Let's get real for a second—Fed rate isn’t just some fancy term thrown around in economics class or on cable news. It’s a big deal, folks. It affects everything from your mortgage to your credit card bills. So, if you’ve ever wondered why people freak out when the Fed tweaks rates, you’re about to find out. This ain’t just numbers; it’s your money we’re talking about.

Think of the Fed rate like the thermostat for the economy. When it’s too hot, they turn it down. When it’s too cold, they crank it up. But unlike your thermostat, this one doesn’t just regulate your living room—it controls the financial world. And yeah, that includes you.

We’re diving deep into what the Fed rate really means, how it impacts your life, and why you should care. Don’t worry; we’re keeping it simple, conversational, and packed with real-world examples. Because, hey, who needs jargon when you can get straight to the point?

Read also:Chicago Tornado The Untold Story Of Natures Fury

What Is the Fed Rate, Anyway?

Alright, let’s break it down. The Fed rate, officially known as the federal funds rate, is the interest rate that banks charge each other for overnight loans. Yeah, banks borrow money too, and this rate sets the tone for everything else in the financial system. Think of it like the price of money.

When the Fed lowers the rate, borrowing becomes cheaper. That means businesses and consumers are more likely to take out loans for things like cars, houses, and expansions. On the flip side, when the rate goes up, borrowing gets more expensive, which can slow down spending and investment.

Here’s the kicker: the Fed doesn’t just set this rate willy-nilly. They’ve got a whole committee called the Federal Open Market Committee (FOMC) that meets regularly to decide whether to raise, lower, or keep the rate the same. And trust me, those meetings are no joke.

Why Should You Care About the Fed Rate?

Because it affects you, buddy. Let’s say you’ve got a mortgage with a variable rate. When the Fed rate goes up, your monthly payments might too. Same goes for credit cards and car loans. It’s like a ripple effect that touches every corner of your financial life.

But it’s not all doom and gloom. A higher Fed rate can actually be good news for savers. Banks tend to offer better interest rates on savings accounts and certificates of deposit when the Fed rate climbs. So, if you’ve been saving up, you might start seeing some extra cash in your account.

How Does the Fed Rate Impact the Economy?

The Fed uses the federal funds rate as a tool to manage inflation and unemployment. When the economy is overheating—meaning inflation is rising too fast—they’ll hike the rate to cool things down. Conversely, if the economy’s sluggish, they’ll lower the rate to stimulate growth.

Read also:Why Ben Amp Jerrys Ice Cream Is A Musttry For Every Dessert Lover

But it’s a delicate balancing act. Raise the rate too much, and you risk sending the economy into a tailspin. Lower it too much, and inflation could spiral out of control. That’s why the Fed has to be strategic and data-driven in their decision-making.

And let’s not forget the global impact. The U.S. dollar is the world’s reserve currency, so changes in the Fed rate can have ripple effects across international markets. If the rate goes up, foreign investors might flock to U.S. assets, strengthening the dollar. But that can make U.S. exports more expensive, potentially harming American businesses.

Key Factors Influencing Fed Rate Decisions

There are a few key indicators the Fed looks at when deciding on rate changes:

- Inflation: If prices are rising too fast, the Fed might hike rates to slow things down.

- Unemployment: High unemployment might prompt the Fed to lower rates to encourage job creation.

- GDP Growth: If the economy’s growing too slowly, a rate cut could help kickstart activity.

- Global Events: Things like trade wars, pandemics, or geopolitical tensions can also influence the Fed’s decisions.

A Brief History of the Fed Rate

Back in the day, the Fed rate wasn’t always the star of the show. But over time, it’s become one of the most powerful tools in the Fed’s arsenal. Let’s take a quick trip down memory lane:

