Let’s talk about something that could save your life—or at least your peace of mind: social security identity verification. Yep, you heard me right. In today’s world, where digital footprints are as common as coffee stains on your favorite mug, protecting your identity is not just important—it’s essential. Social security numbers (SSNs) have become the backbone of our personal and financial lives, but they’re also a goldmine for scammers. So, buckle up, because we’re diving deep into how you can verify and safeguard your identity through proper SSN checks.

Now, you might be wondering, why should I care about this? Well, here’s the deal: identity theft is on the rise, and it’s not just happening to celebrities or big-shot executives. Regular folks like you and me are just as vulnerable. If someone gets their hands on your SSN, they could open credit cards, apply for loans, and even file taxes in your name. Scary, right? That’s why understanding social security identity verification is more crucial now than ever.

Before we dive deeper, let me drop this little nugget: according to a recent study by Javelin Strategy & Research, identity fraud hit a record high in 2022, affecting millions of people worldwide. So, whether you’re trying to protect your own identity or helping a loved one, this guide will arm you with the knowledge you need to stay safe.

Read also:Feeding Our Future Nurturing The Next Generation Through Sustainable Nutrition

What is Social Security Identity Verification?

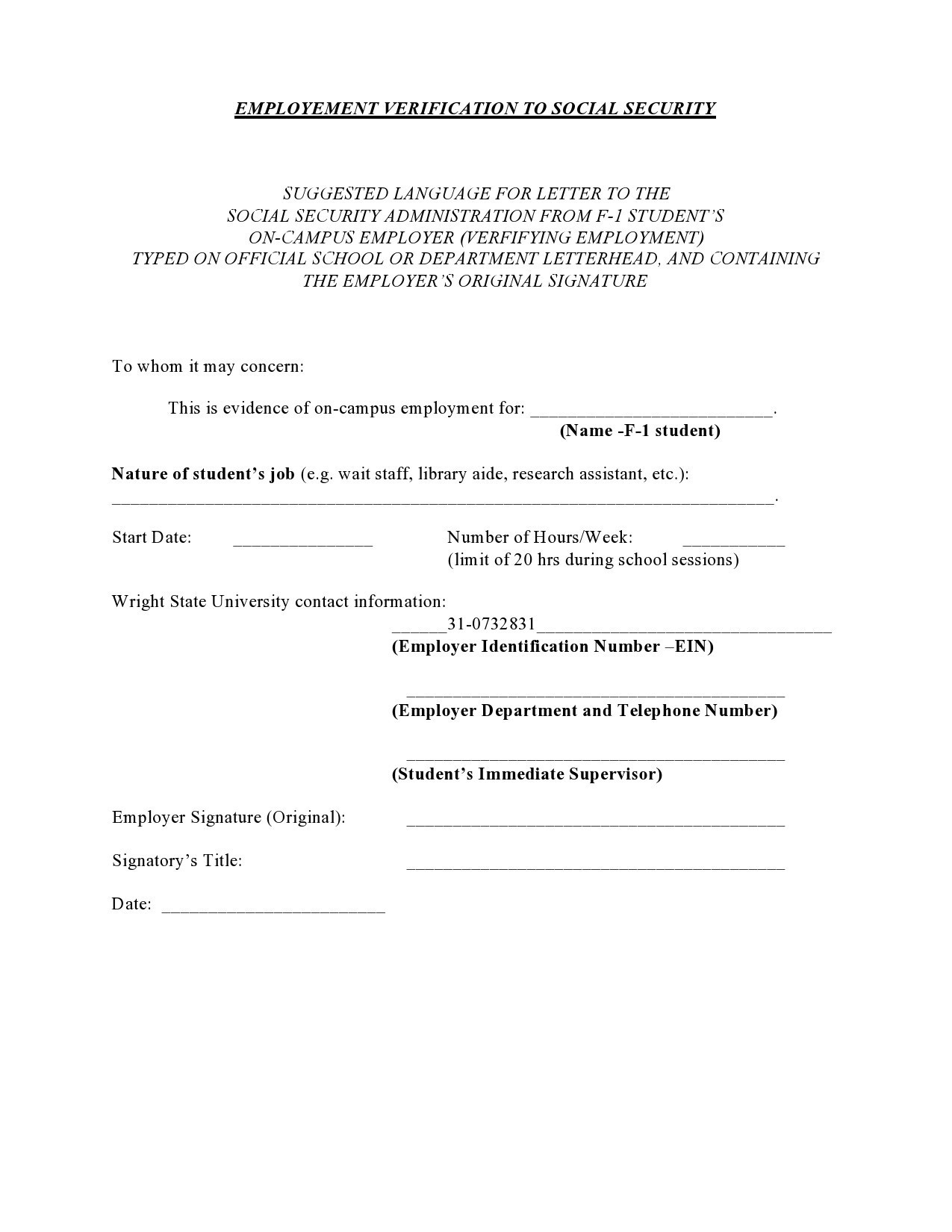

Let’s break it down, shall we? Social security identity verification is the process of confirming that the person using a specific SSN is who they claim to be. Think of it like a digital fingerprint for your financial life. This process is used by employers, financial institutions, government agencies, and even landlords to ensure that the SSN provided matches the individual’s identity.

In simpler terms, it’s like when you go to a bar and the bouncer asks for your ID. They’re not just checking your age—they’re making sure the person in the picture is really you. Social security identity verification works in much the same way, but instead of a bouncer, it’s a system designed to protect you from identity thieves.

Why is SSN Verification Important?

Here’s the thing: your SSN is like the key to your kingdom. It’s used for everything from applying for jobs to accessing healthcare benefits. If someone gets their hands on it, they can wreak havoc on your life. That’s why verifying your identity through proper SSN checks is so important.

- Protects against identity theft

