Ever wondered how much Tesla stock is worth today? If you're one of the millions of people who’ve been keeping an eye on this electric car powerhouse, then you're in the right place. Tesla has become more than just a car company—it's a symbol of innovation, sustainability, and financial potential. Whether you're an investor, a tech enthusiast, or simply curious about the electric vehicle (EV) revolution, understanding Tesla stock is key to unlocking the bigger picture of the global economy. So, let’s dive in and explore what makes Tesla stock so fascinating.

Let’s be real here—Tesla isn’t your average company. It’s a game-changer. With Elon Musk at the helm, Tesla has disrupted industries, pushed boundaries, and set new standards for what’s possible in the automotive world. But when it comes to its stock, things get even more interesting. How much is Tesla stock worth right now? That’s the million-dollar question everyone’s asking.

In this article, we’ll break it all down for you. From the current price of Tesla stock to the factors influencing its value, we’ll give you the lowdown on why Tesla continues to dominate the market. So, whether you’re looking to invest or just want to stay informed, buckle up because we’re about to take a deep dive into the world of Tesla stock.

Read also:Why The Google Pixel 9a Is A Gamechanger For Tech Enthusiasts

Table of Contents

- What is the Current Price of Tesla Stock?

- A Brief History of Tesla Stock

- Factors Affecting Tesla Stock Price

- Tesla Stock Market Performance

- Insights for Investors

- Future Potential of Tesla Stock

- Long-Term Growth Prospects

- Risks Associated with Tesla Stock

- Tesla Stock vs. Other EV Stocks

- Conclusion: Should You Invest in Tesla Stock?

What is the Current Price of Tesla Stock?

Alright, let’s get straight to the point. If you’re asking, “How much is Tesla stock right now?” the answer depends on the moment you’re reading this. As of the latest data, Tesla’s stock price has been hovering around $250 to $300 per share, but keep in mind that these numbers can fluctuate rapidly based on market conditions. To give you a clearer picture, let’s break it down:

- Opening Price: The stock usually starts the day within a predictable range, but don’t be surprised if it spikes or drops based on news or announcements.

- Intraday Movements: Tesla stock is known for its volatility, meaning it can swing up or down significantly during a single trading session.

- Closing Price: This is the final price at which the stock trades at the end of the day, and it’s often the number investors focus on.

But hey, don’t just rely on today’s numbers. To truly understand Tesla stock, you need to look at the bigger picture. That’s where history comes in.

A Brief History of Tesla Stock

Let’s take a trip down memory lane. Tesla went public in 2010, and its stock has been on a wild ride ever since. Here’s a quick rundown of the major milestones:

- Initial Public Offering (IPO): Tesla’s stock debuted at $17 per share in June 2010. Fast forward to today, and that’s a staggering return on investment!

- First Profitable Quarter: In 2013, Tesla reported its first profitable quarter, sending its stock price soaring.

- Stock Splits: Tesla has undergone multiple stock splits, most recently in 2020, making shares more accessible to individual investors.

These events have shaped Tesla’s journey as a publicly traded company. But what drives its stock price? Let’s find out.

Factors Affecting Tesla Stock Price

Global Demand for Electric Vehicles

One of the biggest factors influencing Tesla stock is the global shift toward electric vehicles. With governments worldwide pushing for greener solutions, Tesla is perfectly positioned to capitalize on this trend.

