Hey there, finance enthusiasts! Let’s dive straight into what could be one of the most pivotal topics for anyone interested in global markets. FOMC meeting—yes, those three little letters that make traders and investors either jump with joy or pull their hair out in frustration. If you’ve ever wondered why Wall Street goes bananas every time the Federal Reserve announces something, you’re in the right place. We’re about to break down everything you need to know about the FOMC meeting and why it matters so much to your wallet. So, buckle up!

Now, for those who might be scratching their heads, FOMC stands for Federal Open Market Committee. It’s basically the brain trust behind the U.S. monetary policy, and its decisions can ripple through economies worldwide. Think of it as the steering wheel of the financial ship, and if they turn it the wrong way, watch out—it could mean trouble for your investments.

But don’t worry, we’re here to simplify things. This guide isn’t just for seasoned traders or economists; it’s for anyone curious about how these meetings affect everyday life. Whether you’re managing a retirement fund, dabbling in stocks, or just trying to understand the economic headlines, this article will give you the lowdown. Let’s get started!

Read also:Texas Vs Xavier Prediction Who Will Dominate The Battle

What Exactly Is the FOMC Meeting?

The FOMC meeting is where the bigwigs of the Federal Reserve gather to discuss and decide on monetary policy. Imagine it like a high-stakes poker game, but instead of chips, they’re dealing with interest rates and inflation. These meetings happen eight times a year, and each one is a major event in the financial calendar.

During these sessions, the committee reviews economic data, analyzes market conditions, and decides whether to raise, lower, or maintain interest rates. Their goal? To keep the economy running smoothly by balancing growth, employment, and inflation. Sounds simple, right? Well, not exactly.

Why Does the FOMC Meeting Matter?

Here’s the deal: the decisions made during an FOMC meeting can have a domino effect on everything from mortgage rates to stock prices. For instance, if the committee raises interest rates, borrowing becomes more expensive, which can slow down economic activity. On the flip side, cutting rates can stimulate spending and investment. Investors pay close attention because even a small change can send shockwaves through the market.

The FOMC Meeting Process Explained

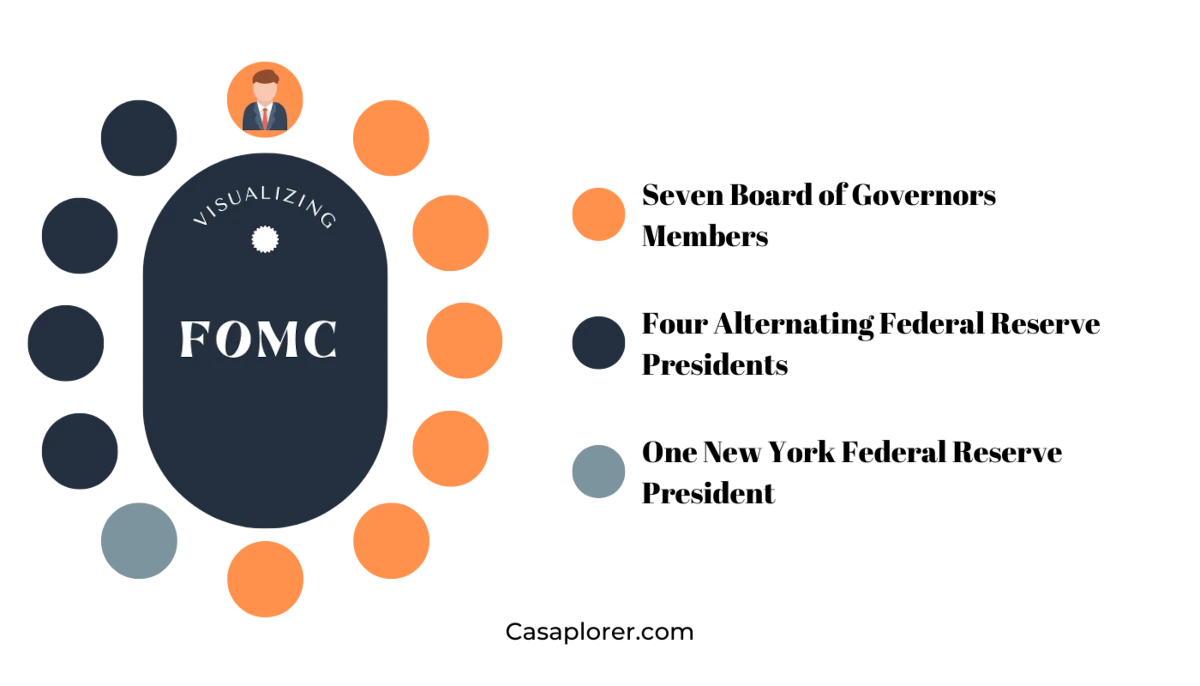

Alright, let’s get into the nitty-gritty of how these meetings work. First off, the FOMC consists of 12 members, including the Board of Governors of the Federal Reserve System and five Federal Reserve Bank presidents. They meet regularly to assess the current state of the economy and make informed decisions.

