Today's stock market is making headlines, and it's all about the Nasdaq leading the charge in a massive market rally. Investors are celebrating after the Fed's rate decision sent waves of optimism through Wall Street. If you're wondering what's happening and why it matters, you're in the right place. This article will dive deep into the details, breaking down the key factors driving this rally and what it means for your portfolio.

So, let's get one thing straight—stock markets are like a roller coaster, but today? Today, it feels more like a rocket ship. The Nasdaq is soaring, and investors are popping champagne bottles. But what exactly is going on? Well, buckle up, because we’re about to break it down for you in a way that even your grandma could understand.

Whether you're a seasoned trader or just dipping your toes into the world of investing, understanding what's happening in the stock market today is crucial. The Fed's decision on interest rates has sparked a massive rally, and it’s not just the Nasdaq that’s benefitting. Let’s explore why this matters and how it could impact your financial future.

Read also:Mt St Marys Vs American The Ultimate Showdown In College Basketball

Understanding the Stock Market Today

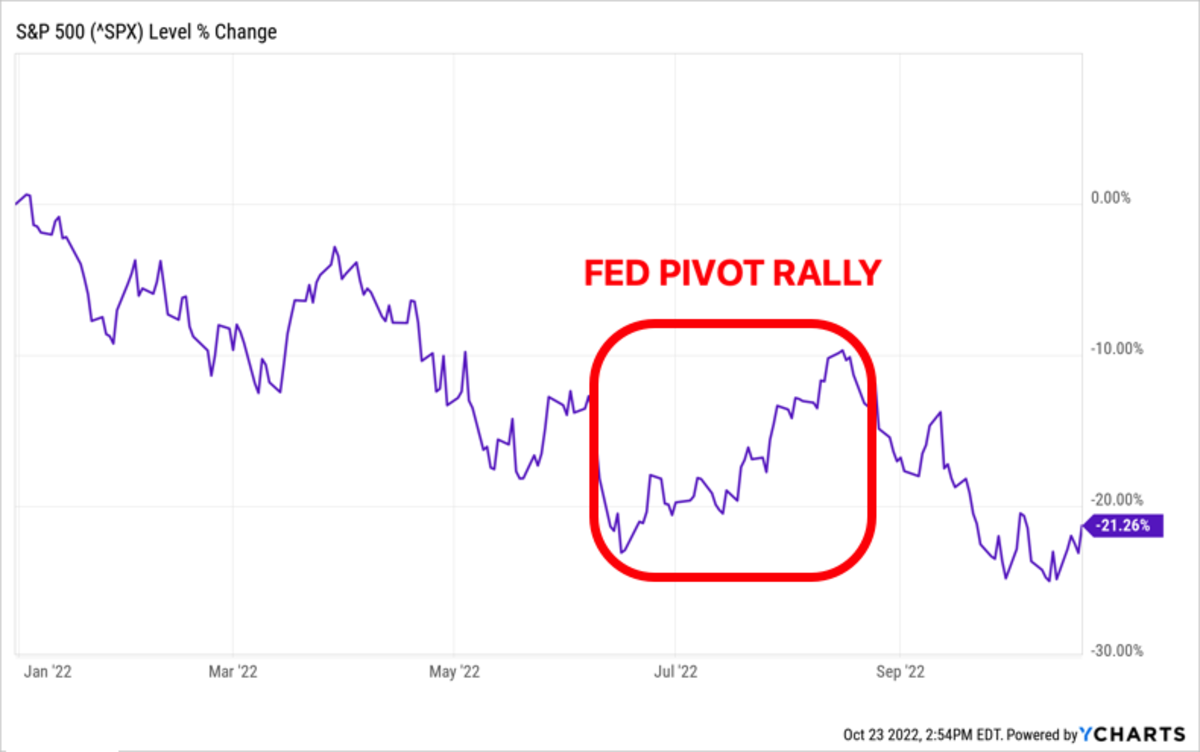

Alright, so let’s start with the basics. The stock market today is a reflection of investor sentiment, economic conditions, and, of course, the Fed's decisions. When the Federal Reserve makes a move, it sends ripples through the entire financial ecosystem. Today, those ripples have turned into waves, and the Nasdaq is leading the charge.

The Nasdaq Composite Index, which is home to some of the biggest tech companies in the world, is up significantly. This rally is being fueled by a mix of factors, including positive earnings reports, optimism about the economy, and, most importantly, the Fed's decision to adjust interest rates. But why does this matter? Let’s break it down further.

