Hey there, finance enthusiasts! Let’s talk about something that shapes the global economy in ways you might not even realize. **FOMC meeting** is more than just a term thrown around in financial news—it’s a game-changer for investors, businesses, and everyday folks like you and me. Whether you’re a seasoned trader or just starting to dip your toes into the world of finance, understanding what happens during these meetings is crucial. So buckle up, because we’re about to break it down in a way that’s both simple and engaging.

Think of the FOMC meeting as the backstage pass to the Federal Reserve’s decision-making process. It’s where the bigwigs gather to decide on monetary policy, interest rates, and other critical factors that affect the economy. But why should you care? Well, because these decisions can impact everything from your mortgage payments to the stock market’s performance. And trust me, when the Fed sneezes, the global economy catches a cold.

Now, before we dive deeper, let’s set the stage. The Federal Open Market Committee (FOMC) is like the brain trust of the Federal Reserve. They meet eight times a year, and each meeting is a potential turning point for economic trends. So, if you’re looking to stay ahead of the curve, this guide is your golden ticket to understanding the ins and outs of FOMC meetings. Let’s get to it!

Read also:Erdogan The Man Who Shaped Modern Turkey And Captured Global Attention

What Exactly Is the FOMC Meeting?

Alright, let’s start with the basics. The FOMC meeting is essentially a gathering of the Federal Reserve’s decision-makers. These guys and gals are responsible for setting monetary policy, which is basically the blueprint for how the U.S. economy should run. They discuss things like interest rates, inflation targets, and economic growth strategies. But what makes these meetings so important?

Well, the decisions made during FOMC meetings can have ripple effects across the globe. For example, if the Fed decides to raise interest rates, it can lead to higher borrowing costs for businesses and consumers. On the flip side, lowering interest rates can stimulate economic growth by making loans more affordable. It’s like a giant economic seesaw, and the FOMC is the one holding the balance.

Who’s Involved in the FOMC Meeting?