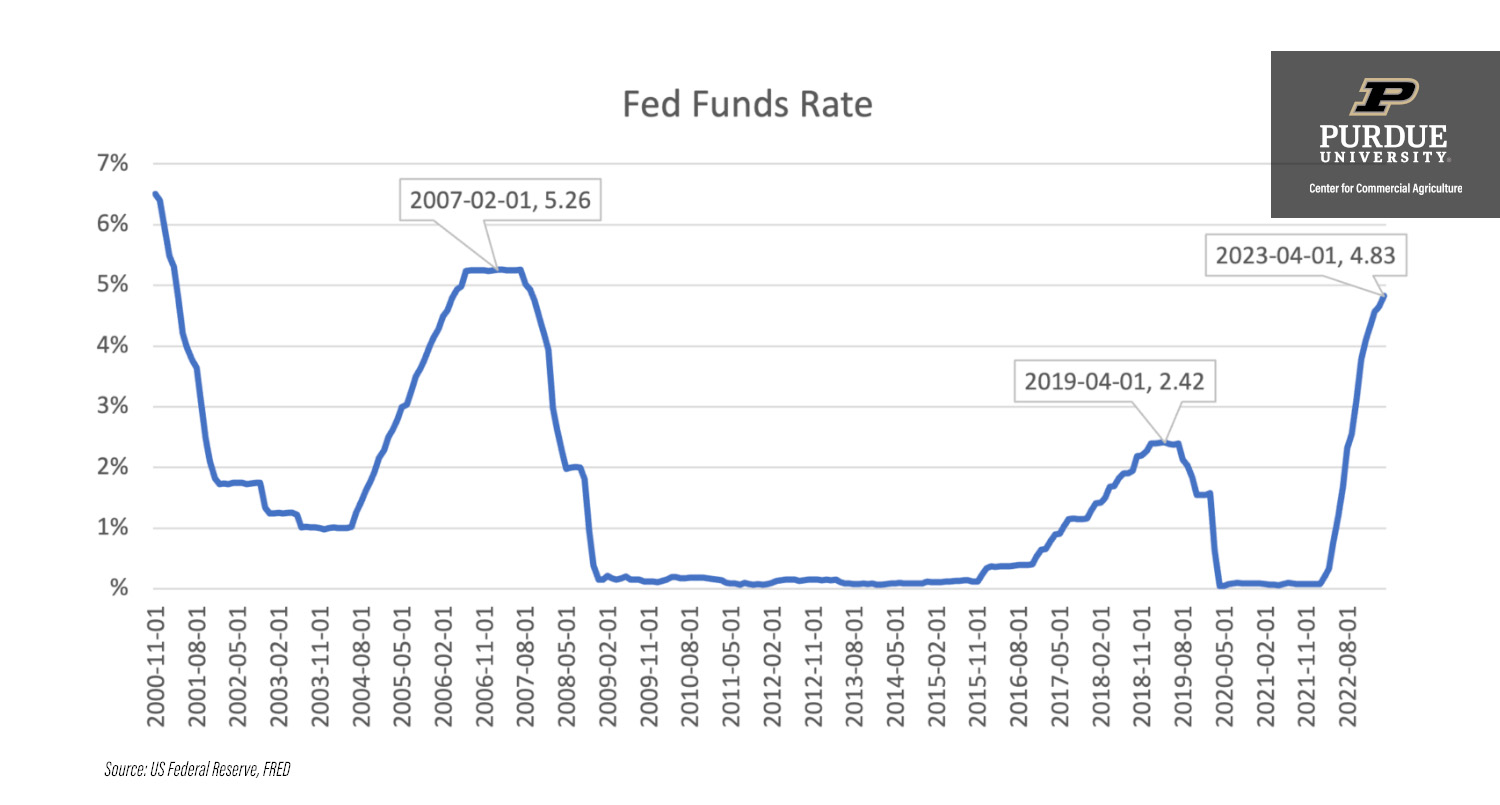

In the 1970s, the U.S. was dealing with sky-high inflation. Enter Paul Volcker, the Fed chairman who famously jacked up rates to nearly 20% to tame inflation. It worked, but it also triggered a recession. Fast forward to the 2008 financial crisis, and the Fed slashed rates to near zero to prevent an economic meltdown.

More recently, the Fed has been navigating the post-pandemic recovery. In 2020, they dropped rates to near zero again to support the economy during lockdowns. But as inflation picked up in 2022, they started raising rates aggressively to get things back on track.

Major Fed Rate Milestones

Here are a few notable moments in Fed rate history:

- 1980: Volcker raises rates to 20% to combat inflation.

- 2008: Rates slashed to near zero during the financial crisis.

