at play can help you make smarter decisions. Remember, investing always comes with risks, so do your homework and consult professionals if needed.

And hey, don't forget to share this article with your friends or drop a comment below. Let's keep the conversation going. Until next time, stay savvy and keep those stocks rolling!

Table of Contents

- Understanding Google Stock Price: The Basics

- Google Stock Price Trends Over the Years

- Factors Influencing Google Stock Price Today

- How to Analyze Google Stock Price

- Investing in Google Stock: Is It Worth It?

- Google Stock Price Predictions: What Analysts Say

- How to Buy Google Stock

- Common Misconceptions About Google Stock Price

- Conclusion: The Final Word on Google Stock Price