Let's talk about Fed News, because whether you're a finance geek or just someone trying to keep their wallet full, this stuff matters. The Federal Reserve, often called the Fed, is like the backstage crew running the financial show in the U.S. Their decisions can make or break markets, influence interest rates, and even affect your coffee budget. So buckle up, because we're diving deep into what's going on behind the scenes.

You know those moments when you're scrolling through your newsfeed and you come across headlines like "Fed Raises Interest Rates Again"? It might sound boring, but trust me, it's a big deal. These moves by the Fed can ripple through the economy like a pebble dropped in a pond. So, understanding Fed News isn't just for economists—it's for anyone who cares about their financial future.

Now, let's get something straight: the Fed isn't just some random group of people sitting around making arbitrary decisions. They're a well-oiled machine with a mission to keep the economy stable. And when they speak, the world listens. So, if you've ever wondered why stock markets react like a rollercoaster whenever the Fed announces something, you're in the right place. Let's break it down.

Read also:Jayz The King Of Hiphop Who Turned Hustle Into History

What Exactly is Fed News?

Let's start with the basics. Fed News refers to any announcement, decision, or statement coming from the Federal Reserve. Think of it like a financial weather forecast. The Fed gives updates on monetary policy, interest rates, inflation targets, and more. It's like they're telling the world, "Here's what we're doing to keep the economy on track." And trust me, people pay attention.

For example, if the Fed decides to raise interest rates, it's like they're tapping the brakes on the economy. This can lead to higher borrowing costs for businesses and consumers. On the flip side, if they lower rates, it's like giving the economy a little turbo boost. Borrowing becomes cheaper, and people might start spending more. So, Fed News isn't just numbers—it's real-life impacts.

Why Should You Care About Fed News?

Here's the deal: Fed News affects everyone, whether you realize it or not. If you've got a mortgage, a car loan, or even a savings account, the Fed's decisions can hit close to home. For instance, when interest rates go up, your monthly mortgage payments might increase. And if you're saving money, higher rates could mean more interest in your account. See where I'm going with this?

But it's not just about personal finances. Businesses also feel the Fed's influence. When borrowing costs rise, companies might think twice before expanding or hiring. And if they're not growing, that can trickle down to fewer job opportunities. So, whether you're a homeowner, a business owner, or just someone trying to make ends meet, Fed News is worth keeping an eye on.

How Does the Fed Impact the Economy?

Now, let's talk about the Fed's role in the economy. Picture the Fed as the conductor of an orchestra. Their job is to keep all the instruments—the stock market, inflation, employment, and more—playing in harmony. They do this through monetary policy, which is basically their toolkit for managing the economy.

One of the main tools in their arsenal is setting interest rates. When they raise rates, it's like telling the economy to slow down. This can help control inflation, which is when prices for goods and services start climbing too fast. On the other hand, when they lower rates, it's like giving the economy a pep talk. It encourages spending and investment, which can boost growth.

Read also:Texas Mens Basketball Your Ultimate Guide To The Longhorns Hoops Phenomenon

Breaking Down the Fed's Goals

Let's dive a little deeper into what the Fed aims to achieve. They have a dual mandate, which means they focus on two main goals: maximum employment and stable prices. Maximum employment doesn't mean everyone has a job, but it means as many people as possible are employed without causing inflation to spiral out of control. Stable prices mean keeping inflation in check so that the cost of living doesn't skyrocket.

To achieve these goals, the Fed uses a variety of tools. Besides setting interest rates, they can also buy and sell government bonds, adjust reserve requirements for banks, and provide guidance through statements and speeches. It's like they've got a whole toolbox ready to tackle whatever economic challenges come their way.

Understanding the Fed's Structure

Before we go any further, let's take a quick look at how the Fed is structured. It's not just one big group—it's a network of 12 regional Federal Reserve Banks spread across the U.S. Each bank has its own president and board of directors, but they all work together under the Federal Reserve Board of Governors.

The Board of Governors is like the Fed's central command. They set monetary policy and oversee the entire system. At the heart of it all is the Federal Open Market Committee (FOMC), which meets regularly to discuss economic conditions and make decisions about interest rates and other policies. Think of the FOMC as the decision-makers who keep the economy running smoothly.

Who Are the Key Players?

Now, let's meet some of the key players in the Fed. The Chair of the Federal Reserve is like the captain of the ship. They lead the Board of Governors and the FOMC and are often the public face of the Fed. Other important figures include the Vice Chair, the regional bank presidents, and various economists and analysts who provide input on policy decisions.

These folks aren't just any bureaucrats—they're experts in economics and finance. They spend their days analyzing data, forecasting trends, and making decisions that can impact millions of lives. And while they might not be household names, their work affects everyone from Wall Street traders to Main Street shoppers.

How Fed News Affects Markets

So, how exactly does Fed News move markets? Well, investors are like detectives. They're always looking for clues about what the Fed might do next. When the Fed hints at raising interest rates, stock markets might dip as investors worry about higher borrowing costs. Conversely, if the Fed signals a rate cut, markets might rally as investors anticipate cheaper money.

