Student loans have become a hot topic in today's world, shaping the financial journey of millions. Whether you're just starting college or thinking about paying off your debt, understanding student loans is crucial. It's like a financial roadmap that can either open doors or trap you in a maze of numbers. So, buckle up because we’re diving deep into this world of education financing!

Imagine this—you’re standing at the edge of a financial cliff, trying to figure out how to fund your dreams of higher education. That’s where student loans come in. They’re like a double-edged sword; they help you achieve your goals but also come with strings attached. Understanding them is key to making smart decisions.

From repayment plans to interest rates, student loans can get overwhelming. But don’t worry, we’ve got your back. In this guide, we’ll break down everything you need to know about student loans, so you can make informed choices. Let’s get started!

Read also:Mexico National Football Team The Heart And Soul Of El Tri

Understanding the Basics of Student Loans

Before we dive into the nitty-gritty, let’s start with the basics. What exactly are student loans? Simply put, they’re financial aid packages designed to help students cover the cost of higher education. These loans can cover tuition fees, books, housing, and even living expenses. But here’s the catch—they’re not free money. You’ll have to pay them back, often with interest.

Types of Student Loans

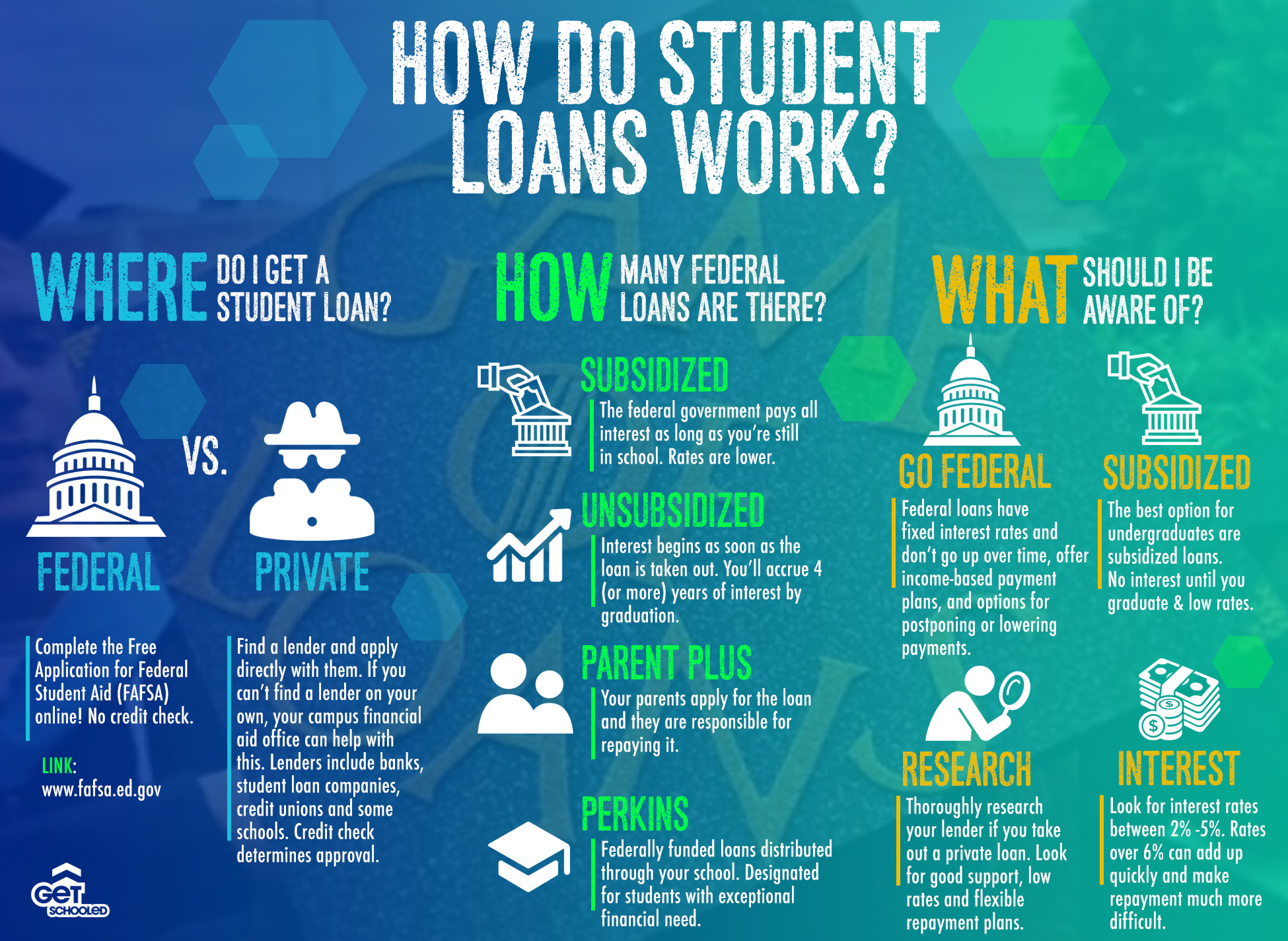

Not all student loans are created equal. There are two main types: federal and private loans. Let’s break them down.

- Federal Loans: Offered by the government, these loans come with fixed interest rates and flexible repayment options. They’re usually the go-to choice for students because of their borrower-friendly terms.

- Private Loans: Offered by banks and other financial institutions, these loans often have variable interest rates and stricter repayment terms. They might require a co-signer, especially for younger borrowers with limited credit history.

Choosing between the two depends on your financial situation and future plans. Federal loans are generally more forgiving, but private loans might be necessary if you need a higher loan amount.

How Student Loans Work: The Inside Scoop

Now that we know what student loans are, let’s explore how they work. When you apply for a student loan, the lender evaluates your eligibility based on factors like income, credit score, and sometimes even your academic performance. Once approved, the loan is disbursed directly to your school or into your account.

