Let’s be real here—interest rates might sound boring at first glance, but trust me, they’re the secret sauce behind your financial decisions. Whether you’re saving for a dream house, paying off student loans, or just trying to keep your credit card debt in check, interest rates are everywhere. These seemingly small percentages can make or break your financial plans, and ignoring them could cost you big time. So, buckle up because we’re about to dive deep into the world of interest rates and how they impact your life in ways you might not even realize.

Now, I know what you're thinking—why should you care about interest rates? Well, here’s the deal: they affect everything from the cost of borrowing money to the return on your savings. They’re like the invisible hands controlling the economy, and understanding them can help you make smarter financial choices. It’s not just about numbers; it’s about knowing how these rates work so you can take control of your money instead of letting it control you.

So, whether you're a first-time borrower or a seasoned investor, this article is here to break down the complexities of interest rates in a way that’s easy to digest. We’ll cover everything from how interest rates are set to how they impact your wallet. By the end of this, you’ll be armed with the knowledge to navigate the financial world like a pro. Let’s get started, shall we?

Read also:Kyle Chandler The Man Behind The Iconic Roles That Captured Our Hearts

What Are Interest Rates and Why Should You Care?

Interest rates, in their simplest form, are the cost of borrowing money. Think of them as rent for using someone else's cash. When you take out a loan or use a credit card, the lender charges you interest as a way to make a profit. On the flip side, when you deposit money in a savings account, the bank pays you interest because they’re using your money to lend to others. It’s a two-way street, and both sides have implications for your financial well-being.

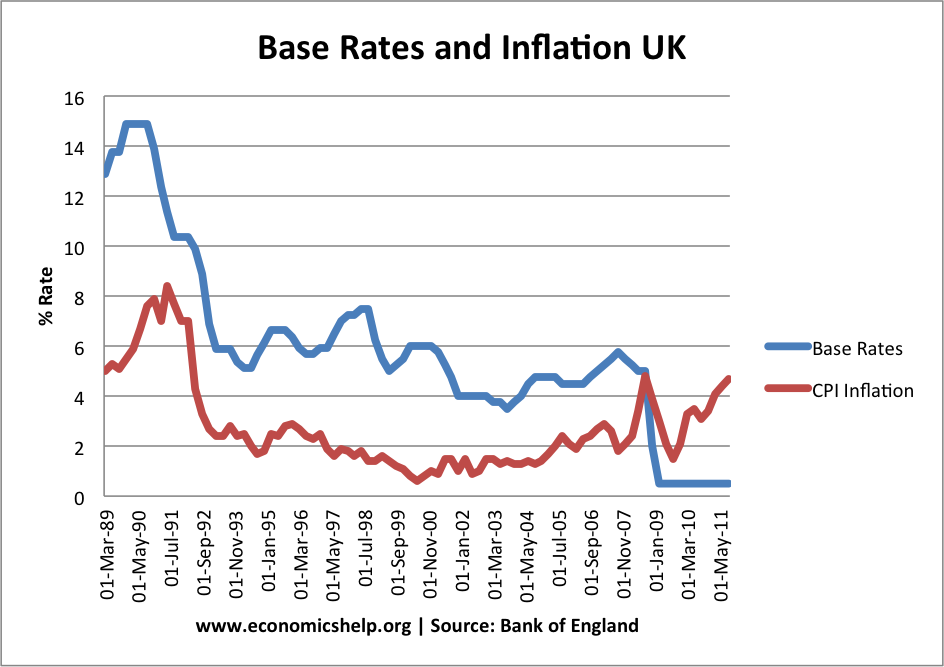

But here’s the kicker: interest rates don’t just affect individuals. They play a huge role in the overall economy. Central banks, like the Federal Reserve in the U.S., use interest rates as a tool to manage inflation and encourage economic growth. When rates are low, borrowing becomes cheaper, which can stimulate spending and investment. On the other hand, when rates rise, borrowing becomes more expensive, which can slow down the economy and control inflation.

So, whether you’re a consumer, a business owner, or an investor, interest rates matter. They influence everything from mortgage payments to stock prices. Understanding them can help you make informed decisions that align with your financial goals. And hey, who doesn’t want to save a few bucks or make a smart investment?

How Are Interest Rates Determined?

Interest rates aren’t just pulled out of thin air. They’re influenced by a variety of factors, and understanding these factors can give you a better grasp of how they work. Let’s break it down:

Central Banks and Monetary Policy

Central banks, like the Federal Reserve or the European Central Bank, play a key role in setting interest rates. They use monetary policy to control inflation and stabilize the economy. When inflation is too high, central banks might raise interest rates to cool down spending. Conversely, when the economy is sluggish, they might lower rates to encourage borrowing and investment.

