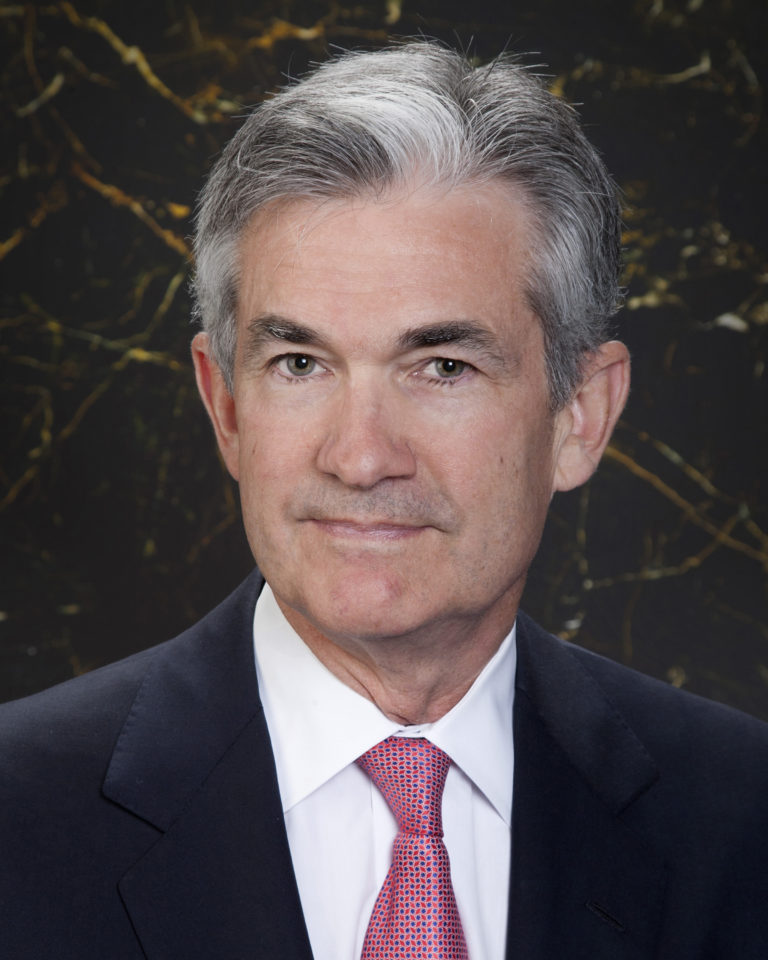

Jerome Powell, the name that sends ripples through global financial markets. Whether you're an investor, economist, or just someone curious about how the economy works, Powell's decisions matter. As the Chair of the Federal Reserve, he's like the captain of a massive ship navigating rough waters. In this article, we'll dive deep into his background, leadership style, and the impact he's had on the U.S. economy. So buckle up, because we're about to explore the world of Jerome Powell!

Now, you might be wondering why Jerome Powell is such a big deal. Well, imagine the Federal Reserve as the central control room for America's financial system. Powell's job is to make sure the economy runs smoothly, keeping inflation in check while promoting employment. It's not an easy task, but he's been at the helm since 2018, shaping policies that affect everyone from Wall Street tycoons to Main Street workers.

But before we jump into the nitty-gritty of his policies, let's take a moment to understand the man behind the title. Jerome Powell isn't just a face on the news; he's a complex individual with a rich background that has prepared him for one of the most challenging roles in economics. So, let's dive in and see what makes him tick.

Read also:Sec Ripple The Epic Battle That Could Reshape Crypto Forever

Biography of Jerome Powell

Before we get into the meat of his career, let's talk about Jerome Powell's early life. Born on February 4, 1953, in Washington, D.C., Powell grew up in a middle-class family. His father, Jerome Powell Sr., was a lawyer, and his mother, Venida Powell, was a teacher. This environment shaped his values and work ethic from a young age.

Education played a crucial role in Powell's life. He attended Princeton University, where he earned a Bachelor of Arts in Politics in 1975. But that wasn't the end of his academic journey. Powell went on to attend Georgetown University Law Center, where he obtained his Juris Doctor in 1979. These educational foundations laid the groundwork for his future success.

Early Career and Key Milestones

Powell's career didn't start in economics. After law school, he practiced law for a few years before transitioning into the world of finance. In 1984, he joined the investment bank Dillon, Read & Co., where he worked as a corporate lawyer and later became a partner. This experience gave him a deep understanding of financial markets, which would prove invaluable later in his career.

In 1990, Powell took a significant turn when he joined the U.S. Treasury Department under President George H.W. Bush. He served as Under Secretary for Domestic Finance, where he played a key role in shaping financial policies. This stint in government provided him with the experience he needed to understand the intersection of politics and finance.

Jerome Powell's Role at the Federal Reserve

So, what exactly does Jerome Powell do at the Federal Reserve? As the Chair, he's responsible for leading the central bank's efforts to maintain economic stability. This involves setting monetary policy, regulating banks, and ensuring the financial system operates efficiently. Think of him as the conductor of a symphony orchestra, making sure all the instruments play in harmony.

