Hey there, folks! Ever wondered what all the fuss is about when people talk about Fed interest rates? It’s not just some financial jargon that economists throw around—it’s a big deal that affects your wallet, your investments, and even your daily life. So, buckle up, because we’re diving deep into the world of the Federal Reserve and their interest rate policies, and by the end of this article, you’ll be clued in on how it all works.

Now, before we get too far ahead of ourselves, let’s break it down. The Federal Reserve, often called the "Fed," is like the financial captain of the ship for the United States. One of their key tools to steer the economy is by tweaking something called the federal funds rate, which is essentially the interest rate banks charge each other for short-term loans. But why does this matter to you? Well, it’s simple: when the Fed moves these rates, it ripples through the entire economy, impacting everything from mortgage payments to credit card interest.

Think of it this way: the Fed is like the DJ at a party. If the economy’s too slow, they lower the rates to get the dance floor hopping by making borrowing cheaper. If things are getting too wild and inflation starts to rise, they crank up the rates to cool things down. So, whether you’re planning to buy a house, save for retirement, or just wondering why your credit card bill keeps climbing, understanding Fed interest rates is key.

Read also:Channel 7 News The Epic Source For Breaking Stories And Beyond

What Are Fed Interest Rates Anyway?

Alright, so let’s dig a little deeper. Fed interest rates, or more formally known as the federal funds rate, is the interest rate at which banks lend reserve balances to other banks on an overnight basis. This rate is set by the Federal Open Market Committee (FOMC), a part of the Federal Reserve System. But don’t let all the fancy terms scare you—this is just the cost of borrowing money between banks.

Now, here’s the kicker: while it’s technically a bank-to-bank rate, it has a massive ripple effect throughout the economy. When the Fed lowers interest rates, borrowing becomes cheaper, which encourages businesses to invest and consumers to spend. On the flip side, when they raise rates, borrowing gets more expensive, which can slow down spending and investment. So, it’s not just about banks—it’s about all of us.

How Do Fed Interest Rates Impact You?

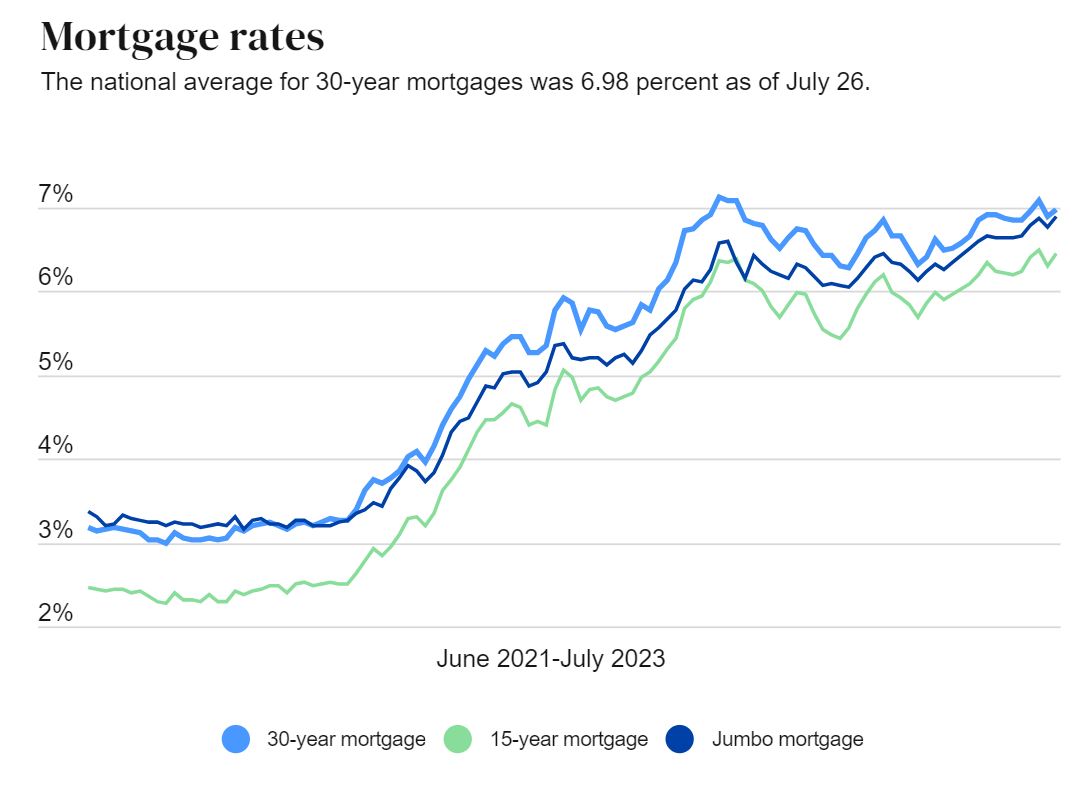

Let’s get personal for a second. Fed interest rates don’t just sit in some boardroom in Washington; they hit close to home. For instance, if you’ve got a mortgage, the rate you pay is influenced by the Fed’s decisions. A lower rate means cheaper monthly payments, while a higher rate means your wallet takes a bigger hit. Same goes for car loans, credit cards, and even savings accounts.