Why the Fed's Rate Decision Matters

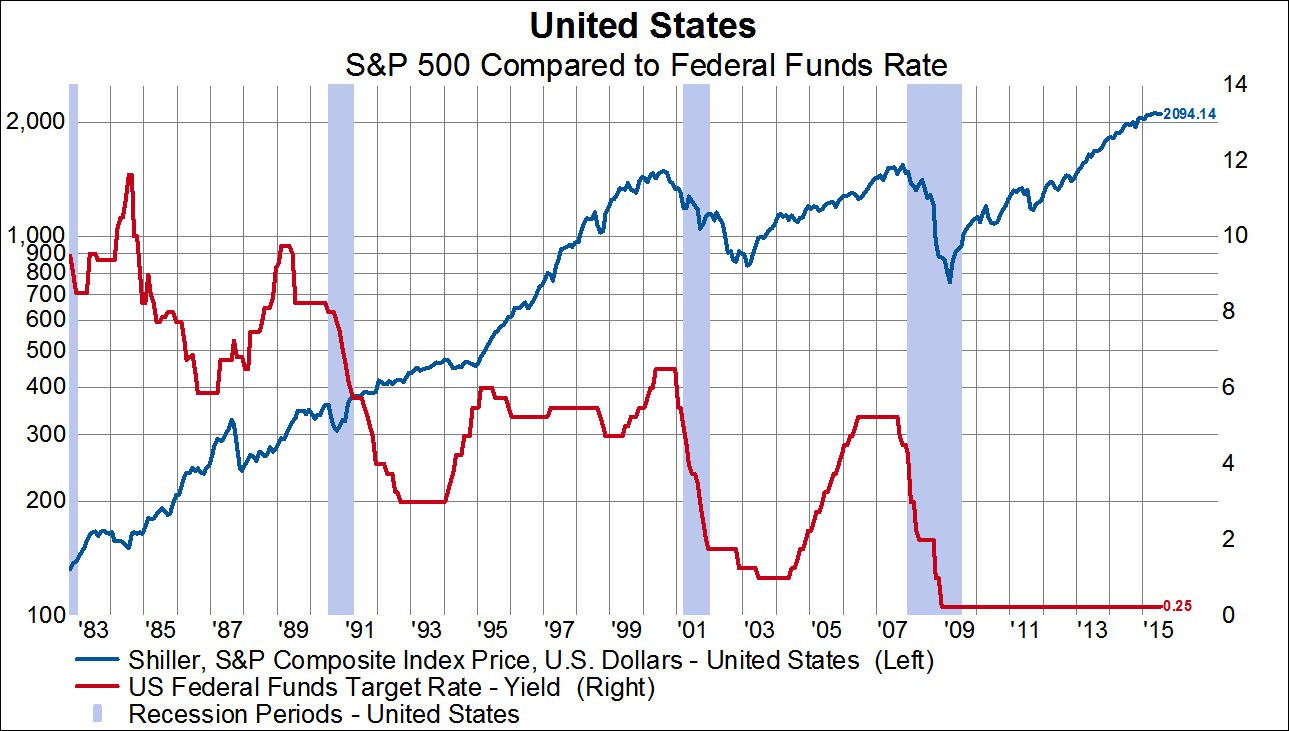

Here's the deal—the Federal Reserve plays a huge role in shaping the financial landscape. When they adjust interest rates, it affects everything from borrowing costs to consumer spending. Today, the Fed's decision to lower rates has given investors a reason to cheer. Lower rates mean cheaper borrowing, which can lead to increased spending and investment.

For example, companies can now borrow money at lower rates, allowing them to expand, hire more employees, and invest in new projects. This, in turn, boosts the overall economy and, by extension, the stock market. It's like a domino effect, but instead of falling, everything is rising.

Nasdaq: The Star of the Show

Now, let’s talk about the Nasdaq. This index is often seen as the pulse of the tech sector, and today, it's beating stronger than ever. Companies like Apple, Microsoft, and Amazon are all part of the Nasdaq, and their performance directly impacts the index. So, when these companies do well, the Nasdaq does well too.

But what's driving this particular rally? It's a combination of strong earnings reports, innovative products, and, again, the Fed's rate decision. Investors are seeing the potential for growth and are willing to put their money where their mouths are. This is why the Nasdaq is leading the market rally today.

Read also:Roki Sasaki Stats The Rising Star Shattering Records

Key Players in the Nasdaq Rally

Let’s take a closer look at some of the key players driving this rally. Companies like Tesla, Nvidia, and Alphabet are all seeing significant gains. Here’s a quick breakdown:

- Tesla: With its focus on electric vehicles and renewable energy, Tesla is a favorite among investors.

- Nvidia: Known for its graphics processing units, Nvidia is benefiting from the growing demand for AI and gaming technologies.

- Alphabet: As the parent company of Google, Alphabet continues to dominate the digital advertising space.

These companies, along with others in the tech sector, are driving the Nasdaq higher and higher. It's a testament to their innovation and resilience in a rapidly changing world.