The Federal Reserve: A Quick Overview

The Federal Reserve, often referred to as the Fed, is the central banking system of the United States. Its primary goals are to promote maximum employment, stable prices, and moderate long-term interest rates. Powell, along with the Federal Open Market Committee (FOMC), decides on key interest rates and other monetary policies that influence the economy.

Read also:Alan Jackson Getting Emotional During One Of His Last Performances Ever Has Me Ldquobawling My Eyes Outrdquo

Key Policies Under Jerome Powell

Since taking office in 2018, Powell has implemented several key policies that have shaped the U.S. economy. One of the most notable is his approach to interest rates. Unlike his predecessors, who often raised rates aggressively, Powell has taken a more measured approach, adjusting rates based on economic conditions.

Interest Rate Adjustments

- In 2019, Powell cut interest rates three times in response to global economic uncertainties.

- During the pandemic, he slashed rates to near zero to stimulate the economy.

- As the economy recovered, he gradually raised rates to combat inflation.

These decisions weren't made lightly. Powell had to balance the need for economic growth with the risk of inflation spiraling out of control. It's a delicate dance that requires constant monitoring and adjustment.

Jerome Powell's Leadership Style

When it comes to leadership, Jerome Powell is often described as calm and steady. Unlike some of his predecessors, who were known for their fiery speeches, Powell prefers a more measured approach. He's a listener, someone who takes the time to understand different perspectives before making a decision.

Communication and Transparency

One of Powell's strengths is his ability to communicate complex economic concepts in a way that's easy to understand. He holds regular press conferences, where he explains the Fed's decisions and their impact on the economy. This transparency helps build trust with the public and financial markets.

Challenges Faced by Jerome Powell

No one said being the Fed Chair would be easy, and Powell has faced his fair share of challenges. From navigating the economic fallout of the pandemic to dealing with rising inflation, his tenure has been anything but smooth sailing.

The Pandemic's Economic Impact

When the pandemic hit in early 2020, it sent shockwaves through the global economy. Powell responded by implementing unprecedented measures, including cutting interest rates to near zero and launching massive bond-buying programs. These actions helped stabilize the financial system and prevent a deeper economic downturn.

Inflation and Its Implications

One of the biggest challenges Powell has faced is inflation. After years of low inflation, prices started to rise sharply in 2021. Powell initially described this as "transitory," meaning it would be temporary. However, as inflation persisted, he had to reassess his strategy and take more aggressive action to bring it under control.

How Inflation Affects You

Inflation impacts everyone, from the cost of groceries to the price of housing. Powell's job is to ensure that inflation remains stable, so the economy can grow without overheating. This requires a delicate balancing act, and his decisions have far-reaching consequences for both businesses and consumers.

Jerome Powell's Legacy

As Powell's tenure at the Fed continues, his legacy is already taking shape. He's been credited with guiding the U.S. economy through one of its most challenging periods in recent history. But his impact goes beyond just numbers and statistics. Powell has reshaped how the Fed communicates with the public, making it more transparent and accessible.

Looking to the Future

What does the future hold for Jerome Powell and the Fed? With inflation still a concern and the global economy facing uncertainty, there's no doubt that challenges lie ahead. However, Powell's leadership and experience make him well-equipped to navigate these waters. Whether he'll be reappointed to another term remains to be seen, but his influence on monetary policy will be felt for years to come.

Data and Statistics

Let's take a look at some key data points that highlight Powell's impact on the economy:

- Unemployment Rate: Dropped from 14.8% in April 2020 to 3.5% in 2023.

- Inflation Rate: Rose to 9.1% in June 2022 but has since declined to around 3%.

- Federal Funds Rate: Cut to near zero in 2020 and gradually raised to over 5% in 2023.

These numbers tell a story of resilience and adaptability, showcasing Powell's ability to steer the economy through turbulent times.

Conclusion

In conclusion, Jerome Powell has been a pivotal figure in shaping the U.S. economy over the past few years. From his early days as a corporate lawyer to his current role as Fed Chair, he's demonstrated a commitment to stability and transparency. His leadership during the pandemic and his efforts to combat inflation have left a lasting impact on both the financial markets and everyday Americans.

So, what can you do next? If you found this article helpful, why not share it with your friends and family? And if you're hungry for more insights into economics and finance, be sure to check out our other articles. After all, staying informed is the key to making smart financial decisions!

Table of Contents

- Biography of Jerome Powell

- Early Career and Key Milestones

- Jerome Powell's Role at the Federal Reserve

- The Federal Reserve: A Quick Overview

- Key Policies Under Jerome Powell

- Interest Rate Adjustments

- Jerome Powell's Leadership Style

- Communication and Transparency

- Challenges Faced by Jerome Powell

- The Pandemic's Economic Impact

- Inflation and Its Implications

- Jerome Powell's Legacy

- Looking to the Future

- Data and Statistics