But it's not just stocks that react. Bonds, currencies, and commodities can all be affected by Fed News. For example, when interest rates rise, bonds might become more attractive to investors because they offer higher yields. And if the dollar strengthens due to Fed policy, it can impact global trade and investment flows.

What Investors Should Watch For

Investors who want to stay ahead of the curve should keep an eye on a few key things. First, pay attention to the Fed's economic projections. These are like roadmaps for where the Fed thinks the economy is headed. Second, listen to Fed speeches and press conferences. These can provide insights into the Fed's thinking and potential policy shifts. And finally, watch for any changes in the Fed's balance sheet. This can signal whether they're tightening or loosening monetary policy.

Recent Fed News Highlights

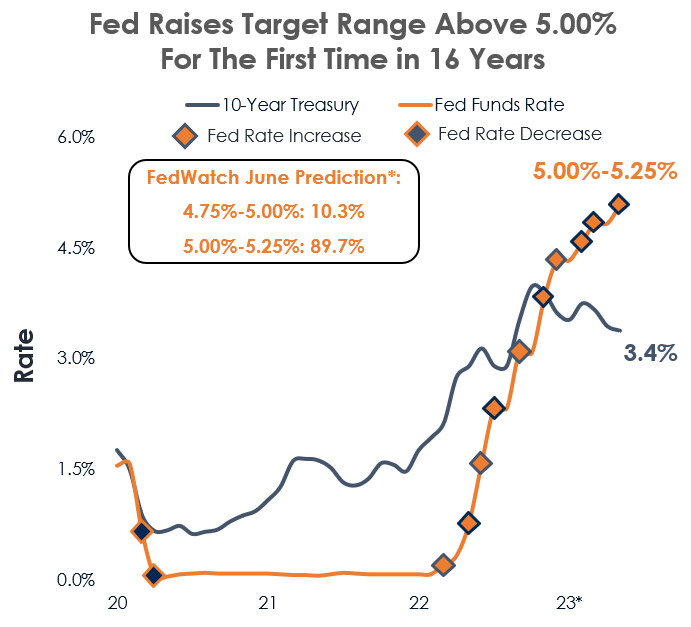

Let's take a look at some recent Fed News that's made headlines. In the past year, the Fed has been focused on battling inflation. They've raised interest rates several times in an effort to cool down the economy and bring prices under control. This has led to some volatility in the markets, but it's all part of the Fed's plan to maintain long-term stability.

Another big topic has been the labor market. The Fed has been closely watching employment numbers to gauge the health of the economy. Strong job growth is a good sign, but if it comes with rising wages, it could fuel inflation. So, the Fed has to strike a delicate balance between encouraging employment and keeping inflation in check.

What's on the Horizon?

Looking ahead, the Fed will continue to monitor economic conditions and adjust policy as needed. They'll be keeping a close eye on inflation, employment, and global economic trends. And while no one can predict the future, the Fed's actions will undoubtedly play a big role in shaping the economic landscape in the coming months and years.

How to Stay Informed About Fed News

Now that you know why Fed News matters, how can you stay up to date? There are plenty of ways to keep informed. First, follow reputable financial news outlets like Bloomberg, CNBC, and The Wall Street Journal. They provide detailed coverage of Fed announcements and analysis from experts.

Second, check out the Fed's official website. They publish statements, speeches, and economic data that can give you a firsthand look at what's happening. And if you really want to dive deep, consider subscribing to economic research reports from banks and think tanks. These can offer valuable insights into the Fed's thinking and potential policy moves.

Tips for Understanding Fed Jargon

One challenge of following Fed News is deciphering the jargon. Terms like "quantitative easing," "balance sheet normalization," and "forward guidance" might sound like a foreign language. But don't worry—there are resources to help you out. Websites like Investopedia and Khan Academy offer clear explanations of financial terms. And if you're ever unsure about something, don't hesitate to ask an expert or do a little research.

Conclusion: Why Fed News Matters to You

So there you have it—a deep dive into Fed News and why it matters. From influencing interest rates to shaping market trends, the Fed's decisions can have a real impact on your financial life. Whether you're saving for retirement, buying a home, or just trying to make ends meet, staying informed about Fed News can help you make smarter financial decisions.

And remember, the Fed isn't just some distant entity—they're working hard to keep the economy on track for everyone. So, take a moment to appreciate their role and keep an eye on what they're doing. After all, when the Fed speaks, it's worth listening.

Now it's your turn. Got any thoughts or questions about Fed News? Drop a comment below and let's chat. And if you found this article helpful, don't forget to share it with your friends. Together, we can all become better informed about the financial world around us.

Table of Contents

- What Exactly is Fed News?

- Why Should You Care About Fed News?

- How Does the Fed Impact the Economy?

- Understanding the Fed's Structure

- How Fed News Affects Markets

- Recent Fed News Highlights

- How to Stay Informed About Fed News

Thanks for reading, and here's to staying financially savvy!