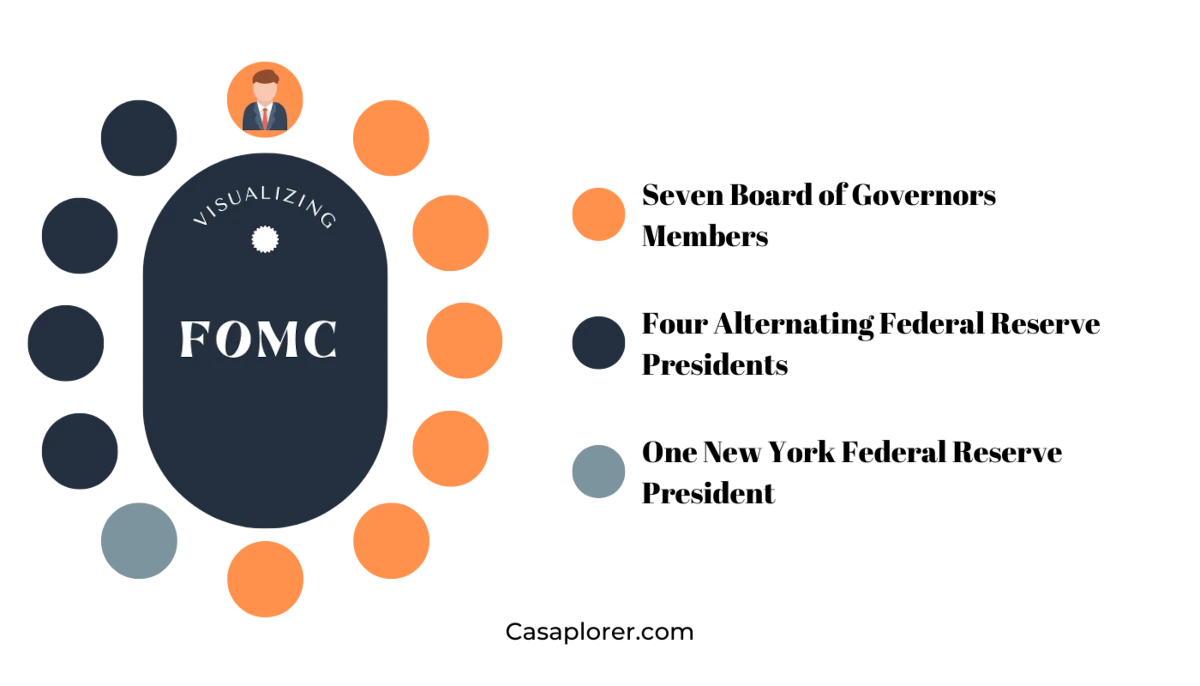

The FOMC isn’t just a random group of people. It’s made up of 12 members, including the seven members of the Board of Governors of the Federal Reserve System and five Federal Reserve Bank presidents. These folks are the cream of the crop in the financial world, and their decisions carry a lot of weight. Here’s a quick breakdown of who’s who:

- Board of Governors: The seven members are appointed by the President and confirmed by the Senate. They serve as the Fed’s primary policymakers.

- Federal Reserve Bank Presidents: Out of the 12 regional Federal Reserve Bank presidents, only five have voting rights at any given time. These guys rotate in and out, ensuring a diverse perspective on economic issues.

So, when you hear about the FOMC meeting, you’re hearing about a group of experts coming together to make decisions that affect millions of people. It’s like a financial summit, but with way more numbers and graphs.

Why Should You Care About FOMC Meetings?

Let me ask you this: Do you have a mortgage? A car loan? A retirement fund? If you answered yes to any of those, then you should definitely care about FOMC meetings. Why? Because the decisions made during these meetings can directly impact your wallet.

For instance, if the Fed raises interest rates, your mortgage payments might go up. If they lower rates, borrowing money becomes cheaper, which can be a boon for businesses looking to expand. And let’s not forget the stock market—investors hang on every word from the FOMC, because even the slightest hint of a policy change can send markets soaring or tumbling.

Read also:Princeton Vs Iowa State A Deep Dive Into Two Titans Of Academia And Sports

Impact on the Stock Market

The stock market is like a giant mood ring, and the FOMC is the temperature gauge. When the Fed announces a rate cut, it’s often seen as a positive sign for the economy, which can lead to a surge in stock prices. Conversely, a rate hike might spook investors, causing a dip in the markets. It’s all about perception and anticipation.

But here’s the kicker: The FOMC doesn’t just announce rate changes outright. They release statements filled with economic jargon and subtle hints about future policy moves. That’s why analysts and economists spend hours dissecting every word, looking for clues about what’s coming next. It’s like a treasure hunt for financial geeks.

How Does the FOMC Meeting Work?

Now that you know why FOMC meetings matter, let’s talk about how they actually work. These meetings typically last for two days, and they’re packed with discussions, debates, and data analysis. Here’s a quick rundown of the process:

- Pre-Meeting Prep: Before the meeting, FOMC members review economic data, forecasts, and research papers. They also consult with outside experts to get a well-rounded view of the economy.

- Day One: The first day is all about presentations. Members hear from economists and other experts about the current state of the economy. They also discuss any potential risks or opportunities on the horizon.

- Day Two: On the second day, the real decision-making happens. Members vote on monetary policy decisions, including interest rate changes. After the meeting, they release a statement summarizing their decisions and rationale.

It’s a pretty intense process, but it’s all done with one goal in mind: to promote economic stability and growth. And while the meetings themselves are closed to the public, the Fed does provide transcripts and minutes a few weeks later, giving everyone a peek behind the curtain.

Key Decisions Made During FOMC Meetings

So, what exactly do the FOMC members decide during these meetings? Here are some of the key decisions that can have a major impact on the economy:

Interest Rate Changes

Interest rates are probably the most talked-about aspect of FOMC meetings. The Fed uses interest rates as a tool to control inflation and stimulate economic growth. If inflation is too high, they might raise rates to cool things down. If the economy is sluggish, they might lower rates to encourage spending and investment.

