Listen up, folks. The IRS still has unclaimed money waiting for you, and yeah, we're talking about that sweet $1,400 stimulus check. If you missed out on it—or weren’t even aware it existed—don’t panic just yet. You might still be eligible to claim it, and I’m here to break it all down for you.

Now, before you start thinking this is some kind of scam or fake news, let me assure you—it’s legit. The government rolled out these payments as part of the American Rescue Plan back in 2021, but not everyone got theirs automatically. Some people fell through the cracks, and if that’s you, there’s still hope.

Here’s the deal: claiming your stimulus check isn’t rocket science, but it does require a bit of effort on your part. Don’t worry though; I’ve got your back. In this article, we’ll cover everything you need to know about how to get that cash into your pocket. So grab a cup of coffee, sit tight, and let’s dive in!

Read also:Why The Mavs Are Making Waves In The Nba This Season

Table of Contents

- What is the $1,400 Stimulus Check?

- Who Qualifies for the $1,400 Stimulus Check?

- Why Did Some People Miss Out?

- How to Claim Your Unclaimed Stimulus Check

- Common Questions About Stimulus Checks

- IRS Timeline for Processing Claims

- Tax Implications of Receiving a Stimulus Check

- Avoiding Stimulus Check Scams

- Useful Resources and Links

- Wrapping It All Up

What is the $1,400 Stimulus Check?

Let’s start with the basics. The $1,400 stimulus check was part of the government’s efforts to help Americans weather the economic storm caused by the pandemic. Think of it as a financial lifeline extended to those who really needed it. This wasn’t just a one-time thing either—there were multiple rounds of stimulus payments, but today we’re focusing on that specific $1,400 chunk.

Here’s the kicker: not everyone received their payment automatically. If you’re reading this and wondering whether you qualify, don’t stress. We’ll go over all the details so you can figure out if you’re eligible and what steps to take next.

Why Was This Payment Necessary?

The pandemic hit hard, and millions of Americans found themselves struggling financially. Jobs disappeared overnight, businesses shut down, and families faced uncertainty like never before. To ease the burden, the government stepped in with direct payments to individuals and households. The idea was simple: put money directly into people’s hands so they could pay bills, buy groceries, and keep their heads above water.

