Alright folks, let’s talk about something that might sound boring at first but trust me, it’s super important—Fed Rates. If you’ve ever wondered why the stock market goes haywire or why your mortgage payments might change, this is the article for you. Fed Rates are like the heartbeat of the global economy, and understanding them can make you a smarter investor, borrower, or just someone who’s clued in about how the world works. So buckle up, because we’re diving deep into this financial powerhouse.

Now, I get it. The term "Fed Rates" might sound like a snooze fest, something that only economists or financial wizards care about. But here’s the deal: these rates affect everyone, from the big-shot Wall Street traders to the regular Joe trying to buy his first home. When the Federal Reserve—the central bank of the U.S.—adjusts these rates, it’s like ripples in a pond that affect the entire global financial ecosystem.

So, why should you care? Because your money, your job, and even your dreams of owning that dream house are tied to the decisions made by the Fed. In this article, we’ll break it down in a way that’s easy to understand, even if you’re not a finance guru. We’ll cover what Fed Rates are, how they work, why they matter, and what you can do to protect yourself—or even take advantage of them. Let’s dive in, shall we?

Read also:American Vs Mount St Marys The Ultimate Showdown In College Basketball

What Exactly Are Fed Rates?

Let’s start with the basics. Fed Rates, or the Federal Funds Rate, is the interest rate at which banks lend money to each other overnight. Think of it like this: banks, just like you and me, sometimes need a little cash to keep things running smoothly. Instead of going to a payday lender, they borrow from each other. The Fed sets the guidelines for this borrowing, and that’s where the Fed Rate comes in.

It’s not just some random number. The Fed Rate is a tool used by the Federal Reserve to influence the economy. If the economy is sluggish, they might lower the rate to encourage borrowing and spending. On the flip side, if things are heating up too much and inflation is creeping in, they might raise the rate to cool things down. It’s a delicate balancing act, and the Fed is like the conductor of this economic orchestra.

Why Do Fed Rates Matter?

Here’s the thing: Fed Rates don’t just affect banks. They have a domino effect on the entire economy. When the Fed raises or lowers rates, it impacts everything from credit card interest rates to car loans to mortgage payments. If you’re thinking about buying a house or taking out a loan, you better pay attention to what the Fed is doing.

But it’s not just about loans. Fed Rates also affect the stock market. When rates go up, borrowing becomes more expensive, which can slow down business growth and lead to a dip in stock prices. Conversely, when rates go down, it can be a green light for businesses to expand and invest, boosting the market. So, whether you’re a seasoned investor or just someone with a 401(k), Fed Rates are something you should keep an eye on.

How Fed Rates Impact the Average Person

Let me paint you a picture. Imagine you’re planning to buy a house. You’ve been saving up for years, and you finally have enough for a down payment. But then, out of nowhere, the Fed decides to raise rates. Suddenly, that dream house becomes a lot more expensive because your mortgage payments just went up. Or maybe you’ve got a credit card with a variable interest rate. A Fed Rate hike could mean you’re paying more in interest every month.

On the flip side, if the Fed lowers rates, it could mean lower mortgage payments, cheaper loans, and even better returns on savings accounts. It’s like a financial seesaw, and the Fed is the one pulling the strings.

Read also:How To Watch March Madness Your Ultimate Guide To Catching All The Action

How Are Fed Rates Determined?

The Federal Reserve doesn’t just pull a number out of a hat. They have a whole process for determining Fed Rates. It starts with the Federal Open Market Committee (FOMC), a group of economists and policymakers who meet several times a year to discuss the state of the economy. They look at things like inflation, unemployment rates, and economic growth to decide whether to raise, lower, or keep rates the same.

It’s not an exact science, but it’s a well-thought-out process. The FOMC considers a ton of data, from consumer spending to global economic trends, before making a decision. And let me tell you, these decisions don’t happen overnight. They’re the result of months of analysis and debate, and they can have far-reaching consequences.

The Role of Inflation in Fed Rate Decisions

Inflation is like the Fed’s arch-nemesis. When prices start rising too fast, it can wreak havoc on the economy. That’s why the Fed keeps a close eye on inflation when setting rates. If inflation is too high, they might raise rates to slow down spending and bring things back under control. On the other hand, if inflation is too low, they might lower rates to encourage spending and get the economy moving again.

Think of it like this: inflation is the heat in a pot of water, and the Fed is the chef adjusting the burner. Too much heat, and the water boils over. Not enough heat, and nothing happens. The Fed’s job is to keep things simmering at just the right temperature.