Quantitative Easing (QE)

Quantitative easing is another big decision that can come out of FOMC meetings. This is when the Fed buys government bonds and other financial assets to inject money into the economy. It’s like giving the economy a shot of adrenaline, but it’s not something they do lightly.

Economic Forecasts

During the meetings, FOMC members also discuss and update their economic forecasts. These forecasts cover everything from GDP growth to unemployment rates. They use this information to guide their policy decisions and provide insights to the public.

Understanding FOMC Statements

After each FOMC meeting, the Fed releases a statement that summarizes their decisions and provides some context. But let’s be real—these statements can be a bit… dense. They’re filled with economic jargon and technical terms that might leave you scratching your head. So, how do you make sense of them?

Here are a few tips:

- Look for Key Words: Pay attention to words like “hawkish” (favoring higher interest rates) or “dovish” (favoring lower rates). These terms can give you a quick clue about the Fed’s stance.

- Focus on the Numbers: The statement often includes specific numbers, like the target range for interest rates or inflation forecasts. These numbers are crucial for understanding the Fed’s plans.

- Read Between the Lines: Sometimes, the Fed’s language is intentionally vague. They might use phrases like “data-dependent” or “monitoring developments,” which means they’re not ready to commit to a specific policy path just yet.

By breaking down the statement in this way, you can get a clearer picture of what the Fed is thinking and how it might affect the economy.

Common Misconceptions About FOMC Meetings

There are a lot of myths and misconceptions floating around about FOMC meetings. Let’s bust a few of them, shall we?

Myth 1: The Fed Controls the Stock Market

While the Fed’s decisions can influence the stock market, they don’t control it. The market is driven by a wide range of factors, including company earnings, geopolitical events, and investor sentiment. The Fed is just one piece of the puzzle.

Myth 2: FOMC Meetings Are Always About Interest Rates

Interest rates get a lot of attention, but they’re not the only thing discussed during FOMC meetings. The committee also talks about things like inflation, unemployment, and financial stability. These discussions can be just as important, even if they don’t make the headlines.

Myth 3: The Fed Always Acts Predictably

Sorry to break it to you, but the Fed doesn’t always play by the rules. Sometimes, they surprise everyone with unexpected decisions. That’s why it’s important to stay informed and keep an eye on their statements and minutes.

Preparing for FOMC Meetings as an Investor

If you’re an investor, FOMC meetings should be on your radar. Here’s how you can prepare:

- Stay Informed: Follow financial news and analysis leading up to the meetings. This will give you a better understanding of what to expect.

- Review Your Portfolio: Take a look at your investments and consider how they might be affected by potential policy changes.

- Be Ready to Act: Market movements can happen quickly after an FOMC announcement. Have a plan in place so you can make informed decisions if needed.

Remember, the key to successful investing is staying informed and adaptable. FOMC meetings are just one of many factors to consider, but they’re definitely worth paying attention to.

Conclusion: Why FOMC Meetings Matter

Alright, we’ve covered a lot of ground here. Let’s recap the key points:

- FOMC meetings are where the Federal Reserve makes critical decisions about monetary policy.

- These decisions can impact everything from interest rates to stock prices.

- Understanding FOMC statements and staying informed can help you make better financial decisions.

So, whether you’re an investor, a business owner, or just someone who wants to understand how the economy works, paying attention to FOMC meetings is a smart move. And hey, if you found this guide helpful, don’t forget to share it with your friends and drop a comment below. Let’s keep the conversation going!

Table of Contents

- What Exactly Is the FOMC Meeting?

- Why Should You Care About FOMC Meetings?

- How Does the FOMC Meeting Work?

- Key Decisions Made During FOMC Meetings

- Understanding FOMC Statements

- Common Misconceptions About FOMC Meetings

- Preparing for FOMC Meetings as an Investor

- Conclusion: Why FOMC Meetings Matter