But it’s not just about loans and credit. Fed interest rates also affect the stock market. When rates are low, companies can borrow money more easily to grow and expand, which can lead to stock prices rising. Conversely, when rates go up, it can slow down corporate growth and lead to stock market dips. So, if you’ve got any investments, you might want to keep an eye on what the Fed’s doing.

Why Does the Fed Change Interest Rates?

Alright, so we know what they are, but why do they change? Well, the Fed has a couple of big jobs: to keep prices stable and to promote maximum employment. These are known as their "dual mandate." When inflation starts to creep up, meaning prices are rising too fast, the Fed might raise interest rates to slow things down. Think of it like tapping the brakes on a speeding car. On the flip side, if the economy’s slowing down too much, they might lower rates to give it a little gas.

Factors Influencing Fed Interest Rate Decisions

There’s a lot that goes into the Fed’s decision-making process. They look at a bunch of economic indicators, like unemployment rates, inflation data, and GDP growth. For instance, if unemployment is high and inflation is low, they might decide to lower rates to stimulate the economy. But if inflation is running rampant and the economy’s overheating, they might raise rates to cool things down.

Read also:Texas Longhorns Basketball The Ultimate Guide For Fans And Enthusiasts

And it’s not just about domestic factors. Global economic conditions also play a role. If there’s a major economic event overseas, like a recession in Europe or a trade war with China, the Fed might adjust rates to protect the U.S. economy. It’s a delicate balancing act, and they’ve got to weigh a lot of factors to make the right call.

The Historical Context of Fed Interest Rates

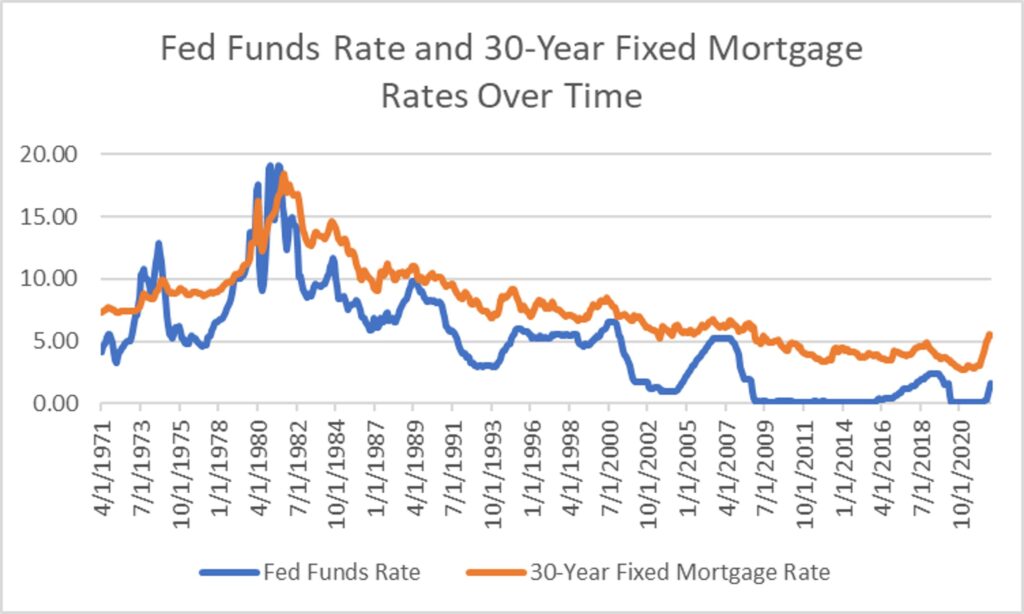

To really understand where we are now, it helps to look at where we’ve been. Fed interest rates have fluctuated wildly over the years, depending on the economic conditions of the time. Back in the 1980s, under Chairman Paul Volcker, rates were sky-high to combat rampant inflation. Fast forward to the 2008 financial crisis, and rates were slashed to near zero to stimulate the economy.