Economic Conditions

The state of the economy also affects interest rates. During times of economic growth, rates might rise because there’s more demand for borrowing. On the other hand, during recessions, rates might fall to stimulate the economy. It’s all about balancing supply and demand.

Read also:Chicago Tornado Warning Stay Safe And Informed

Market Forces

Beyond central banks, market forces also play a role. Lenders consider factors like risk, inflation expectations, and the overall health of the economy when setting interest rates. For example, if inflation is expected to rise, lenders might demand higher interest rates to compensate for the loss of purchasing power.

Now, let’s put this into perspective. Imagine you’re applying for a mortgage. The interest rate you’re offered will depend on factors like the current economic climate, the central bank’s policies, and your own creditworthiness. It’s a complex web, but understanding it can help you negotiate better terms.

The Impact of Interest Rates on Borrowing

When it comes to borrowing, interest rates can make a huge difference. Whether you’re taking out a mortgage, buying a car, or using a credit card, the interest rate you’re charged will affect how much you ultimately pay. Let’s look at some examples:

- Mortgages: A small change in interest rates can lead to significant differences in monthly payments. For instance, a 1% increase in the interest rate on a $300,000 mortgage could add hundreds of dollars to your monthly bill.

- Car Loans: Lower interest rates can make buying a car more affordable, while higher rates can make it more expensive. It’s all about finding the right deal.

- Credit Cards: Credit card interest rates can be some of the highest out there. If you carry a balance, those rates can quickly add up, making it harder to pay off your debt.

Knowing how interest rates work can help you shop around for the best deals and avoid getting stuck with high-interest debt. It’s all about being informed and making smart choices.

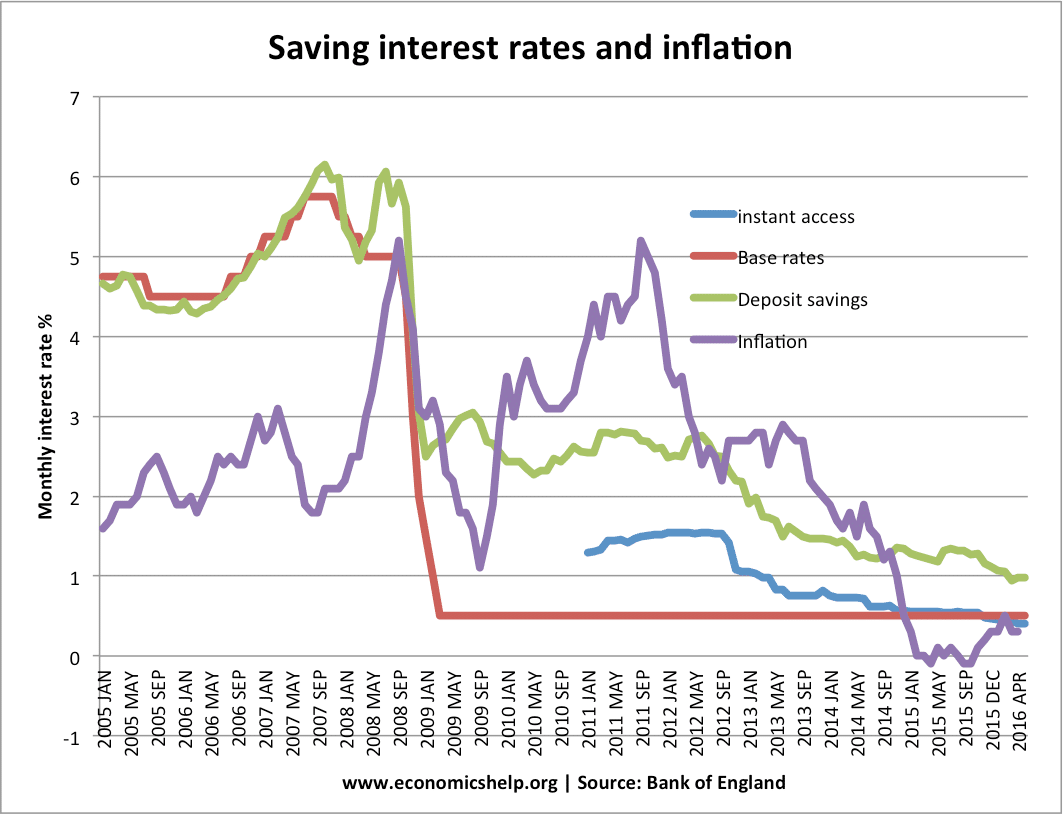

Interest Rates and Savings: The Good News

While higher interest rates can make borrowing more expensive, they’re not all bad news. For savers, higher rates mean better returns on their money. Whether you’re putting money in a savings account, a certificate of deposit (CD), or a money market account, higher interest rates can help your savings grow faster.

Types of Savings Accounts

There are several types of savings accounts, each with its own pros and cons:

- Savings Accounts: These are the most common type of savings account. They offer easy access to your money and typically pay interest, though the rates can vary widely.