Before each meeting, members pore over mountains of data—everything from employment reports to inflation numbers. Then, during the actual meeting, they debate and vote on what actions to take. The results are announced in a statement, followed by a press conference from the Fed Chair, who explains the reasoning behind their decisions.

Key Players in the FOMC Meeting

Here’s a quick rundown of the main characters involved:

Read also:Xrp Price The Ultimate Guide To Understanding Ripples Value And Potential

- Federal Reserve Board of Governors: These are the permanent members who provide continuity and oversight.

- Federal Reserve Bank Presidents: Five of them rotate as voting members, bringing regional perspectives to the table.

- Jay Powell (or whoever the current Chair is): The face of the FOMC, responsible for communicating decisions to the public.

How FOMC Decisions Impact the Economy

So, what happens when the FOMC tweaks interest rates? Let’s break it down:

Interest Rate Hikes: When rates go up, borrowing costs increase, making loans less attractive. This can slow down consumer spending and business investments, potentially cooling off an overheated economy.

Interest Rate Cuts: Conversely, lowering rates makes borrowing cheaper, encouraging people to spend more. This can boost economic growth, but if done excessively, it might lead to inflation.

Real-World Examples of FOMC Impact

Take the 2008 financial crisis, for example. The FOMC slashed interest rates to near-zero levels to help stabilize the economy. Fast forward to 2022, and they were aggressively hiking rates to combat soaring inflation. Each decision was tailored to the specific challenges of the time, showing just how dynamic and responsive the FOMC can be.

Reading Between the Lines: The FOMC Statement

After every meeting, the FOMC releases a statement summarizing their decisions and rationale. Investors devour this document like it’s a treasure map, looking for clues about future moves. Phrases like “economic activity has been rising at a moderate pace” or “inflation remains elevated” can send markets soaring or tumbling depending on how they’re interpreted.

Breaking Down the FOMC Statement

Here’s what to look for in the statement:

- Economic Assessment: How do they view the current state of the economy?

- Interest Rate Decision: Did they raise, lower, or keep rates steady?

- Forward Guidance: What hints do they drop about future policy moves?

Common Misconceptions About FOMC Meetings

There’s a lot of noise around FOMC meetings, and not all of it is accurate. For instance, some people think the Fed controls stock prices directly. Nope! While their decisions influence market sentiment, they don’t pull strings like puppeteers. Another myth is that the FOMC always acts in predictable ways. Again, not true—they’re constantly adapting to new information and shifting circumstances.

Separating Fact from Fiction

To avoid falling prey to misinformation, stick to reliable sources. Websites like the Federal Reserve’s official site or reputable financial news outlets are great places to start. And remember, the FOMC’s primary goal is to promote a healthy, stable economy—not to manipulate markets for personal gain.

Preparing for an FOMC Announcement

If you’re an investor or trader, staying ahead of the curve is crucial. Here’s how you can prepare:

- Stay informed: Follow economic indicators leading up to the meeting.

- Set realistic expectations: Don’t expect dramatic changes overnight.

- Have a plan: Know how you’ll react if rates move in an unexpected direction.

Tools and Resources for Tracking FOMC Decisions

There are plenty of tools to help you stay on top of things:

- Economic Calendars: Keep track of meeting dates and release times.

- News Alerts: Set up notifications for breaking updates.

- Market Analysis Platforms: Use software to analyze trends and patterns.

Historical Insights: FOMC Meeting Highlights

Let’s take a trip down memory lane and explore some notable FOMC moments:

In 1994, the committee initiated a series of rate hikes to combat inflation, which initially spooked markets but ultimately proved effective. More recently, the 2020 pandemic response saw the FOMC slash rates to zero and implement massive quantitative easing programs to stabilize the economy.

Learning from the Past

History teaches us that the FOMC is capable of navigating even the toughest economic challenges. By studying past decisions, we can gain valuable insights into how they approach different scenarios and what to expect in the future.

Conclusion: Why You Should Care About FOMC Meetings

There you have it—a comprehensive look at FOMC meetings and why they matter. Whether you’re a seasoned pro or just starting out, understanding the FOMC’s role in shaping monetary policy is key to making informed financial decisions.

So, what’s next? Share your thoughts in the comments below. Did you learn something new? Have any questions about the FOMC? Let’s keep the conversation going. And if you found this article helpful, don’t forget to share it with your friends and fellow finance geeks. Until next time, stay sharp and keep those portfolios growing!

Table of Contents

- What Exactly Is the FOMC Meeting?

- Why Does the FOMC Meeting Matter?

- The FOMC Meeting Process Explained

- Key Players in the FOMC Meeting

- How FOMC Decisions Impact the Economy

- Reading Between the Lines: The FOMC Statement

- Common Misconceptions About FOMC Meetings

- Preparing for an FOMC Announcement

- Historical Insights: FOMC Meeting Highlights

- Conclusion: Why You Should Care About FOMC Meetings

And that’s a wrap, folks! Thanks for reading, and remember—knowledge is power. Keep learning, keep growing, and never stop exploring the world of finance.