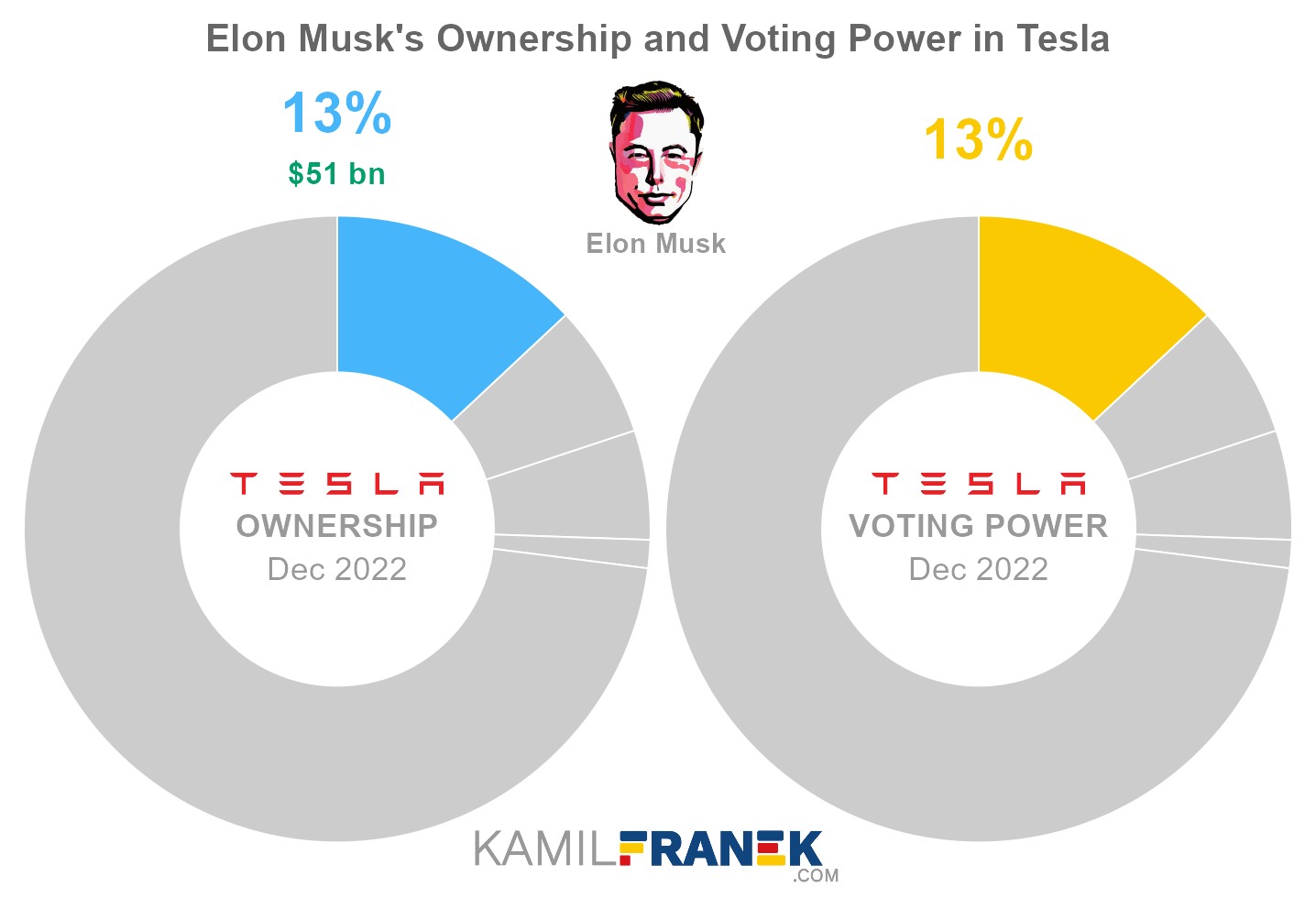

Elon Musk’s Influence

Love him or hate him, Elon Musk’s words and actions have a massive impact on Tesla stock. From Twitter announcements to product launches, anything he says can send the stock price skyrocketing—or plummeting.

Read also:Tornado Warning Illinois What You Need To Know And How To Stay Safe

Financial Performance

At the end of the day, Tesla’s financials matter. Quarterly earnings reports, revenue growth, and profitability all play a role in determining the stock’s value. If Tesla continues to deliver strong results, its stock is likely to keep climbing.

