When it comes to the world of finance and economics, the FOMC is more than just a term—it's a game-changer. Imagine a group of people sitting in a room, making decisions that ripple through markets worldwide. That's the Federal Open Market Committee, or FOMC for short. Their moves? Big. Their impact? Bigger. If you're into understanding what makes the global economy tick, this is where it all starts. So buckle up, because we're diving deep into the heart of economic decision-making.

Now, let's break it down. The FOMC isn't just some random committee. It's the brains behind the Federal Reserve's monetary policy, and its decisions can send shockwaves through markets. If you're an investor, a business owner, or just someone curious about how the economy works, you need to know what this group does. It's like the steering wheel of the economic ship, and today, we're going to explore what makes it so crucial.

Here's the thing: the FOMC doesn't operate in a vacuum. It takes into account a ton of factors—everything from inflation rates to employment numbers. And guess what? Those decisions affect everything from mortgage rates to the value of your stock portfolio. So, if you're looking to stay ahead of the curve, understanding the FOMC is not just smart—it's essential.

Read also:Good American Family Mark Duplass Was Skeptical About Natalia Grace Drama

What Exactly is the FOMC?

Let's start with the basics. The FOMC, or Federal Open Market Committee, is essentially the decision-making arm of the Federal Reserve System. Think of it as the group that calls the shots when it comes to monetary policy. But here's the kicker—it's not just about setting interest rates. Oh no, it's way more complex than that. The FOMC plays a pivotal role in managing the country's money supply and influencing economic growth.

