Listen up, folks! The clock is ticking, and you don’t wanna miss out on that sweet $1,400 stimulus check from 2021. If you haven’t claimed it yet, now’s the time to get moving before the deadline sneaks up on you. This money could make a real difference in your life, so let’s break down everything you need to know to grab what’s rightfully yours.

Let’s face it, life’s tough, and every dollar counts. The $1,400 stimulus check was meant to help people weather the storm of the pandemic, but not everyone got theirs. Maybe you didn’t file your taxes on time, or you didn’t know you were eligible. Whatever the reason, there’s still a chance to claim it—but only if you act fast.

Here’s the deal: the IRS has set a deadline for claiming this money, and once it passes, there’s no turning back. You don’t want to wake up one day and realize you missed out on thousands of dollars just because you didn’t take the right steps. So, buckle up, because we’re about to dive deep into everything you need to know about the stimulus check and how to claim it.

Read also:Breakfast Club The Ultimate Guide To Uniting Over Morning Meals

Without further ado, here’s a quick table of contents to help you navigate through this article. Feel free to jump around if you’re in a hurry, but trust me, reading the whole thing is worth your time!

- What is the $1,400 Stimulus Check?

- Who Qualifies for the Stimulus Check?

- Why Should You Claim It Now?

- How to Check Your Eligibility

- Steps to Claim Your Stimulus Check

- Common Questions About the Stimulus Check

- Important Deadlines to Remember

- What If You Missed the Deadline?

- Tips for Filing Taxes to Secure Future Payments

- Final Thoughts: Act Now!

What is the $1,400 Stimulus Check?

Alright, let’s start with the basics. The $1,400 stimulus check was part of the American Rescue Plan Act of 2021, a massive relief package designed to help Americans cope with the economic fallout of the pandemic. It wasn’t just a one-time thing; this was the third round of stimulus payments after the initial $1,200 checks in 2020 and the $600 checks later that year.

The goal was simple: put cash directly into people’s hands so they could pay their bills, buy groceries, or cover other essential expenses. But here’s the kicker—not everyone who was eligible actually received their payment. Some folks fell through the cracks, either because they didn’t file their taxes or because the IRS didn’t have updated info on them.

Why Was the Stimulus Check Important?

Let’s be real, $1,400 might not seem like a lot to some people, but for millions of Americans, it was a lifeline. With unemployment soaring and businesses shutting down left and right, that extra cash helped families stay afloat. Even now, with inflation running wild, having an extra grand in your pocket can make all the difference.

Who Qualifies for the Stimulus Check?

So, who exactly gets to claim this sweet stimulus loot? Well, it depends on a few factors, but generally speaking, most individuals earning up to $75,000 per year (or couples making up to $150,000) qualify for the full $1,400 payment. Beyond that, the amount starts phasing out until it completely disappears for those earning over $80,000 individually or $160,000 jointly.

But wait, there’s more! Dependents also count, meaning parents with kids under 17 can get an additional $1,400 per child. And here’s a bonus—if you had a baby in 2021 and didn’t file for the payment, you might still be eligible to claim it.

Read also:New Hulu Series Now Streaming Cast Of Good American Family Talks New Drama Series Starring Ellen Pompeo

Key Eligibility Criteria

- U.S. citizen or eligible resident alien

- Valid Social Security number

- Income within the specified limits

- No dependents claimed by someone else

Why Should You Claim It Now?

Here’s the thing—time’s running out. The IRS has set a hard deadline for claiming the $1,400 stimulus check, and once it passes, that’s it. No extensions, no second chances. If you think you might be eligible but haven’t acted yet, now’s the moment to get your act together.

Claiming this money isn’t just about getting a little extra cash; it’s about securing financial stability. Whether you need it to pay off debt, save for emergencies, or invest in your future, that $1,400 could be a game-changer. Plus, who doesn’t love free money, right?

What Happens If You Don’t Claim It?

If you miss the deadline, you’re out of luck. The IRS won’t send you a check later, and you won’t be able to claim it on future tax returns. That’s why it’s crucial to act now while there’s still time.

How to Check Your Eligibility

Okay, so you’re wondering if you qualify for the $1,400 stimulus check. Here’s how you can find out:

- Head over to the IRS website and use their Get My Payment tool. It’s super easy and only takes a few minutes.