Here’s the kicker—interest starts accruing from the moment you receive the funds. Some loans offer grace periods after graduation before repayment begins, but others don’t. It’s essential to understand these terms to avoid unexpected financial surprises.

Interest Rates: The Hidden Cost

Interest rates are a big deal when it comes to student loans. Federal loans usually have fixed interest rates, which means they don’t change over time. Private loans, on the other hand, often have variable rates, meaning they can fluctuate based on market conditions.

Read also:Nba Starting Lineups Your Ultimate Guide To The Best Players On The Court

For example, if you borrow $20,000 at a 5% interest rate, you’ll end up paying significantly more than the original amount by the time you finish repayment. It’s crucial to calculate the total cost of your loan before signing on the dotted line.

The Impact of Student Loans on Your Financial Future

Student loans can have a lasting impact on your financial future. While they provide access to higher education, they also come with long-term obligations. Many graduates find themselves juggling student loan payments alongside other financial responsibilities, such as rent, utilities, and car payments.

According to a recent study by the Federal Reserve, the average student loan debt in the U.S. is around $37,000. That’s a significant burden for anyone starting their career. But here’s the good news—with proper planning and management, you can navigate this challenge successfully.

Repayment Plans: Finding What Works for You

Repayment plans are a lifeline for many borrowers. Federal loans offer several options, including:

- Standard Repayment: Fixed monthly payments over 10 years.

- Income-Driven Repayment: Payments based on your income, making them more manageable for those with lower earnings.

- Graduated Repayment: Payments start low and increase over time, ideal for those expecting higher earnings in the future.

Private loans may not offer as much flexibility, so it’s important to read the fine print before committing.

Strategies for Managing Student Loan Debt

Managing student loan debt requires a strategic approach. Here are a few tips to help you stay on top of your payments:

- Make Extra Payments: Whenever possible, pay more than the minimum required. This reduces the total interest you’ll pay over the life of the loan.