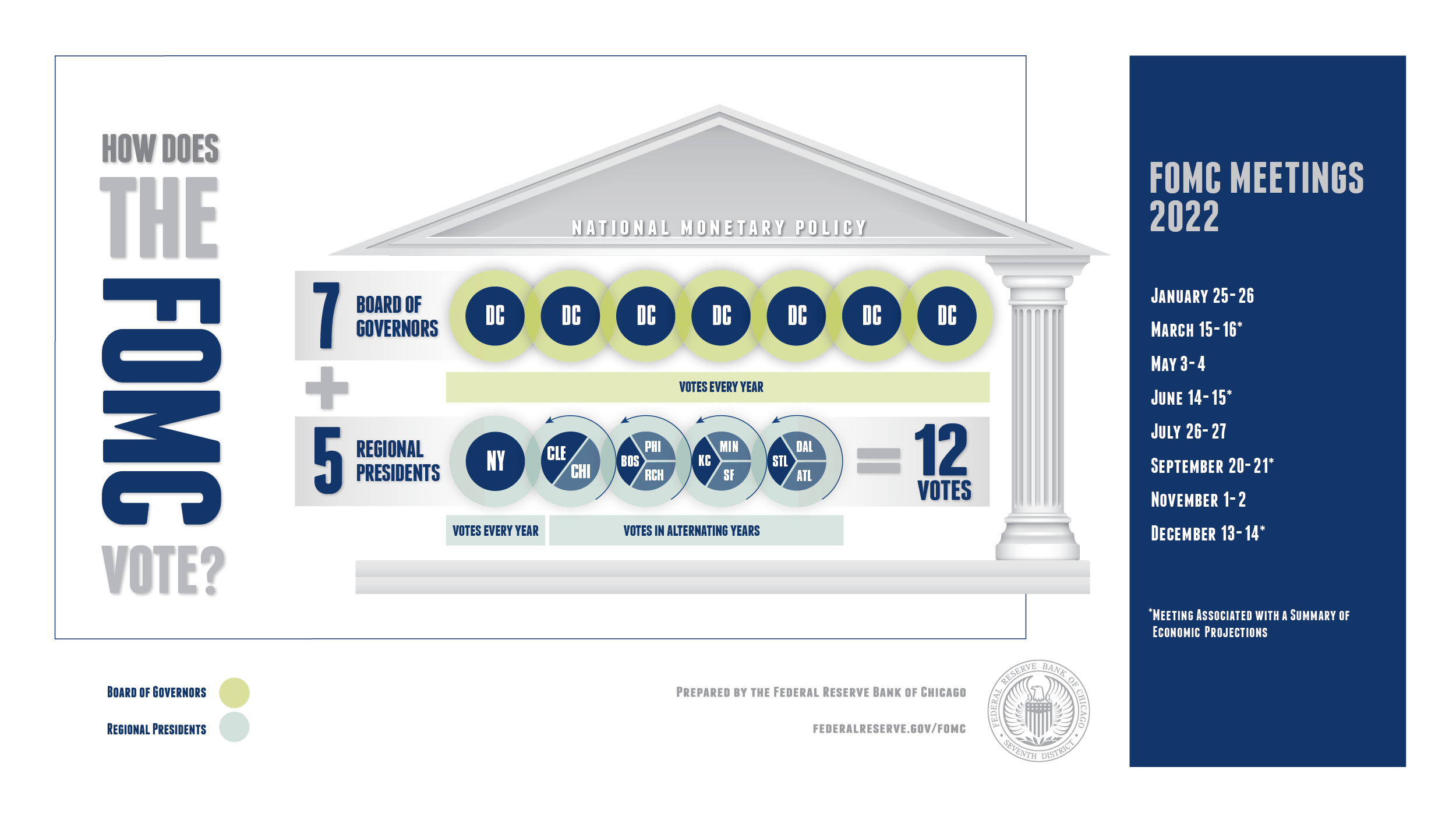

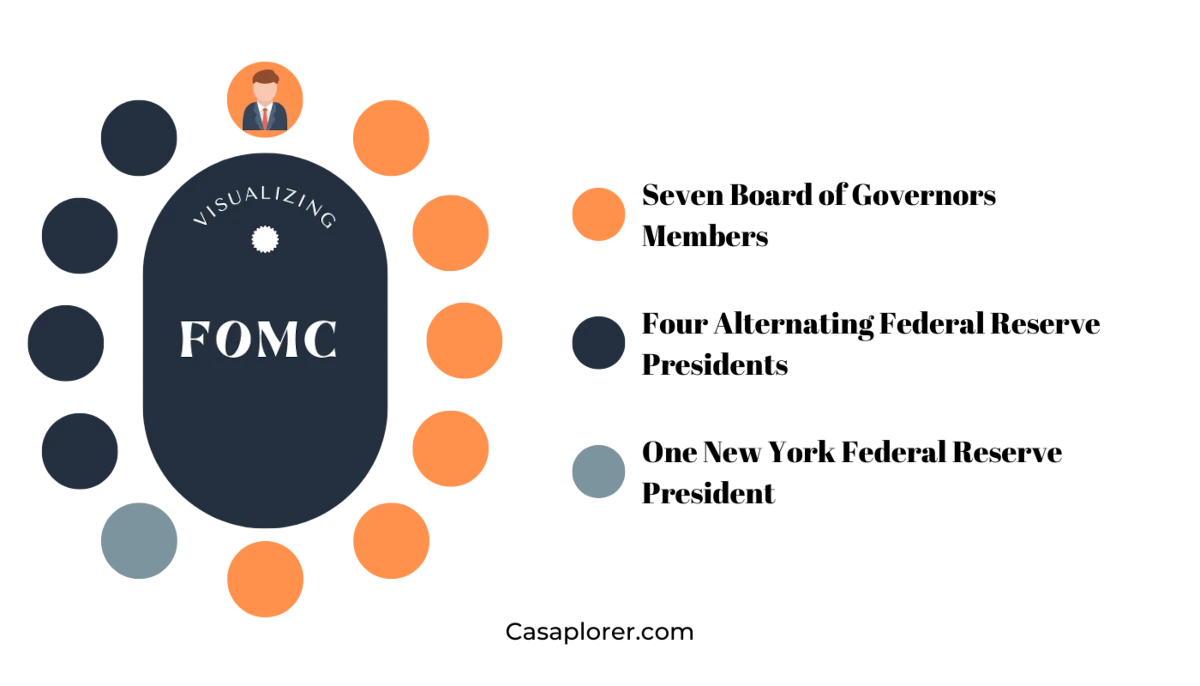

Structure and Membership

The FOMC is made up of 12 members—seven members of the Board of Governors of the Federal Reserve System and five Federal Reserve Bank presidents. But it's not just about numbers. Each member brings a unique perspective to the table, and their collective expertise shapes the decisions that affect us all. And let's not forget, these aren't just any individuals—they're top economists, financial experts, and policymakers who know the ins and outs of the economy better than most.