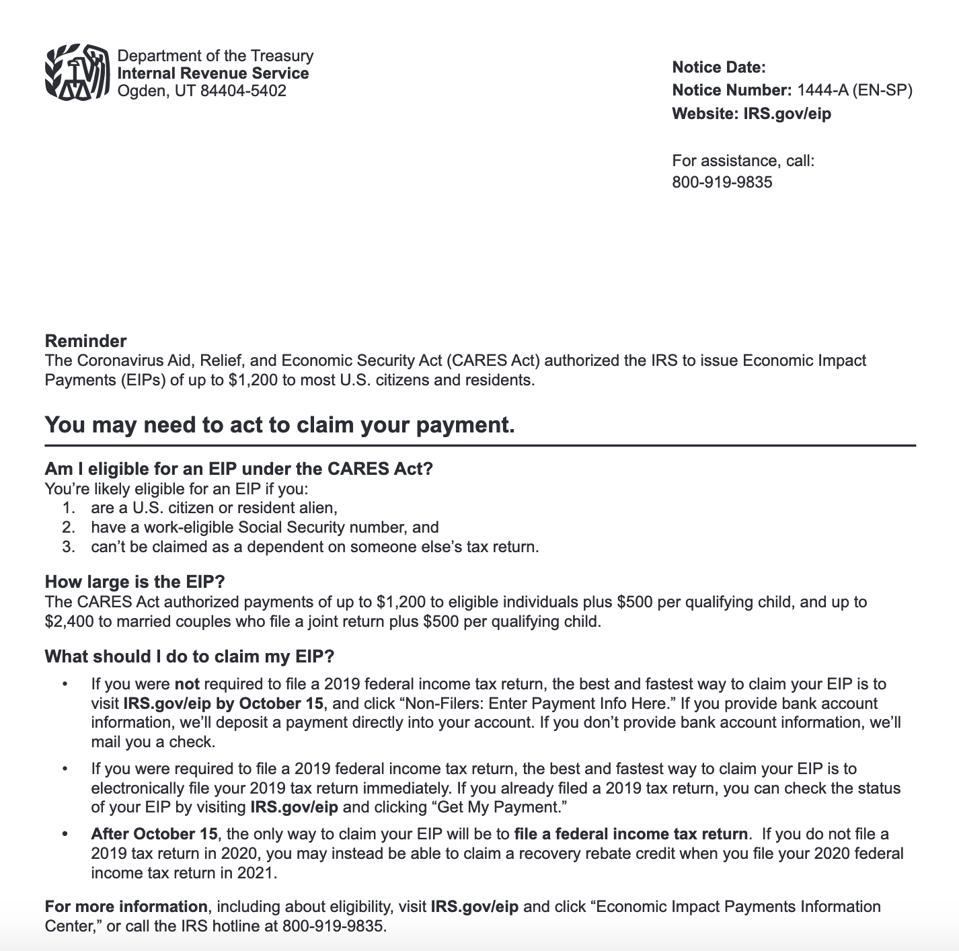

Who Qualifies for the $1,400 Stimulus Check?

This is probably the question on everyone’s mind. Am I eligible? Well, it depends on a few factors, but here’s the general scoop:

- Single filers with an adjusted gross income (AGI) below $75,000 qualify for the full amount.

- Head-of-household filers earning less than $112,500 also get the full payment.

- Couples filing jointly with AGI under $150,000 can expect the full $2,800 (that’s $1,400 per person).

- Dependents, including children and older adults, also count toward the total payment.

But wait—there’s more. Even if your income exceeds these thresholds, you might still receive a partial payment. The key is to check your AGI and see where you stand.

What If I Didn’t File Taxes?

Good news: you don’t necessarily need to file taxes to qualify. The IRS used various methods to identify eligible recipients, including previous tax returns and Social Security records. However, if you weren’t on their radar for whatever reason, you’ll need to take action to claim your money.

Read also:Breakfast Club Live The Ultimate Experience For Music Lovers

Why Did Some People Miss Out?

Believe it or not, a lot of folks missed out on their stimulus checks. Maybe they didn’t file taxes, or maybe their information wasn’t up to date with the IRS. Whatever the reason, it’s frustrating—but it’s not the end of the world.

Some common reasons people missed out include:

- Not filing a tax return in recent years.

- Incorrect or outdated bank account information.

- Moving without updating their address with the IRS.

- Being a dependent claimed by someone else.

If any of these sound familiar, don’t despair. There’s still a chance to recover that missing cash.

How to Claim Your Unclaimed Stimulus Check

Alright, here’s the part you’ve been waiting for. If you believe you’re owed a $1,400 stimulus check, here’s what you need to do:

Step 1: Check Your Eligibility

First things first, confirm that you qualify. Review your AGI and make sure you meet the income requirements. If you’re unsure, consult your most recent tax return or contact the IRS for clarification.

