When it comes to athletic wear and sneakers, Nike is more than just a brand—it's an empire. If you've ever wondered about Nike stock and whether it's worth adding to your investment portfolio, you're in the right place. In this article, we'll break down everything you need to know about Nike's stock performance, market trends, and why it's such a big deal in the world of finance.

Let's face it, Nike has been dominating the market for decades. From their iconic slogan "Just Do It" to their groundbreaking collaborations with athletes and celebrities, the company continues to set the bar high. But what does this mean for investors? Is Nike stock really worth your hard-earned cash? Stick around, and we'll dive deep into the details.

Whether you're a seasoned investor or just starting out, understanding Nike's stock is crucial if you're looking to capitalize on one of the most iconic brands in the world. So, grab your favorite drink, and let's get down to business!

Read also:R333ki Sasaki The Rising Star Whos Taking Baseball By Storm

Understanding Nike Stock: What You Need to Know

Nike stock, traded under the ticker symbol NKE, is one of the most closely watched stocks in the market. Why? Because Nike isn't just any company—it's a global powerhouse that's synonymous with innovation, quality, and style. But before you jump into buying shares, it's essential to understand the basics.

Why Nike Stock Matters

Nike's stock is more than just a piece of paper; it represents ownership in a company that's shaping the future of athletic wear. Here are a few reasons why Nike stock is worth your attention:

- Nike's brand value is unmatched in the industry.

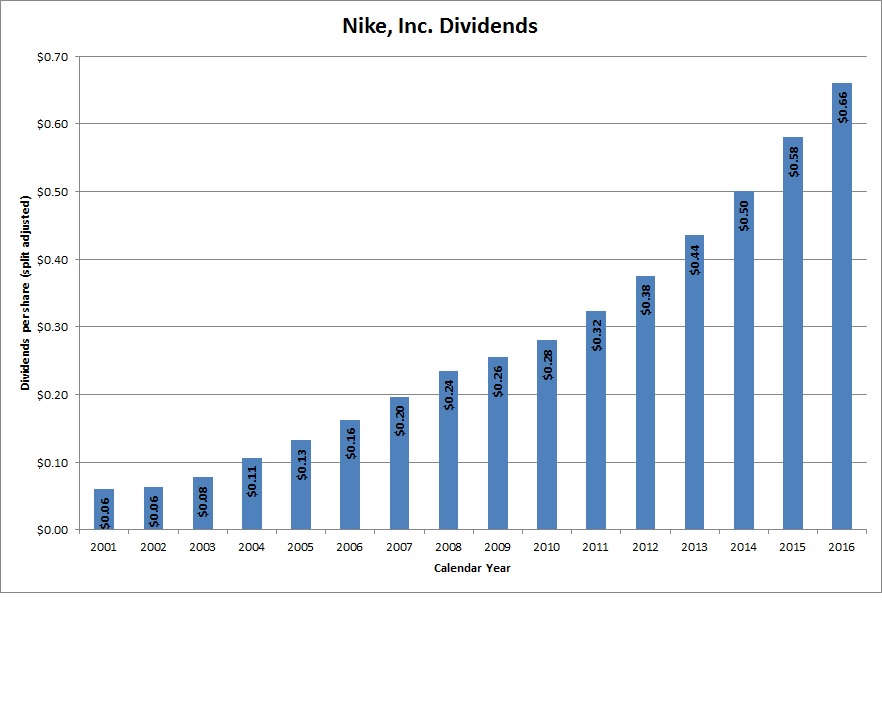

- The company consistently reports strong financials.

- Its global presence ensures steady revenue growth.

- Nike's focus on sustainability and innovation appeals to modern investors.

Key Financial Metrics to Watch

Before investing in Nike stock, it's crucial to keep an eye on key financial metrics. These numbers can give you a clearer picture of the company's health and potential for growth:

- Revenue Growth: Nike's revenue has been steadily increasing, driven by demand for its products worldwide.

- Profit Margins: The company boasts impressive profit margins, thanks to its efficient supply chain and marketing strategies.

- Debt Levels: Nike maintains a manageable level of debt, ensuring financial stability.

Is Nike Stock a Good Investment?

Now that we've covered the basics, let's tackle the million-dollar question: Is Nike stock a good investment? The answer depends on several factors, including market trends, economic conditions, and your personal investment goals.