Tesla Stock Market Performance

So, how has Tesla stock performed over the years? The short answer? Pretty darn well. Since its IPO, Tesla’s stock has seen exponential growth, outpacing many traditional automakers. But it’s not just about the numbers. Tesla’s market performance is a reflection of its innovation, leadership, and vision for the future.

Here are some key stats:

- 5-Year Growth: Tesla stock has grown by over 1,000% in the past five years.

- Market Cap: Tesla is now one of the most valuable companies in the world, with a market cap exceeding $700 billion at its peak.

- Investor Sentiment: Despite occasional volatility, investor confidence in Tesla remains strong.

But what does this mean for you as an investor? Let’s explore further.

Insights for Investors

If you’re thinking about investing in Tesla stock, here are a few things to consider:

- Long-Term Potential: Tesla’s focus on sustainability and cutting-edge technology makes it a solid choice for long-term investors.

- Short-Term Risks: Be prepared for fluctuations. Tesla stock can be volatile, so don’t invest money you can’t afford to lose.

- Dividend Policy: Tesla doesn’t pay dividends, so you’ll need to rely on capital gains for returns.

Remember, investing is all about balancing risk and reward. Tesla stock offers plenty of both.

Future Potential of Tesla Stock

Innovation Pipeline

Tesla isn’t resting on its laurels. With projects like the Cybertruck, the Tesla Bot, and advancements in battery technology, the company is constantly pushing the envelope. These innovations could drive future growth and increase the stock’s value.

Global Expansion

Tesla’s expansion into new markets, such as China and Europe, is another factor to watch. As the company increases its production capacity and enters new regions, its stock could benefit from increased sales and revenue.

Long-Term Growth Prospects

Looking ahead, Tesla’s long-term growth prospects are bright. The company is well-positioned to capitalize on the global shift toward renewable energy and sustainable transportation. Whether it’s through electric vehicles, solar energy, or energy storage solutions, Tesla has a diverse portfolio that sets it apart from competitors.

But as with any investment, there are risks to consider.

Risks Associated with Tesla Stock

While Tesla stock has plenty of upside, it’s not without its challenges. Here are some risks to be aware of:

- Competition: Traditional automakers and new entrants are ramping up their EV offerings, which could impact Tesla’s market share.

- Regulatory Changes: Government policies on emissions and subsidies can affect Tesla’s profitability.

- Supply Chain Issues: Disruptions in the supply chain, particularly for key components like lithium and cobalt, could impact production.

Despite these risks, many investors believe Tesla’s leadership and innovation will help it overcome these challenges.

Tesla Stock vs. Other EV Stocks

How does Tesla stack up against its competitors? Let’s compare Tesla stock with other EV stocks:

- Nikola: While Nikola focuses on hydrogen fuel cell technology, Tesla’s electric vehicles have a more established market presence.

- Rivian: Rivian is gaining traction, but Tesla’s first-mover advantage gives it an edge.

- NIO: NIO’s success in China is impressive, but Tesla’s global reach gives it a broader appeal.

Each company has its strengths, but Tesla’s dominance in the EV space is hard to ignore.

Conclusion: Should You Invest in Tesla Stock?

Wrapping it up, Tesla stock is a fascinating investment opportunity. With its innovative products, global reach, and strong financial performance, Tesla has proven itself as a leader in the EV industry. But like any investment, it comes with risks.

If you’re considering Tesla stock, here’s what you should do:

- Do your research and stay informed about market trends.

- Consider your risk tolerance and investment goals.

- Don’t put all your eggs in one basket—diversify your portfolio.

So, how much is Tesla stock worth? That depends on your perspective. For some, it’s a chance to be part of a revolutionary company. For others, it’s a financial opportunity with immense potential. Whatever your reason, Tesla stock is definitely worth exploring.

Got thoughts or questions? Drop a comment below and let’s chat. And don’t forget to share this article with your friends who might be interested in Tesla stock. Together, let’s keep the conversation going!