And here we are today, with rates sitting at historically low levels in the wake of the pandemic. The Fed slashed rates to near zero in 2020 to help the economy recover, and they’ve been slowly raising them since then as the economy has improved. But the question on everyone’s mind is: where are they headed next?

Key Moments in Fed Interest Rate History

- 1980s: Rates hit double digits to fight inflation.

- 2008: Rates slashed to near zero during the financial crisis.

- 2020: Rates dropped again to combat the pandemic’s economic impact.

These moments show just how much the Fed’s decisions can shape the economic landscape, and how they adapt to changing conditions over time.

The Impact of Fed Interest Rates on the Global Economy

It’s not just the U.S. that feels the effects of Fed interest rate changes. The global economy is interconnected, and what happens in the U.S. can have ripple effects worldwide. For instance, when the Fed raises rates, it can attract foreign investors looking for higher returns, which strengthens the U.S. dollar. But that can hurt exports and make it harder for U.S. companies to compete globally.

How Fed Rates Affect Emerging Markets

Emerging markets, in particular, can be hit hard by Fed rate changes. When rates go up, capital tends to flow back to the U.S., leaving emerging markets scrambling for funding. This can lead to currency devaluation and economic instability in those countries. It’s a reminder that the Fed’s decisions don’t just affect the U.S.; they have far-reaching consequences around the world.

How to Prepare for Fed Interest Rate Changes

So, what can you do to prepare for changes in Fed interest rates? Whether you’re a consumer or an investor, there are steps you can take to protect yourself and even take advantage of the situation.

Tips for Consumers

- Lock in Low Rates: If rates are low and you’re planning to take out a mortgage or car loan, now might be the time to do it.

- Pay Down Debt: High-interest debt, like credit card balances, can become more expensive when rates rise. Paying it down can save you money in the long run.

- Review Your Investments: If you’ve got money in the stock market, keep an eye on how rate changes might affect your portfolio.

Tips for Investors

- Consider Bonds: When rates rise, bond prices tend to fall. But if you’re looking for stable returns, bonds can still be a good option.

- Look for Growth Stocks: In a low-rate environment, growth stocks can thrive as companies have easier access to capital.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. A diversified portfolio can help you weather the ups and downs of rate changes.

Understanding the Fed’s Role in the Economy

Let’s take a step back and look at the bigger picture. The Fed isn’t just some random group of people making decisions in a vacuum. They’re a crucial part of the U.S. economic system, tasked with maintaining stability and promoting growth. Their decisions on interest rates are just one tool in their toolbox, but it’s a powerful one.

And while they’re not perfect, they’ve got a lot of smart people working hard to make the right calls. They study data, consult experts, and weigh the potential outcomes of their decisions. It’s a complex process, and it’s not always easy to get it right, but they’re doing their best to steer the economy in the right direction.

The Future of Fed Interest Rates

So, where are we headed? That’s the million-dollar question, and the truth is, no one knows for sure. The Fed will continue to monitor economic conditions and make adjustments as needed. But one thing’s for sure: interest rates will remain a key tool in their arsenal.

As we look to the future, there are a lot of factors to consider. Will inflation continue to rise? Will the global economy remain stable? Will new challenges emerge that require the Fed to take action? Only time will tell, but one thing’s for sure: the Fed will be watching closely and making decisions based on the best available data.

Conclusion: What You Need to Know About Fed Interest Rates

Alright, folks, let’s wrap this up. Fed interest rates might seem like a complicated topic, but at its core, it’s all about managing the economy. By tweaking the cost of borrowing, the Fed can influence everything from mortgage payments to stock prices. And while it’s not always easy to predict what they’ll do next, understanding their role and how it impacts your life can help you make smarter financial decisions.

So, here’s what you can do: stay informed, keep an eye on the Fed’s announcements, and take steps to protect yourself and your finances. Whether you’re a consumer or an investor, there are opportunities to take advantage of rate changes and strategies to mitigate the risks.

And finally, don’t forget to share this article with your friends and family. The more people understand how the Fed works, the better equipped we all are to navigate the ever-changing economic landscape. So, hit that share button, leave a comment, and let’s keep the conversation going!

Table of Contents

- What Are Fed Interest Rates Anyway?

- How Do Fed Interest Rates Impact You?

- Why Does the Fed Change Interest Rates?

- Factors Influencing Fed Interest Rate Decisions

- The Historical Context of Fed Interest Rates

- Key Moments in Fed Interest Rate History

- The Impact of Fed Interest Rates on the Global Economy

- How Fed Rates Affect Emerging Markets

- How to Prepare for Fed Interest Rate Changes

- Tips for Consumers and Investors

- Understanding the Fed’s Role in the Economy

- The Future of Fed Interest Rates