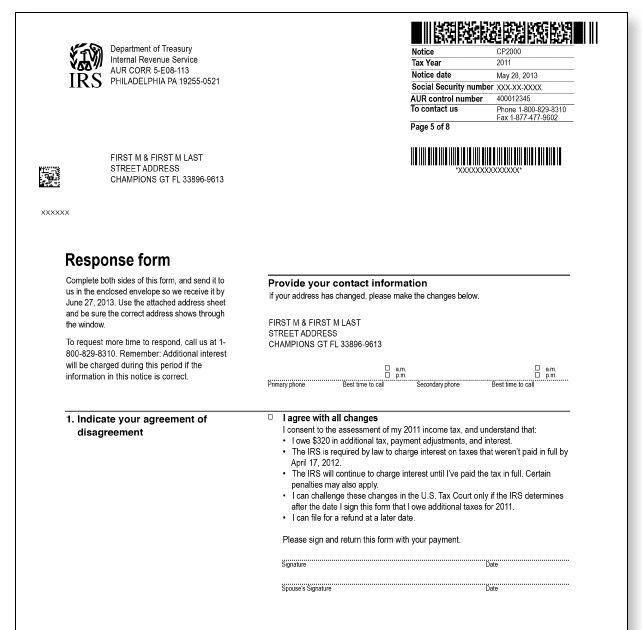

Step 2: File a Recovery Rebate Credit

This is the official way to claim your unclaimed stimulus check. When you file your taxes, you’ll need to complete Form 1040 or Form 1040-SR and include the Recovery Rebate Credit worksheet. Sounds complicated? Don’t worry—it’s easier than it sounds. Many tax software programs will guide you through the process step by step.

Step 3: Submit Your Tax Return

Once you’ve completed the necessary forms, submit your tax return to the IRS. Make sure everything is accurate and double-check your information to avoid delays. You can file electronically or by mail, depending on your preference.

Step 4: Wait for Your Refund

After submitting your tax return, it’s time to sit back and wait. The IRS typically processes refunds within a few weeks, but this can vary depending on the method you used to file. If you filed electronically and opted for direct deposit, you’ll likely receive your money faster.

Common Questions About Stimulus Checks

Let’s tackle some frequently asked questions to clear up any confusion:

Q: Do I Have to Pay Back the Stimulus Check?

A: Nope! The stimulus check is a gift from the government, not a loan. You don’t have to pay it back unless you received too much due to a mistake.

Q: Can I Claim a Stimulus Check for a Dependent?

A: Absolutely! Dependents, including children and older adults, are eligible for their own payments. Be sure to include them on your tax return when claiming the Recovery Rebate Credit.

Q: What If I Already Filed My Taxes?

A: If you’ve already filed your taxes and realize you missed out on the stimulus check, you’ll need to file an amended return. It’s a bit of extra work, but it’s worth it to get the money you’re owed.

IRS Timeline for Processing Claims

Now, let’s talk about timing. How long does it take for the IRS to process a Recovery Rebate Credit claim? Here’s what you need to know:

- Electronic filings typically take 3-4 weeks to process.

- Paper filings can take up to 8 weeks or longer.

- Direct deposit refunds are usually faster than paper checks.

Keep in mind that processing times can vary depending on the IRS’s workload and other factors. If you haven’t received your refund after the expected timeframe, you can check the status using the IRS’s “Where’s My Refund?” tool.

Tax Implications of Receiving a Stimulus Check

Here’s something important to note: the stimulus check itself is not taxable. However, if you received more than you were entitled to, you might need to pay back the excess amount. On the flip side, if you received less than you should have, you can claim the difference on your tax return.

It’s always a good idea to consult with a tax professional if you’re unsure about how the stimulus check affects your overall tax situation. They can help you navigate any complexities and ensure you’re maximizing your benefits.

Avoiding Stimulus Check Scams

Unfortunately, scammers love taking advantage of situations like this. Be on the lookout for fake emails, texts, or phone calls claiming to be from the IRS. Remember, the IRS will never:

- Call you demanding immediate payment.

- Threaten you with arrest or legal action.

- Ask for your Social Security number or bank account info via email.

If you suspect a scam, report it to the Federal Trade Commission (FTC) immediately. Stay vigilant and protect yourself from fraudsters trying to steal your hard-earned money.

Useful Resources and Links

Here are some helpful resources to assist you in claiming your stimulus check:

Wrapping It All Up

There you have it, folks. Claiming your $1,400 stimulus check doesn’t have to be a headache. By following the steps outlined in this article, you can get the money you’re entitled to and breathe a little easier. Remember, it’s not too late to act, so don’t let this opportunity slip through your fingers.

Before you go, I want to leave you with one final thought: knowledge is power. The more you understand about the process, the better equipped you’ll be to navigate it successfully. Share this article with friends and family who might benefit from the information, and don’t hesitate to reach out if you have questions or need further guidance.

So, what are you waiting for? Go ahead and claim that stimulus check—you deserve it!