How the Market Rally Affects Investors

So, what does this mean for you, the investor? Well, if you're holding stocks in the Nasdaq, you're probably pretty happy right now. But even if you're not, there are opportunities to capitalize on this rally. Whether you're looking to buy, sell, or hold, understanding the market dynamics is crucial.

For example, if you believe the rally is just beginning, you might consider buying stocks in companies that are performing well. On the other hand, if you think the market is overvalued, you might want to consider selling. It all depends on your investment strategy and risk tolerance.

Investment Strategies to Consider

Here are a few strategies you might want to consider:

- Dollar-Cost Averaging: This involves investing a fixed amount of money at regular intervals, regardless of market conditions.

- Dividend Reinvestment: If you own stocks that pay dividends, reinvesting those dividends can help grow your portfolio over time.

- Diversification: Spreading your investments across different sectors and asset classes can help mitigate risk.

Remember, the key to successful investing is having a solid strategy and sticking to it, even when the market gets volatile.

Market Trends and Predictions

Now, let’s talk about trends and predictions. While no one can predict the future with 100% accuracy, there are certain indicators that can help us make informed decisions. For example, the tech sector is expected to continue its upward trajectory, driven by innovation and demand for new technologies.

Additionally, the global shift towards sustainability and renewable energy is creating opportunities for companies in those sectors. Investors who are willing to embrace these trends are likely to see positive returns in the long run.

Long-Term vs. Short-Term Investing

When it comes to investing, it's important to decide whether you're in it for the long haul or looking for quick gains. Long-term investors focus on building wealth over time, while short-term investors aim to capitalize on market fluctuations.

Both approaches have their pros and cons, and the choice ultimately depends on your financial goals and risk tolerance. If you're just starting out, it might be wise to focus on long-term investments, as they tend to be less volatile and offer more stable returns.

Global Economic Impact

While the stock market rally is exciting, it's important to consider the broader economic impact. Lower interest rates can stimulate economic growth, but they can also lead to inflation if not managed properly. This is why the Fed's decisions are so crucial—they have to strike a balance between fostering growth and maintaining stability.

Globally, the impact of the Fed's rate decision can be felt in various markets. For example, emerging markets might benefit from lower borrowing costs, while developed markets could see increased investment. It's a complex web, but understanding these dynamics can help you make better investment decisions.

How Inflation Affects the Stock Market

Inflation is a double-edged sword. On one hand, it can erode the purchasing power of consumers, which can negatively impact companies' profits. On the other hand, moderate inflation can be a sign of a healthy economy, as it indicates increasing demand for goods and services.

Investors need to be aware of inflationary pressures and how they might affect their portfolios. For example, companies that can pass on higher costs to consumers are likely to perform better in an inflationary environment.

Challenges and Risks

Of course, no market rally is without its challenges and risks. While the current rally is driven by positive sentiment, there are always potential pitfalls to watch out for. For example, geopolitical tensions, unexpected economic data, or even a sudden shift in investor sentiment could derail the rally.

Additionally, overvalued stocks can be a concern. If investors start to believe that certain stocks are too expensive, they might start selling, which could lead to a market correction. It's important to stay informed and be prepared for any potential setbacks.

Managing Risk in Your Portfolio

Here are a few tips for managing risk in your portfolio:

- Regularly review your investments to ensure they align with your goals.

- Consider using stop-loss orders to limit potential losses.

- Stay informed about market trends and economic developments.

By taking a proactive approach to risk management, you can protect your investments and achieve long-term success.

Conclusion: What's Next for the Stock Market?

As we wrap up, it's clear that today's stock market rally, led by the Nasdaq, is a reflection of positive sentiment and optimism about the future. The Fed's rate decision has played a crucial role in fueling this rally, and investors are reaping the benefits.

But remember, the stock market is unpredictable, and what goes up can also come down. It's important to stay informed, manage risk, and have a solid investment strategy in place. Whether you're a seasoned investor or just starting out, the key is to focus on your long-term goals and make decisions that align with your financial objectives.

So, what’s next? Well, only time will tell. But one thing is for sure—the stock market is always full of surprises, and staying informed is your best bet for success. Don't forget to share your thoughts in the comments below, and be sure to check out our other articles for more insights into the world of finance.

Table of Contents

- Understanding the Stock Market Today

- Why the Fed's Rate Decision Matters

- Nasdaq: The Star of the Show

- Key Players in the Nasdaq Rally

- How the Market Rally Affects Investors

- Investment Strategies to Consider

- Market Trends and Predictions

- Long-Term vs. Short-Term Investing

- Global Economic Impact

- How Inflation Affects the Stock Market

- Challenges and Risks

- Managing Risk in Your Portfolio