- Enter your Social Security number, date of birth, and filing status.

- Check if you’re listed as eligible for the third stimulus payment.

If the tool says you’re eligible but didn’t receive the payment, don’t panic! You can still claim it by filing a Recovery Rebate Credit when you submit your 2021 tax return.

What If the IRS Doesn’t Have My Info?

No problem! If the IRS doesn’t have your details, you can still claim the stimulus check by filing a tax return—even if you don’t usually have to. Just make sure to include all necessary information, like your income and dependents.

Steps to Claim Your Stimulus Check

Ready to claim your money? Here’s a step-by-step guide to help you get it done:

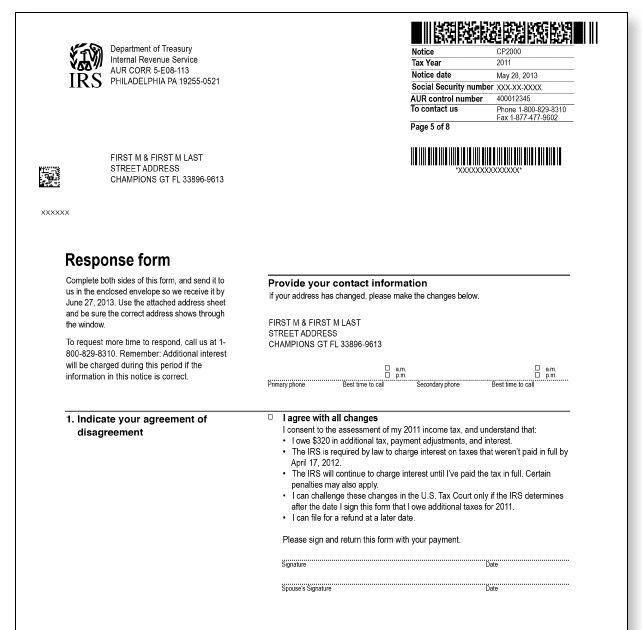

Step 1: Gather Your Documents

You’ll need your Social Security number, proof of income (like W-2 forms or bank statements), and any other relevant paperwork. If you have dependents, make sure you have their info ready too.

Step 2: File Your 2021 Tax Return

Even if you don’t owe taxes, you still need to file a return to claim the stimulus check. Use IRS Free File if you qualify, or hire a professional if you’re unsure about the process.

Step 3: Claim the Recovery Rebate Credit

On your tax return, include Form 8882 to claim the Recovery Rebate Credit. This is where you’ll specify how much you’re owed for the stimulus payment.

Common Questions About the Stimulus Check

Still have questions? Don’t worry, we’ve got you covered. Here are some frequently asked questions about the $1,400 stimulus check:

Can I Claim It If I Didn’t File Taxes in 2021?

Yes, you can! As long as you file your 2021 tax return by the deadline, you’ll still be able to claim the stimulus check. Just make sure to include all necessary information to prove your eligibility.

What If I Moved Since 2021?

No worries! When you file your tax return, you can provide your current address, and the IRS will send the payment to the right place.

Important Deadlines to Remember

Mark these dates on your calendar:

- October 17, 2022: Deadline to file your 2021 tax return and claim the stimulus check.

- December 31, 2022: Final day for the IRS to process your return and issue payments.

Don’t wait until the last minute! The sooner you file, the faster you’ll get your money.

What If You Missed the Deadline?

If you missed the deadline, unfortunately, there’s nothing you can do to claim the $1,400 stimulus check. However, you can still take steps to ensure you’re eligible for future payments. Stay updated on government announcements and keep your tax info up-to-date with the IRS.

Tips for Filing Taxes to Secure Future Payments

Here are a few tips to help you stay ahead of the game:

- File your taxes on time every year.

- Update your address and contact info with the IRS.

- Use direct deposit for faster payments.

Final Thoughts: Act Now!

There you have it, folks! The deadline for claiming the $1,400 stimulus check is fast approaching, and you don’t want to miss out. Take a few minutes to check your eligibility and file your tax return if you haven’t already. That extra cash could make a huge difference in your life.

So, what are you waiting for? Grab that money while you still can! And don’t forget to share this article with friends and family who might need it. Together, we can make sure no one misses out on the help they deserve. Stay safe, stay smart, and keep grinding!