Historical Trends in Fed Rates

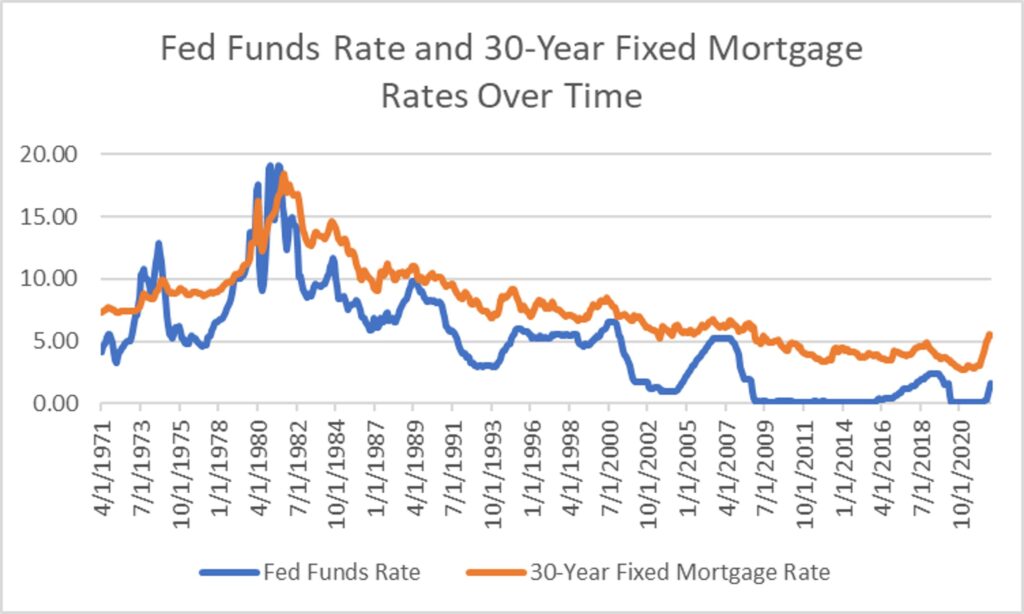

Looking back at history, you can see how Fed Rates have fluctuated over the years. In the 1980s, for example, rates were sky-high, topping out at over 20%. That was a response to the rampant inflation of the time. Fast forward to the 2008 financial crisis, and rates were practically at zero as the Fed tried to jumpstart the economy.

Today, we’re in a different era. Rates have been relatively low for years, but there are signs they might be creeping up again. It’s like a rollercoaster ride, and the Fed is the conductor, deciding when to hit the gas and when to hit the brakes.

What Can We Learn from Past Fed Rate Decisions?

History is a great teacher, and the Fed has learned a lot from past mistakes. In the 1970s, for example, they underestimated the threat of inflation, leading to a decade of economic turmoil. Today, they’re much more proactive, using data and analysis to make informed decisions.

But even with all their tools and expertise, the Fed isn’t infallible. Sometimes, they get it wrong. That’s why it’s important for all of us to stay informed and understand how these decisions affect our lives.

How Can You Protect Yourself from Fed Rate Changes?

So, you’re probably wondering, “What can I do to protect myself from the ups and downs of Fed Rates?” The good news is, there are steps you can take to mitigate the impact. First, if you’re planning to take out a loan or buy a house, try to lock in a fixed rate. That way, you’re not at the mercy of the Fed’s decisions.

Second, if you’ve got credit card debt, consider consolidating it into a loan with a lower, fixed interest rate. And if you’ve got savings, look for accounts that offer higher interest rates when the Fed lowers rates. It’s all about being proactive and taking control of your financial future.

Investing in a Fed Rate Environment

If you’re an investor, Fed Rates can be both a challenge and an opportunity. When rates are low, it can be a great time to invest in stocks or real estate. But when rates are high, you might want to consider more conservative investments, like bonds or dividend-paying stocks.

The key is to stay flexible and adapt to changing conditions. The financial markets are like a river, and Fed Rates are the current. If you know how to navigate the waters, you can find opportunities even in the most turbulent times.

Common Misconceptions About Fed Rates

There are a lot of myths and misconceptions floating around about Fed Rates. Some people think they only affect the rich or the big banks, but that’s not true. Fed Rates impact everyone, from the wealthiest investors to the everyday consumer. Another misconception is that the Fed can control the economy completely. While they have a lot of influence, they can’t predict or control every variable.

It’s also important to understand that Fed Rates aren’t the only factor affecting the economy. Global events, political decisions, and even natural disasters can all have an impact. The Fed is just one piece of the puzzle, albeit a very important one.

Clearing Up the Confusion

Let’s break it down: Fed Rates are a tool, not a magic wand. They can influence the economy, but they can’t fix everything. It’s like a thermostat—you can adjust the temperature, but you can’t control the weather outside. Understanding this can help you make better financial decisions and avoid falling for common misconceptions.

What the Future Holds for Fed Rates

Looking ahead, there’s a lot of uncertainty about where Fed Rates are headed. With inflation creeping up and the global economy still recovering from the pandemic, the Fed has some tough decisions to make. Some experts predict rates will continue to rise, while others think they’ll stay relatively stable.

But one thing’s for sure: the Fed will continue to play a crucial role in shaping the global economy. Whether you’re a seasoned investor or just someone trying to make ends meet, paying attention to Fed Rates can give you a leg up in the financial game.

Staying Informed in a Changing World

The best way to stay ahead of the curve is to stay informed. Follow financial news, keep an eye on Fed announcements, and educate yourself about how these decisions affect your life. Knowledge is power, and in the world of finance, it can mean the difference between success and failure.

Conclusion: Why Fed Rates Matter to You

So there you have it, folks. Fed Rates might not be the sexiest topic in the world, but they’re one of the most important. Whether you’re buying a house, investing in stocks, or just trying to pay off your credit card, these rates can have a huge impact on your financial well-being. By understanding how they work and how they affect the economy, you can make smarter decisions and take control of your financial future.

Now, here’s the call to action: don’t just sit there! Take what you’ve learned and put it into practice. Whether it’s locking in a fixed-rate loan, adjusting your investment strategy, or simply staying informed, there’s always something you can do to protect yourself and take advantage of opportunities. And don’t forget to share this article with your friends and family—because knowledge is power, and the more people who understand Fed Rates, the better off we all are.

Table of Contents

- Fed Rates: The Pulse of the Global Economy You Need to Know About

- What Exactly Are Fed Rates?

- Why Do Fed Rates Matter?

- How Fed Rates Impact the Average Person

- How Are Fed Rates Determined?

- The Role of Inflation in Fed Rate Decisions

- Historical Trends in Fed Rates

- What Can We Learn from Past Fed Rate Decisions?

- How Can You Protect Yourself from Fed Rate Changes?

- Investing in a Fed Rate Environment

- Common Misconceptions About Fed Rates

- Clearing Up the Confusion

- What the Future Holds for Fed Rates

- Staying Informed in a Changing World

- Conclusion: Why Fed Rates Matter to You