Hey there, finance enthusiasts! Ever wondered why everyone’s buzzing about fed rates? It’s not just some random number the Federal Reserve throws around—it’s a game-changer that impacts everything from your mortgage payments to your retirement savings. Fed rates, or federal funds rate as they're officially called, are like the heartbeat of the economy, and if you’re not paying attention, you might miss some critical beats that affect your wallet. So, buckle up and let’s dive into the world of fed rates, where numbers meet real-life implications.

Now, you might be thinking, "Why should I care about fed rates?" Well, my friend, whether you're a first-time homebuyer, an entrepreneur, or someone just trying to keep their savings intact, fed rates play a pivotal role in shaping your financial landscape. They influence borrowing costs, investment opportunities, and even the job market. Understanding them is like having a secret weapon in your financial arsenal.

So, what exactly are fed rates? In simple terms, it’s the interest rate at which banks lend money to each other overnight. But don’t let the simplicity fool you—this rate has far-reaching consequences. It’s the Federal Reserve's way of controlling inflation, stabilizing the economy, and keeping unemployment in check. Ready to unravel the mystery behind fed rates? Let’s get started!

Read also:Xrp Price Prediction Is Ripple Ready To Surge In 2024

What Are Fed Rates and Why Should You Care?

Fed rates, or the federal funds rate, are essentially the interest rate banks charge each other for short-term loans. It’s the Federal Reserve’s primary tool for managing monetary policy, and it’s a big deal because it affects everything from consumer loans to business investments. Think of it as the central bank’s way of steering the economy in the right direction. But why should you care?

Well, fed rates directly impact borrowing costs. When the rate goes up, it becomes more expensive to borrow money, which can affect everything from car loans to credit card interest rates. On the flip side, when the rate drops, borrowing becomes cheaper, encouraging spending and investment. It’s a delicate balancing act that affects both businesses and consumers alike.

How Fed Rates Influence Your Daily Life

You might not realize it, but fed rates have a sneaky way of influencing your day-to-day life. Let’s break it down:

- Mortgage Rates: If you’re in the market for a home, fed rates can affect your mortgage payments. Higher rates mean higher monthly payments, which can impact your budget.

- Credit Cards: Ever notice how your credit card interest rate seems to fluctuate? That’s because many credit cards are tied to the prime rate, which is influenced by fed rates.

- Savings Accounts: When fed rates rise, banks tend to offer higher interest rates on savings accounts, which is great news for savers.

- Investments: Fed rate changes can impact stock and bond markets, affecting your investment portfolio.

So, whether you’re saving, spending, or investing, fed rates are a key player in your financial journey.

Historical Context: A Journey Through Fed Rates

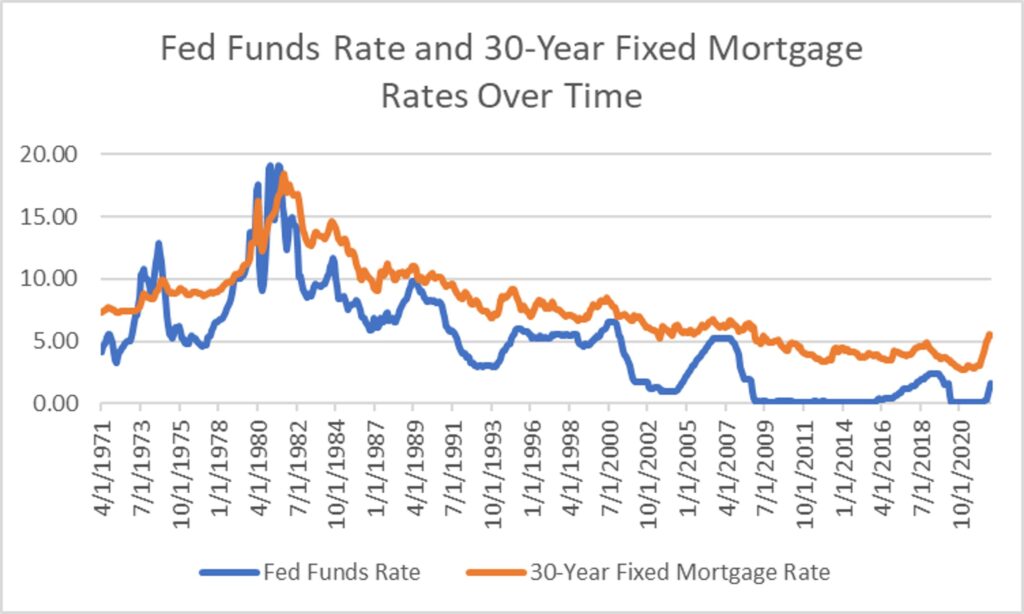

To truly understand fed rates, it’s important to look at their history. Over the years, the Federal Reserve has adjusted rates to tackle various economic challenges. From the high inflation of the 1970s to the Great Recession of 2008, fed rates have been a crucial tool in navigating turbulent times.

In the 1980s, under Chairman Paul Volcker, fed rates soared to combat double-digit inflation. Fast forward to the 2008 financial crisis, and rates were slashed to near-zero to stimulate economic growth. More recently, the Fed has been hiking rates to combat inflation, signaling a shift in monetary policy.

Read also:Fed Meeting Today What You Need To Know About The Latest Economic Moves

Key Milestones in Fed Rates History

Here are some notable moments in the history of fed rates:

- 1980s: Rates peaked at 20% to fight inflation.

- 2008: Rates dropped to near-zero during the financial crisis.

- 2022: The Fed began raising rates to combat rising inflation.

Each of these milestones reflects the Fed’s response to economic conditions, highlighting the importance of fed rates in shaping the financial landscape.

