Let’s face it, folks—student loans repayment can feel like a never-ending marathon. Whether you’re fresh out of college or have been juggling payments for years, the weight of student debt is real and heavy. But don’t panic, because we’re here to break it down for you in a way that’s easy to digest. In this article, we’ll dive deep into the ins and outs of repaying your student loans, offering practical tips and expert advice to help you manage your financial obligations without losing sleep.

Now, I know what you're thinking: "Another article about student loans? Give me something fresh!" Trust me, this isn't your run-of-the-mill guide. We're talking real strategies, actionable insights, and even some fun tidbits to keep things light. By the end of this read, you’ll not only understand how to repay your loans but also discover ways to optimize your repayment plan for long-term financial success.

Before we jump into the nitty-gritty, let’s get one thing straight: you’re not alone in this journey. Millions of students worldwide are navigating the same waters, and with the right approach, you can turn this challenge into an opportunity to build a stronger financial foundation. So, grab a coffee (or tea, if that’s your jam), and let’s tackle student loans repayment together!

Read also:Weather Tornadoes A Closer Look At Natures Fury

Table of Contents

- Understanding Student Loans

- Repayment Options for Student Loans

- Income-Driven Repayment Plans

- Loan Consolidation: Is It Worth It?

- Student Loans Forgiveness Programs

- Tax Benefits for Student Loan Repayers

- Tips to Accelerate Your Repayment

- Common Mistakes to Avoid

- Resources for Help and Support

- Final Thoughts on Student Loans Repayment

Understanding Student Loans

Alright, let’s start with the basics. Student loans are essentially financial aid packages designed to help students cover the costs of higher education. These loans come in two main flavors: federal and private. Federal loans are backed by the government and often come with lower interest rates and more flexible repayment options. Private loans, on the other hand, are offered by banks or financial institutions and tend to have stricter terms.

When it comes to student loans repayment, the key is to understand the type of loan you have, its interest rate, and the repayment terms. This knowledge will empower you to make informed decisions about your financial future. Remember, knowledge is power, and in this case, it’s the power to take control of your debt.

Key Differences Between Federal and Private Loans

Here’s a quick rundown of the differences:

- Federal Loans: Typically offer lower interest rates, income-driven repayment plans, and potential loan forgiveness options.

- Private Loans: Often have higher interest rates, fewer repayment options, and no forgiveness programs. Be sure to read the fine print before signing up!

Repayment Options for Student Loans

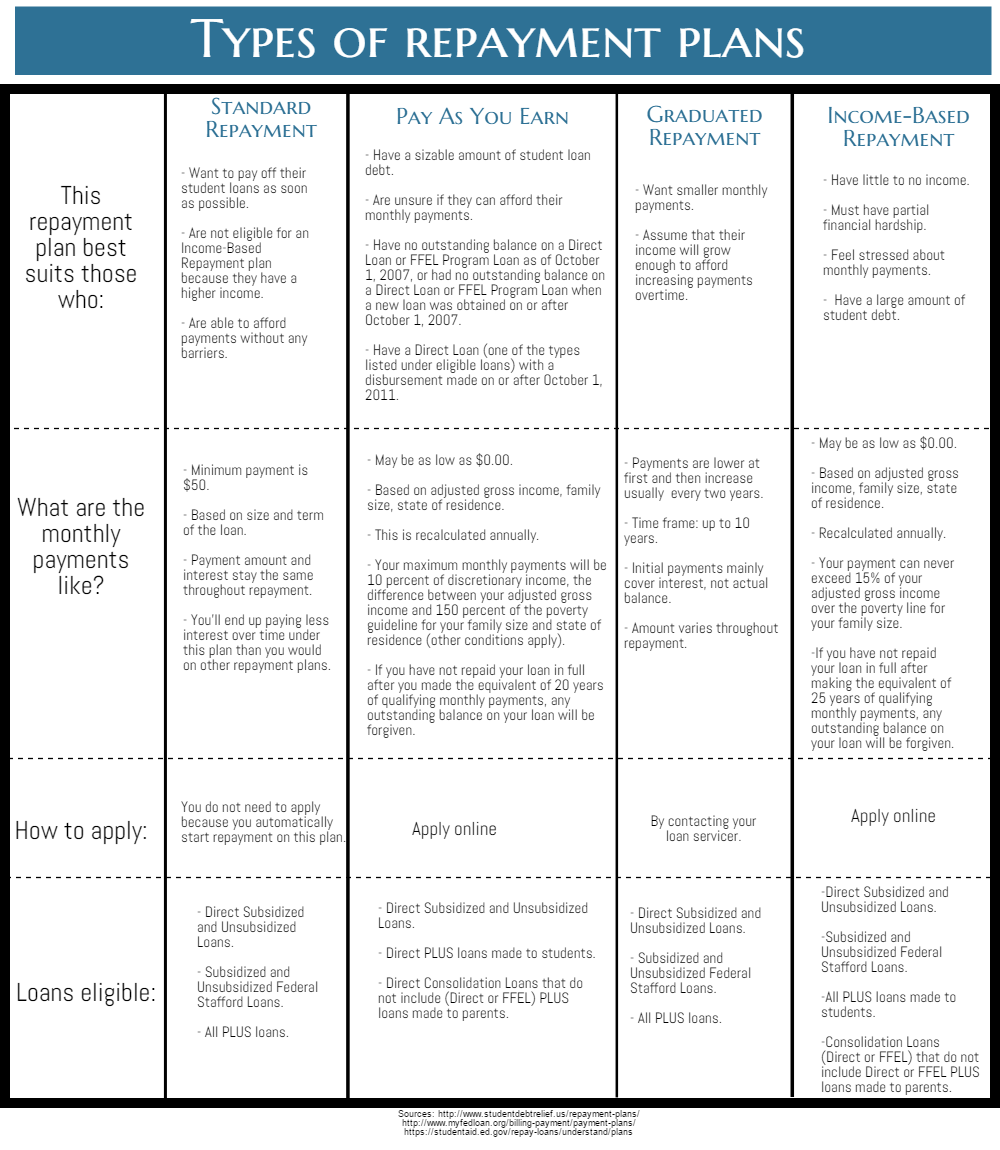

Now that you know the types of loans, let’s talk about how you can repay them. There’s no one-size-fits-all solution when it comes to student loans repayment, but there are several options to consider:

Standard Repayment Plan

This is the default option for most federal loans. With a standard repayment plan, you pay a fixed amount each month over a 10-year period. It’s straightforward and predictable, but the monthly payments can be steep depending on your loan balance.

Read also:Exploring The Hidden Gems Of Joplin Missouri A Mustvisit Destination

Graduated Repayment Plan

If you’re just starting out in your career and expect your income to increase over time, a graduated repayment plan might be a better fit. This plan starts with lower payments that gradually increase every two years, giving you more breathing room in the early years.

Income-Driven Repayment Plans

For those whose monthly payments feel overwhelming, income-driven repayment (IDR) plans offer a lifeline. These plans adjust your monthly payments based on your income and family size, making them more manageable for borrowers with lower incomes.

Types of IDR Plans

- Income-Based Repayment (IBR): Limits your monthly payments to 10-15% of your discretionary income.

- Pay As You Earn (PAYE): Caps your payments at 10% of your discretionary income, with any remaining balance forgiven after 20-25 years.

- Revised Pay As You Earn (REPAYE): Similar to PAYE but available to all borrowers, regardless of when they took out their loans.

Each IDR plan has its pros and cons, so it’s important to assess your financial situation before choosing one. And hey, if you’re still unsure, don’t hesitate to reach out to a financial advisor or loan counselor for guidance.

Loan Consolidation: Is It Worth It?

Loan consolidation is another option worth considering. By combining multiple loans into a single payment, you can simplify your repayment process and potentially lower your interest rate. However, there are trade-offs to consider:

- Pros: Easier to manage, potentially lower monthly payments, and a fixed interest rate.

- Cons: May extend the repayment period, resulting in more interest paid over time.

It’s crucial to weigh the benefits against the drawbacks before deciding if consolidation is right for you. And remember, consolidation doesn’t erase your debt—it just restructures it.

Student Loans Forgiveness Programs

Now, here’s the part everyone wants to hear about: loan forgiveness. While it’s not a guaranteed solution, certain programs can help you wipe out your student debt under specific conditions. Here are a few to explore:

Public Service Loan Forgiveness (PSLF)

If you work in public service or for a nonprofit organization, PSLF could be your ticket to debt freedom. After making 120 qualifying payments, any remaining balance on your federal loans may be forgiven. It’s a great incentive for those dedicated to serving their communities.

Teacher Loan Forgiveness

Teachers who work in low-income schools for at least five years may qualify for up to $17,500 in loan forgiveness. It’s a small but significant step toward reducing the burden of student debt for educators.

Tax Benefits for Student Loan Repayers

Did you know you can deduct up to $2,500 of student loan interest from your taxable income? This tax break can provide some relief during tax season, allowing you to keep more of your hard-earned money. Be sure to consult with a tax professional to ensure you’re taking full advantage of this benefit.

Tips to Accelerate Your Repayment

Ready to pay off your loans faster? Here are a few strategies to consider:

- Make Extra Payments: Even small additional payments can make a big difference over time.

- Refinance Your Loans: If you have good credit, refinancing could secure you a lower interest rate.

- Automate Payments: Set up automatic payments to avoid late fees and ensure you stay on track.

- Use Windfalls Wisely: Whether it’s a tax refund or bonus at work, consider putting that extra cash toward your loans.

Every little bit helps, and consistency is key. Stick to your repayment plan, and you’ll be debt-free before you know it.

Common Mistakes to Avoid

As with any financial endeavor, there are pitfalls to watch out for. Here are a few common mistakes to steer clear of:

- Ignoring Your Loans: Avoiding the problem won’t make it go away. Face your debt head-on and create a plan to tackle it.

- Missing Payments: Late payments can hurt your credit score and lead to penalties. Stay organized and prioritize your payments.

- Not Exploring Options: Don’t assume your only option is the standard repayment plan. Research all available options to find the best fit for your situation.

By avoiding these mistakes, you’ll set yourself up for success and avoid unnecessary stress down the road.

Resources for Help and Support

Don’t go it alone—there are plenty of resources available to help you navigate the world of student loans repayment:

- StudentAid.gov: The official site for federal student aid, offering tools and information to help you manage your loans.

- Nonprofit Organizations: Groups like the National Student Legal Defense Network provide advocacy and support for borrowers.

- Financial Advisors: If you’re feeling overwhelmed, a professional advisor can offer personalized guidance to help you conquer your debt.

Take advantage of these resources to gain a deeper understanding of your options and make informed decisions about your financial future.

Final Thoughts on Student Loans Repayment

Repaying student loans can feel like climbing a mountain, but with the right strategies and mindset, you can reach the summit. Remember, the goal isn’t just to pay off your debt—it’s to build a solid financial foundation that will serve you for years to come.

So, take action today. Review your repayment options, explore forgiveness programs, and consider ways to accelerate your payments. And don’t forget to celebrate small victories along the way—it’s all part of the journey.

Got questions or feedback? Drop a comment below or share this article with someone who could benefit from it. Together, we can make student loans repayment less daunting and more achievable. You’ve got this!