- Ensures accurate reporting of income and taxes

- Helps prevent fraudulent activity

- Keeps your personal information secure

Imagine this scenario: you get a letter from the IRS saying that someone else filed taxes in your name. Yeah, it’s not fun. But with proper SSN verification, you can catch these issues before they spiral out of control.

How Does Social Security Identity Verification Work?

Alright, so now that you know what it is, let’s talk about how it works. The process typically involves matching your SSN with your personal information, such as your name, date of birth, and address. This can be done through various methods, including:

- Online verification services

- In-person visits to Social Security Administration (SSA) offices

- Third-party verification tools

Most employers and financial institutions use automated systems to verify SSNs. These systems compare the information you provide with the data stored in the SSA’s database. If everything matches, you’re good to go. But if there’s a discrepancy, it could signal potential fraud or an error that needs to be addressed.

Read also:Tru Tv The Ultimate Destination For Crime And Reality Entertainment

Common Methods of SSN Verification

There are several ways to verify your SSN, depending on your needs and circumstances. Here are some of the most common methods:

- SSA Verification Service: The SSA offers a free service called the Consent-Based SSN Verification (CBSV) that allows businesses and organizations to verify SSNs electronically.

- Third-Party Tools: Many companies offer SSN verification services, often integrated into their broader identity protection offerings.

- In-Person Verification: If you prefer the old-school approach, you can visit your local SSA office to verify your SSN in person.

Each method has its pros and cons, so it’s important to choose the one that best fits your situation.

The Importance of Accurate SSN Data

Having accurate SSN data is critical for several reasons. First and foremost, it ensures that your personal information is protected from fraud. But beyond that, it also affects things like:

- Tax reporting

- Employment verification

- Access to government benefits

- Credit scoring

Think about it: if your SSN is linked to incorrect information, it could lead to denied loans, incorrect tax filings, or even trouble with law enforcement. That’s why it’s so important to regularly check and verify your SSN data.

Steps to Verify Your SSN

Ready to take control of your SSN verification? Here’s a step-by-step guide to help you get started:

- Gather your personal information, including your SSN, name, date of birth, and address.