The Mechanics of Fed Rates: How It All Works

So, how exactly do fed rates work? The Federal Reserve sets a target range for the federal funds rate, and banks are expected to lend to each other within this range. If the rate is too high, borrowing becomes expensive, which can slow down economic growth. Conversely, if the rate is too low, it can lead to inflationary pressures.

The Fed uses a variety of tools to influence fed rates, including open market operations, reserve requirements, and forward guidance. These tools help the Fed achieve its dual mandate of promoting maximum employment and price stability.

Tools Used by the Federal Reserve

Here’s a quick rundown of the tools the Fed uses to manage fed rates:

- Open Market Operations: Buying and selling government securities to influence the money supply.

- Reserve Requirements: Setting the amount of reserves banks must hold, affecting their lending capacity.

- Forward Guidance: Communicating future policy intentions to influence market expectations.

These tools work together to ensure the economy stays on track, with fed rates playing a central role in the process.

The Impact of Fed Rates on the Economy

Fed rates have a profound impact on the economy, influencing everything from consumer spending to business investment. When rates are low, borrowing becomes cheaper, encouraging spending and investment. This can boost economic growth and create jobs. However, if rates are too low for too long, it can lead to inflation, eroding purchasing power.

On the other hand, when rates are high, borrowing becomes more expensive, which can slow down economic activity. This can help control inflation but may also lead to higher unemployment if businesses cut back on spending and hiring.

The Dual Mandate: Employment and Inflation

The Federal Reserve has a dual mandate: to promote maximum employment and price stability. Fed rates are a key tool in achieving these goals. By adjusting rates, the Fed can influence economic activity, aiming to keep inflation in check while maintaining low unemployment.

However, balancing these two objectives is no easy feat. The Fed must constantly monitor economic indicators and adjust policy accordingly, ensuring the economy remains on a stable path.

Global Implications of Fed Rates

Fed rates don’t just affect the U.S. economy; they have global implications as well. As the world’s largest economy, the U.S. plays a significant role in the global financial system. Changes in fed rates can impact currency exchange rates, international trade, and global investment flows.

For example, when the Fed raises rates, it can strengthen the U.S. dollar, making American exports more expensive and imports cheaper. This can affect trade balances and impact economies around the world. Additionally, higher rates can attract foreign capital, influencing global investment patterns.

How Fed Rates Affect Emerging Markets

Emerging markets are particularly sensitive to changes in fed rates. When rates rise, capital tends to flow out of these markets and into the U.S., where higher returns can be found. This can lead to currency depreciation, higher borrowing costs, and economic instability in emerging economies.

Conversely, when rates are low, emerging markets can benefit from increased capital inflows, boosting their economies. However, they must be cautious of the potential for inflation and asset bubbles if borrowing becomes too cheap.

How Fed Rates Affect Different Sectors

Fed rates impact various sectors of the economy in different ways. Let’s take a closer look at how they affect key industries:

Housing Market

The housing market is highly sensitive to fed rates. When rates are low, mortgage rates tend to be lower, making it more affordable for people to buy homes. This can boost the housing market, increasing home sales and construction activity.

However, when rates rise, mortgage rates also increase, making it more expensive to buy a home. This can slow down the housing market, impacting builders, real estate agents, and homeowners alike.

Financial Sector

The financial sector is also heavily influenced by fed rates. Banks and financial institutions rely on interest rate spreads to generate profits. When rates rise, banks can charge higher interest on loans, increasing their revenue. However, they must also pay higher interest on deposits, which can squeeze margins.

Investors also pay close attention to fed rates, as they can impact stock and bond markets. Rising rates can lead to higher yields on bonds, making them more attractive to investors and potentially causing stock prices to fall.

Strategies for Navigating Fed Rate Changes

With fed rates constantly in flux, it’s important to have strategies in place to navigate these changes. Whether you’re a consumer, business owner, or investor, understanding how to respond to rate changes can help you make informed decisions.

Tips for Consumers

Here are some tips for consumers dealing with fed rate changes:

- Lock in Low Rates: If rates are low, consider locking in a fixed-rate mortgage or refinancing existing debt.

- Monitor Credit Card Rates: Keep an eye on your credit card interest rates, as they can fluctuate with fed rates.

- Boost Savings: When rates rise, take advantage of higher interest rates on savings accounts and certificates of deposit.

Tips for Businesses

Businesses should also be proactive in managing fed rate changes:

- Plan for Higher Borrowing Costs: If rates are expected to rise, consider locking in financing now to avoid higher costs later.

- Adjust Pricing Strategies: Rising rates can impact input costs, so businesses may need to adjust pricing to maintain profitability.

- Invest in Efficiency: Use periods of low rates to invest in technology and processes that improve efficiency, reducing costs in the long run.

Conclusion: Staying Ahead of the Curve

And there you have it, folks—a deep dive into the world of fed rates. From their historical context to their impact on the economy, fed rates are a crucial element in the financial landscape. Whether you’re a consumer, business owner, or investor, understanding fed rates can help you make better financial decisions.

So, what’s next? Stay informed, keep an eye on economic indicators, and be prepared to adapt to changing conditions. And don’t forget to share your thoughts in the comments below or check out our other articles for more insights into the world of finance. Remember, knowledge is power, and when it comes to fed rates, being informed can make all the difference!

Table of Contents

- What Are Fed Rates and Why Should You Care?

- Historical Context: A Journey Through Fed Rates

- The Mechanics of Fed Rates: How It All Works

- The Impact of Fed Rates on the Economy

- Global Implications of Fed Rates

- How Fed Rates Affect Different Sectors

- Strategies for Navigating Fed Rate Changes

- Conclusion: Staying Ahead of the Curve