- Certificates of Deposit (CDs): CDs offer higher interest rates in exchange for locking up your money for a set period. If you don’t need immediate access to your savings, a CD could be a good option.

- Money Market Accounts: These accounts often offer higher interest rates than regular savings accounts and may come with check-writing privileges. However, they might also have higher minimum balance requirements.

No matter which type of account you choose, higher interest rates mean more money in your pocket. It’s like getting paid just for saving!

Interest Rates and Investments: The Bigger Picture

Interest rates don’t just affect borrowing and saving—they also have a big impact on investments. When rates change, it can affect everything from stock prices to bond yields. Let’s break it down:

Stock Market

When interest rates rise, borrowing becomes more expensive, which can slow down economic growth. This, in turn, can lead to lower stock prices as companies earn less profit. On the flip side, when rates fall, borrowing becomes cheaper, which can boost economic growth and drive stock prices higher.

Bond Market

Bonds are particularly sensitive to interest rate changes. When rates rise, existing bonds with lower rates become less attractive, causing their prices to fall. Conversely, when rates fall, existing bonds with higher rates become more valuable. It’s all about supply and demand.

For investors, understanding how interest rates affect the markets can help you make smarter decisions. Whether you’re buying stocks, bonds, or other assets, keeping an eye on interest rates can give you a competitive edge.

How to Take Advantage of Interest Rates

Now that you know how interest rates work, let’s talk about how you can use them to your advantage. Here are a few tips:

- Shop Around: Don’t settle for the first loan or savings account you find. Compare rates from different lenders and banks to get the best deal.

- Time Your Borrowing: If you’re planning to take out a loan, consider doing it when interest rates are low. This can save you thousands of dollars over the life of the loan.

- Maximize Savings: Look for savings accounts and CDs with high interest rates. Even a small difference in rates can add up over time.

- Invest Wisely: Keep an eye on interest rate trends when making investment decisions. Understanding how rates affect the markets can help you make informed choices.

By being proactive and informed, you can turn interest rates into an asset instead of a liability. It’s all about playing the game smartly.

Common Misconceptions About Interest Rates

There’s a lot of misinformation out there about interest rates. Let’s clear up a few common myths:

Myth 1: Lower Interest Rates Always Mean Better Deals

Not necessarily. While lower rates can make borrowing cheaper, they can also lead to lower returns on savings. Plus, lenders might charge higher fees to compensate for the lower rates, so always read the fine print.

Myth 2: Interest Rates Don’t Affect Me if I Don’t Borrow Money

Wrong! Even if you don’t borrow money, interest rates can still impact you. They affect the cost of goods and services, the value of your investments, and even your job prospects. The economy is interconnected, and interest rates are a big part of it.

Myth 3: Interest Rates Are Set in Stone

Interest rates are constantly changing, and they can be influenced by a variety of factors. What’s true today might not be true tomorrow, so staying informed is key.

By separating fact from fiction, you can make better financial decisions that align with your goals.

Interest Rates and the Global Economy

Interest rates aren’t just a local issue—they have a global impact. When one country raises or lowers its rates, it can affect economies around the world. For example, when the U.S. Federal Reserve raises interest rates, it can attract foreign investors looking for higher returns, which can strengthen the dollar. Conversely, when rates fall, it can lead to a weaker dollar and affect trade balances.

For businesses operating internationally, understanding global interest rate trends is crucial. It can affect everything from currency exchange rates to the cost of doing business in different countries. In today’s interconnected world, no economy operates in a vacuum.

Conclusion: Take Control of Your Financial Future

Interest rates might seem like just another financial term, but they’re so much more than that. They’re the driving force behind many of the financial decisions you make every day. By understanding how they work and how they impact your life, you can take control of your financial future.

So, here’s what you can do next: start paying attention to interest rates. Compare rates when borrowing or saving, and consider how they affect your investment decisions. And don’t forget to stay informed about economic trends and global developments that could impact rates in the future.

Remember, knowledge is power. The more you know about interest rates, the better equipped you’ll be to make smart financial choices. So, go out there and take charge of your money. You’ve got this!

Table of Contents

Interest Rates: The Silent Force Shaping Your Financial Future

What Are Interest Rates and Why Should You Care?

How Are Interest Rates Determined?

The Impact of Interest Rates on Borrowing

Interest Rates and Savings: The Good News

Interest Rates and Investments: The Bigger Picture

How to Take Advantage of Interest Rates

Common Misconceptions About Interest Rates

Interest Rates and the Global Economy

Conclusion: Take Control of Your Financial Future

![Buying a Home? Mortgage Rate Guide for Singapore [2023]](https://blog.roshi.sg/wp-content/uploads/2022/08/Singapore-Home-Loan-Rates-2022.jpeg)