- Decide which verification method you want to use (online, third-party, or in-person).

- Follow the instructions provided by the verification service or SSA office.

- Review the results and address any discrepancies immediately.

It might sound like a lot, but trust me, it’s worth the effort. Plus, most online verification services can be completed in just a few minutes.

Common SSN Verification Challenges

Of course, nothing in life is perfect, and SSN verification is no exception. Here are some common challenges you might face:

- Data Entry Errors: Typos or mistakes in your personal information can cause verification issues.

- Fraudulent Activity: If someone has stolen your SSN, it could show up as a discrepancy during verification.

- Outdated Information: If you’ve recently changed your name or address, it might not be updated in the SSA’s database.

The good news is that most of these issues can be resolved with a little effort. If you encounter any problems, don’t panic. Just contact the SSA or the verification service for assistance.

How to Address SSN Verification Issues

If you do run into issues during the verification process, here’s what you can do:

- Contact the SSA to report any discrepancies or fraudulent activity.

- Update your personal information if it’s outdated or incorrect.

- Consider enrolling in an identity protection service to monitor your SSN for suspicious activity.

Remember, the sooner you address any issues, the easier it will be to resolve them. Don’t wait until it’s too late!

Protecting Your SSN from Fraud

Now that you know how to verify your SSN, let’s talk about how to protect it from fraud. Here are some tips to keep your SSN safe:

- Never share your SSN unless absolutely necessary.

- Shred any documents containing your SSN before disposing of them.

- Use strong, unique passwords for online accounts.

- Monitor your credit reports regularly for any suspicious activity.

By taking these precautions, you can significantly reduce your risk of identity theft. And if the worst happens, you’ll be better prepared to handle it.

Signs of SSN Fraud

Knowing the signs of SSN fraud can help you catch potential issues early. Here are some red flags to watch out for:

- Unexplained charges on your credit card statements.

- Denial of credit or loans despite good credit history.

- IRS notices about multiple tax returns filed in your name.

- Unfamiliar accounts on your credit report.

If you notice any of these signs, act quickly to address the issue. Time is of the essence when it comes to identity theft.

Legal Protections for SSN Owners

Thankfully, there are laws in place to protect SSN owners from fraud and misuse. The Fair Credit Reporting Act (FCRA) and the Identity Theft and Assumption Deterrence Act are just a couple of examples. These laws give you the right to:

- Freeze your credit reports to prevent unauthorized access.

- Place fraud alerts on your accounts if you suspect identity theft.

- Dispute inaccurate information on your credit reports.

Knowing your legal rights can empower you to take action if your SSN is compromised. Don’t hesitate to exercise these rights if needed.

Resources for SSN Verification and Protection

Here are some resources to help you with SSN verification and protection:

- Social Security Administration: Visit ssa.gov for official information and services.

- Federal Trade Commission: The FTC offers guidance on identity theft prevention and recovery.

- Credit Monitoring Services: Companies like Experian and Equifax offer tools to monitor your SSN for suspicious activity.

Take advantage of these resources to stay informed and protected.

Conclusion: Take Control of Your SSN Verification

So there you have it: everything you need to know about social security identity verification. From understanding what it is to protecting your SSN from fraud, this guide has armed you with the knowledge to stay safe in an increasingly digital world.

Remember, your SSN is more than just a number—it’s a key to your financial and personal life. By taking the time to verify and protect it, you’re safeguarding your future. So, what are you waiting for? Go ahead and take that first step today!

And don’t forget to share this article with your friends and family. Knowledge is power, and the more people who understand the importance of SSN verification, the safer we all are. Now, go out there and be the guardian of your own identity!

Table of Contents

- What is Social Security Identity Verification?

- How Does Social Security Identity Verification Work?

- The Importance of Accurate SSN Data

- Common SSN Verification Challenges

- Protecting Your SSN from Fraud

- Legal Protections for SSN Owners