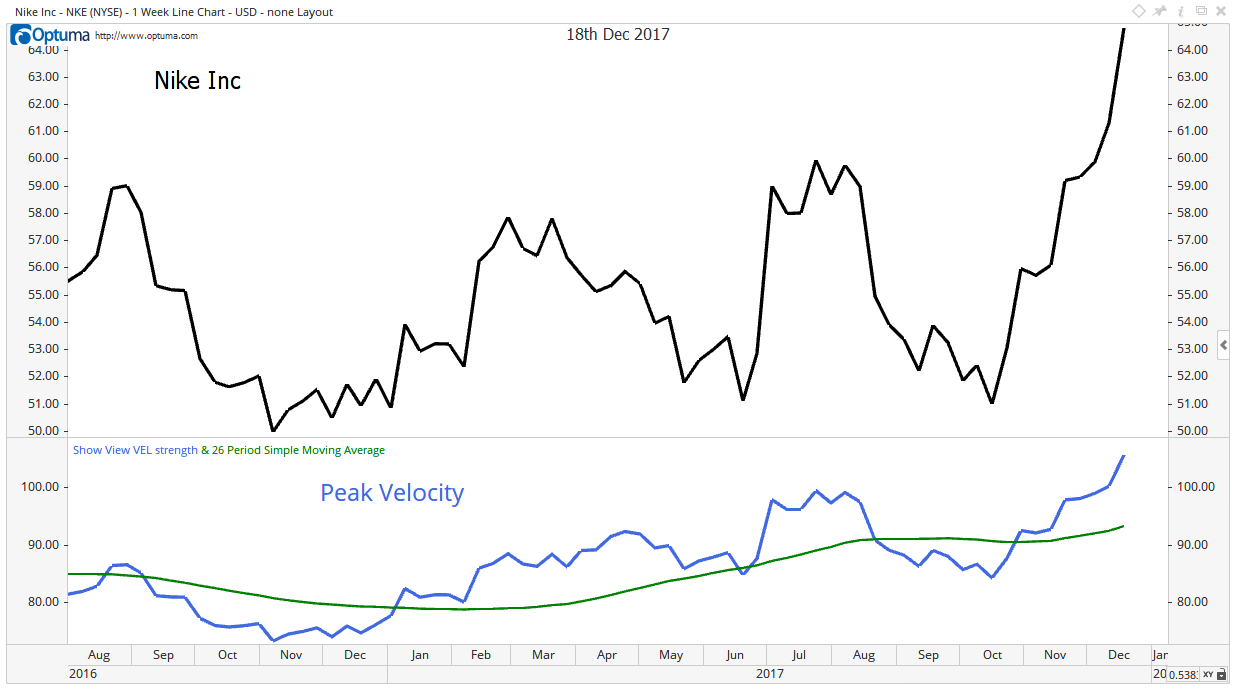

Market Trends and Analysis

The athletic wear industry is booming, and Nike is at the forefront of this trend. With more people prioritizing fitness and wellness, the demand for Nike products shows no signs of slowing down. Additionally, the rise of e-commerce has allowed Nike to reach a broader audience, further boosting its stock performance.

Risks to Consider

While Nike stock has a lot going for it, there are risks to consider. Global economic uncertainties, supply chain disruptions, and increasing competition can all impact the company's performance. It's important to weigh these factors before making any investment decisions.

Read also:2025 Best Picture Winner Who Will Take Home Hollywoods Coveted Trophy

Nike Stock Performance Over the Years

Looking back at Nike's stock performance over the years reveals a fascinating story of growth and resilience. Despite facing challenges, the company has consistently delivered strong returns to its shareholders.

Historical Stock Prices

From its initial public offering (IPO) in 1980 to today, Nike's stock has seen remarkable growth. Here's a snapshot of its journey:

- In the 1980s, Nike's stock price hovered around $10 per share.

- By the early 2000s, the stock had reached the $40 mark.

- Today, Nike's stock trades at over $100 per share, showcasing its impressive growth trajectory.

Factors Driving Stock Growth

Several factors have contributed to Nike's stock growth over the years:

- Innovative product launches, such as the Air Max and Flyknit lines.

- Strategic partnerships with athletes and celebrities.

- Expansion into emerging markets, particularly in Asia.

How to Buy Nike Stock

Ready to add Nike stock to your portfolio? Here's a step-by-step guide to help you get started:

Step 1: Choose a Broker

First things first, you'll need a brokerage account. Look for a reputable broker that offers competitive fees and a user-friendly platform. Some popular options include Charles Schwab, Fidelity, and Robinhood.

Step 2: Research and Analyze

Before making a purchase, take the time to research Nike's financials, market position, and growth prospects. This will help you make an informed decision.

Step 3: Place Your Order

Once you're ready, place your order through your brokerage account. You can choose to buy a specific number of shares or invest a fixed amount of money.

Nike's Competitive Edge

What sets Nike apart from its competitors? It's not just about the products—it's about the brand's ability to innovate, adapt, and stay ahead of the curve.

Innovation in Product Design

Nike's commitment to innovation is evident in its product design. From cutting-edge materials to state-of-the-art technology, the company continually pushes the boundaries of what's possible in athletic wear.

Strong Brand Identity

The Nike brand is more than just a logo—it's a symbol of inspiration and empowerment. This strong brand identity resonates with consumers worldwide, driving loyalty and repeat purchases.

Challenges Facing Nike Stock

While Nike has achieved incredible success, it's not without its challenges. Here are some of the key issues the company faces:

Supply Chain Disruptions

Global supply chain disruptions have impacted Nike's ability to meet demand. The company is working to address these challenges by diversifying its supplier base and investing in technology.

Increasing Competition

Nike faces stiff competition from brands like Adidas, Puma, and Under Armour. To stay ahead, the company continues to innovate and expand its product offerings.

Future Outlook for Nike Stock

Looking ahead, the future of Nike stock looks promising. With a strong focus on sustainability, digital transformation, and global expansion, the company is well-positioned for continued growth.

Sustainability Initiatives

Nike has made significant strides in sustainability, from using recycled materials in its products to reducing its carbon footprint. These efforts not only appeal to environmentally conscious consumers but also enhance the company's reputation.

Digital Transformation

The rise of e-commerce has transformed the way people shop, and Nike is embracing this shift with open arms. By investing in digital platforms and enhancing the customer experience, the company aims to capture a larger share of the online market.

Conclusion: Should You Invest in Nike Stock?

In conclusion, Nike stock offers a compelling opportunity for investors looking to capitalize on the growth of the athletic wear industry. With its strong financials, innovative products, and global reach, Nike is poised for continued success.

So, what's next? If you're considering investing in Nike stock, take the time to research and analyze the company's performance. Remember, investing always carries risks, so it's important to make informed decisions. And don't forget to share your thoughts in the comments below—we'd love to hear from you!

Table of Contents

- Understanding Nike Stock: What You Need to Know

- Is Nike Stock a Good Investment?

- Nike Stock Performance Over the Years

- How to Buy Nike Stock

- Nike's Competitive Edge

- Challenges Facing Nike Stock

- Future Outlook for Nike Stock

- Conclusion: Should You Invest in Nike Stock?