- 2020: Another near-zero rate cut during the pandemic.

- 2022: Rates start climbing again to fight inflation.

How Can You Protect Yourself from Fed Rate Changes?

Here’s the thing: you can’t control what the Fed does, but you can control how you respond. If you’re worried about rising rates, consider locking in fixed-rate loans or refinancing existing debt. For savers, it might be worth shopping around for better interest rates on savings accounts or CDs.

Investors should also be mindful of how rate changes can impact the stock market. Higher rates can weigh on stock prices, especially for growth-oriented companies. But don’t panic—diversification is key. Mixing stocks, bonds, and other assets can help cushion the blow of rate fluctuations.

Strategies to Weather Fed Rate Changes

Here are a few strategies to consider:

- Refinance Debt: Lock in lower rates before they go up.

- Shop for Better Savings Rates: Take advantage of higher rates on savings accounts and CDs.

- Diversify Investments: Spread your risk across different asset classes.

- Review Insurance Policies: Ensure you’re adequately covered in case of economic uncertainty.

What Do Experts Say About the Future of Fed Rates?

Experts are divided on where the Fed rate is headed. Some believe the Fed will continue raising rates to keep inflation in check, while others think they’ll ease up if the economy slows too much. One thing’s for sure: the Fed will be watching the data closely.

According to a report by the Federal Reserve Bank of St. Louis, the long-term neutral rate—the rate that neither stimulates nor slows the economy—is estimated to be around 2.5%. But that’s just an estimate, and actual rates could vary based on economic conditions.

For now, the Fed’s stance seems to be one of caution. They’re likely to proceed with rate hikes, but at a slower pace than in 2022. Still, it’s important to stay informed and adjust your financial plans accordingly.

Predictions for the Next Few Years

Here’s what some experts are predicting:

- 2023-2024: Gradual rate hikes to combat lingering inflation.

- 2025-2026: Potential rate cuts if the economy slows significantly.

- Long-Term: Rates settling around the neutral rate of 2.5%.

Real-World Examples of Fed Rate Impact

Let’s look at some real-world examples of how the Fed rate has impacted people’s lives:

In 2008, when the Fed slashed rates to near zero, homeowners with adjustable-rate mortgages saw their payments drop significantly. Some were even able to refinance into fixed-rate loans at historically low rates. But on the flip side, savers struggled to find decent returns on their savings accounts.

Fast forward to 2022, and the story’s different. With rates climbing, some homeowners are seeing their mortgage payments skyrocket. Credit card bills are getting pricier, and car loans are becoming more expensive. But savers are finally seeing some decent returns on their savings accounts.

Case Studies of Fed Rate Impact

Here are a few case studies:

- Homeowner A: Benefited from low rates in 2008 but now facing higher payments in 2022.

- Saver B: Struggled with low returns in 2008 but now enjoying better rates in 2022.

- Business C: Expanded during low-rate periods but now rethinking plans due to higher borrowing costs.

Conclusion: Why Fed Rate Matters to You

So there you have it—the lowdown on the Fed rate and why it matters to your wallet. Whether you’re a homeowner, saver, investor, or just someone trying to make ends meet, the Fed rate has a real impact on your financial life. And while you can’t control what the Fed does, you can take steps to protect yourself and make the most of the situation.

So, what’s next? Start by reviewing your finances. Look at your debt, savings, and investments. Consider locking in fixed rates or shopping around for better deals. And don’t forget to stay informed—knowledge is power, especially when it comes to your money.

Got questions or comments? Drop them below. And if you found this article helpful, be sure to share it with your friends and family. After all, the more people who understand the Fed rate, the better off we all are.

Table of Contents

- What Is the Fed Rate, Anyway?

- Why Should You Care About the Fed Rate?

- How Does the Fed Rate Impact the Economy?

- Key Factors Influencing Fed Rate Decisions

- A Brief History of the Fed Rate

- Major Fed Rate Milestones

- How Can You Protect Yourself from Fed Rate Changes?

- Strategies to Weather Fed Rate Changes

- What Do Experts Say About the Future of Fed Rates?

- Predictions for the Next Few Years

- Real-World Examples of Fed Rate Impact

- Case Studies of Fed Rate Impact