How the FOMC Influences the Economy

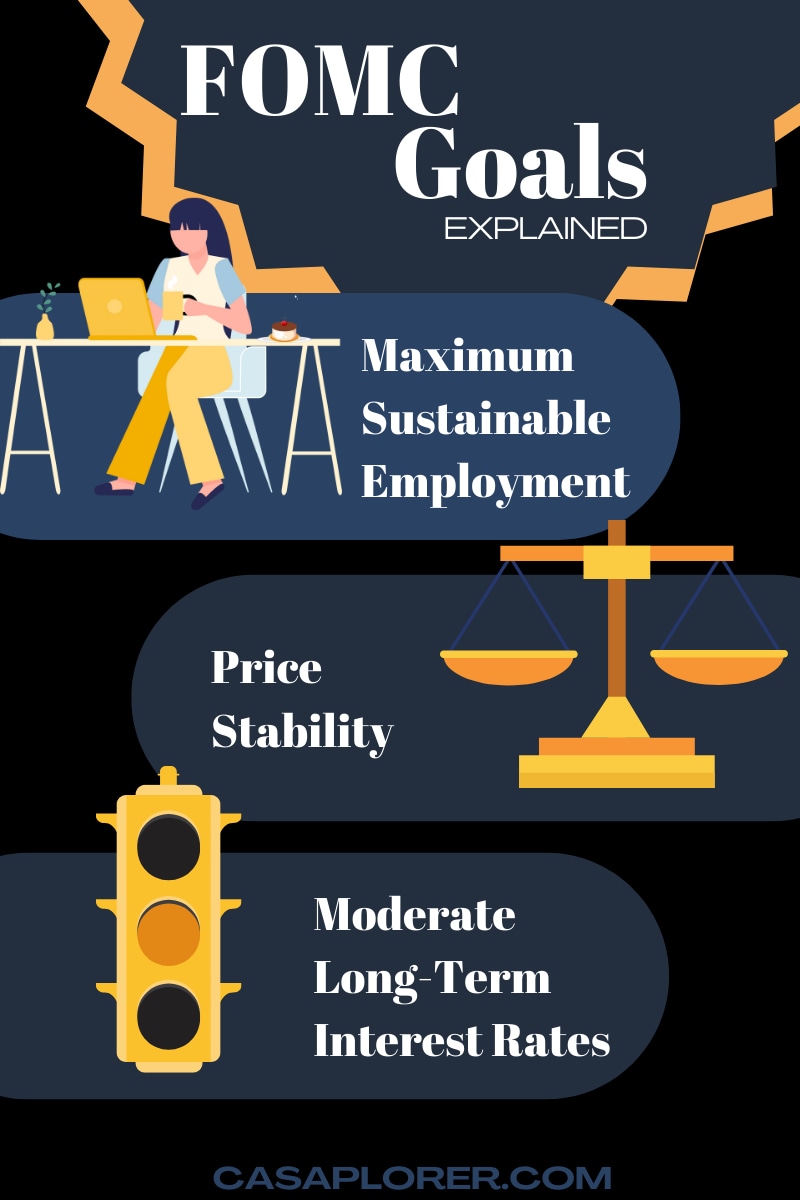

Now, let's talk about how the FOMC wields its power. Through its meetings and decisions, the FOMC influences everything from inflation to employment rates. But how exactly does it do that? The answer lies in its tools—open market operations, setting the federal funds rate, and adjusting reserve requirements. These might sound like fancy terms, but they're the levers that control the economic engine.

The Federal Funds Rate: A Key Tool

One of the most powerful tools in the FOMC's arsenal is the federal funds rate. This is the interest rate at which banks lend reserve balances to other banks overnight. Why does this matter? Because it affects everything from consumer loans to business investments. When the FOMC lowers the rate, borrowing becomes cheaper, which can stimulate economic growth. Conversely, when it raises the rate, it can help control inflation. It's a delicate balance, and the FOMC has to get it just right.

Understanding FOMC Meetings

Alright, so we know the FOMC makes important decisions, but how does it actually do that? The answer lies in its meetings. The committee holds eight scheduled meetings each year, where members discuss economic conditions and make decisions on monetary policy. But these aren't just your average meetings—they're intense, data-driven discussions that can last for hours.

What Happens During FOMC Meetings?

During these meetings, members review a ton of economic data, from GDP growth to unemployment rates. They also listen to presentations from experts and engage in deep discussions about the state of the economy. And when the dust settles, they vote on key policy decisions. But here's the thing—these meetings aren't just about making decisions. They're also about setting expectations for the future, which can have a huge impact on market sentiment.

Read also:Min Vs Nop The Ultimate Showdown You Didnrsquot Know You Needed

The Impact of FOMC Decisions on Markets

Now, let's talk about the real-world impact of FOMC decisions. When the committee makes a move, markets react—sometimes dramatically. Investors, businesses, and even consumers all pay close attention to what the FOMC says and does. Why? Because its decisions can affect everything from stock prices to mortgage rates. And in today's interconnected world, those effects can be felt far beyond the borders of the United States.