- Refinance or Consolidate: If you have multiple loans, consider refinancing or consolidating them into a single loan with a lower interest rate.

- Explore Forgiveness Programs: Certain professions, such as teaching and public service, may qualify for loan forgiveness programs. Check if you’re eligible!

Remember, every little step counts. Even small changes in your repayment strategy can make a big difference in the long run.

Dealing with Financial Hardship

Life doesn’t always go as planned. If you face financial hardship, don’t panic. Federal loans offer deferment and forbearance options, allowing you to pause or reduce payments temporarily. Private loans may offer similar options, but it’s best to contact your lender directly to explore possibilities.

Student Loans and Your Credit Score

Your credit score plays a vital role in your financial life, and student loans can affect it both positively and negatively. Making timely payments can boost your score, showing lenders you’re responsible with debt. However, missing payments or defaulting on your loans can have severe consequences.

According to Experian, missed payments can stay on your credit report for up to seven years. That’s a long time to recover from a financial misstep. So, it’s crucial to prioritize your student loan payments to maintain a healthy credit score.

Building Credit Responsibly

Student loans can be a tool for building credit responsibly. As long as you stay on top of your payments, they can help establish a solid credit history. This can open doors to better financial opportunities in the future, such as lower interest rates on mortgages or car loans.

Alternatives to Student Loans

While student loans are a popular choice, they’re not the only way to fund your education. Here are a few alternatives to consider:

- Scholarships: These don’t need to be repaid and can cover a significant portion of your tuition costs.

- Grants: Similar to scholarships, grants are free money awarded based on financial need or academic merit.

- Work-Study Programs: These allow you to earn money while gaining valuable work experience.

Exploring these options can help reduce your reliance on student loans and ease the financial burden after graduation.

How to Apply for Scholarships and Grants

Applying for scholarships and grants requires some effort, but it’s worth it. Start by researching opportunities specific to your field of study or demographic. Many organizations offer awards for students pursuing certain majors or coming from specific backgrounds.

Don’t forget to submit your Free Application for Federal Student Aid (FAFSA) early. It’s your ticket to accessing federal grants and other forms of financial aid.

Success Stories: Real People, Real Solutions

Let’s hear from some real people who’ve successfully managed their student loan debt. Sarah, a recent graduate, shares her story: “I was overwhelmed by my loans at first, but I created a budget and stuck to it. I also refinanced my loans to get a lower interest rate, which made a huge difference.”

John, another borrower, adds: “I took advantage of an income-driven repayment plan, which made my monthly payments more manageable. It gave me peace of mind knowing I could afford my bills.”

These stories show that with the right mindset and resources, you can conquer student loan debt.

Lessons Learned from Borrowers

One common theme among successful borrowers is planning. Creating a budget, exploring repayment options, and staying informed about your loans are key to success. Don’t hesitate to seek advice from financial advisors or student loan counselors if you need help.

Final Thoughts: Taking Control of Your Student Loan Journey

Student loans don’t have to be a source of stress. By understanding how they work and implementing smart strategies, you can take control of your financial future. Remember, knowledge is power. The more you know about student loans, the better equipped you’ll be to make informed decisions.

So, what’s next? Start by reviewing your current loans and repayment options. Explore alternative funding sources and don’t hesitate to reach out for help if needed. Together, we can turn the challenge of student loans into an opportunity for growth.

Call to Action: Share your thoughts in the comments below! What’s your experience with student loans? Do you have any tips for fellow borrowers? Let’s start a conversation and support each other on this journey.

Table of Contents

- Understanding the Basics of Student Loans

- Types of Student Loans

- How Student Loans Work

- Interest Rates

- The Impact of Student Loans on Your Financial Future

- Repayment Plans

- Strategies for Managing Student Loan Debt

- Student Loans and Your Credit Score

- Alternatives to Student Loans

- Success Stories