How Investors React to FOMC Announcements

Investors, in particular, are highly sensitive to FOMC announcements. A hint of a rate hike can send stock markets tumbling, while a signal of lower rates can spark a rally. But it's not just about immediate reactions. The FOMC's decisions can have long-term implications for investment strategies, portfolio allocations, and risk management. So, if you're in the investing game, keeping an eye on the FOMC is crucial.

Key Economic Indicators the FOMC Watches

So, what exactly does the FOMC look at when making its decisions? It's all about the data. The committee keeps a close eye on a range of economic indicators, including inflation rates, employment numbers, GDP growth, and consumer spending. But why these indicators? Because they provide a snapshot of the economy's health and help the FOMC gauge whether it's on the right track.

Why Inflation Matters to the FOMC

Inflation is one of the most critical indicators the FOMC monitors. Why? Because it affects the purchasing power of consumers and the overall stability of the economy. If inflation gets too high, the FOMC might raise interest rates to cool things down. On the flip side, if inflation is too low, it might lower rates to stimulate growth. It's all about finding that sweet spot where the economy can thrive without overheating.

The Role of the FOMC in Global Markets

Here's the thing—the FOMC doesn't just affect the U.S. economy. Its decisions have far-reaching implications for global markets. When the FOMC raises or lowers interest rates, it can impact currency values, trade balances, and capital flows worldwide. And in today's interconnected world, that means businesses and investors everywhere need to pay attention.

How Global Markets Respond to FOMC Moves

When the FOMC makes a move, global markets often respond swiftly. Currencies can strengthen or weaken, bond yields can rise or fall, and stock markets can experience significant fluctuations. But it's not just about immediate reactions. The FOMC's decisions can shape the global economic landscape for years to come, influencing everything from trade policies to investment strategies.

Historical Decisions by the FOMC

Let's take a trip down memory lane and look at some of the FOMC's most significant decisions. From navigating the Great Recession to managing the economic fallout of the pandemic, the FOMC has been at the forefront of some of the most challenging economic periods in recent history. And each decision has had lasting effects on the economy and markets.

Lessons Learned from Past FOMC Actions

Looking back at past FOMC actions, we can see valuable lessons about the importance of data-driven decision-making and the need for flexibility in the face of changing economic conditions. Whether it's adjusting interest rates during a crisis or implementing quantitative easing to stimulate growth, the FOMC's actions have shown us that monetary policy is a powerful tool—but one that must be wielded carefully.

The Future of the FOMC

So, what does the future hold for the FOMC? As the global economy continues to evolve, the committee will face new challenges and opportunities. From navigating the rise of digital currencies to addressing climate change, the FOMC will need to adapt and innovate to stay ahead of the curve. And with the ever-increasing complexity of the global economy, its role will only become more important.

Preparing for the Challenges Ahead

To prepare for the challenges ahead, the FOMC will need to continue leveraging data, expertise, and collaboration. It will also need to stay attuned to the needs of businesses, consumers, and investors, ensuring that its decisions support a stable and prosperous economy. And as technology continues to reshape the financial landscape, the FOMC will need to embrace innovation to remain effective.

Conclusion

In conclusion, the FOMC is a crucial player in shaping the global economy. Its decisions influence everything from interest rates to market sentiment, making it a must-know for anyone interested in finance and economics. By understanding its role, structure, and decision-making processes, we can better navigate the complexities of the modern economy.

So, what's next? If you've found this article informative, why not share it with your friends and colleagues? And if you're hungry for more insights into the world of finance and economics, be sure to check out our other articles. Together, let's stay ahead of the curve and make informed decisions for a brighter financial future.

Table of Contents

- Introduction to FOMC

- What Exactly is the FOMC?

- Structure and Membership

- How the FOMC Influences the Economy

- The Federal Funds Rate: A Key Tool

- Understanding FOMC Meetings

- What Happens During FOMC Meetings?

- The Impact of FOMC Decisions on Markets

- How Investors React to FOMC Announcements

- Key Economic Indicators the FOMC Watches

- Why Inflation Matters to the FOMC

- The Role of the FOMC in Global Markets

- How Global Markets Respond to FOMC Moves

- Historical Decisions by the FOMC

- Lessons Learned from Past FOMC Actions

- The Future of the FOMC

- Preparing for the Challenges Ahead